|

If there are problems with how this message is displayed,

click here

to view it in a browser.

|

|

|

Moonstone Monitor - 29 August 2019 |

|

|

|

Read Moonstone Monitor for CPD

purposes

Click here to register.

|

| |

|

|

| |

|

|

|

|

|

|

A man can fail many times, but he isn't a failure until he begins to blame

somebody else - John Burroughs |

| |

|

|

Distributed to 55 133 subscribers.

To advertise with us

click here |

|

| |

|

From the Crow's Nest |

|

|

Men Are from Mars, Women Are from Venus – Does this apply

to financial matters as well? |

A recent American survey examined how

consumers are talking about money to their friends, family and financial

advisers. The survey results showed that women are more likely than men

to purposely avoid the “money” topic, 55% versus 45%. Can this also be

true in the way that people complain about financial issues?

In the midst of Women’s Month, the Ombudsman for Banking Services

analysed their complaints to assess if there is a difference between

complaints lodged by women vs men. The Ombud’s office statistic shows

that they received a total of 3 785 formal cases for the year to date,

and only 31% of the complaints lodged in this period were from women.

The number of men and women utilising banking services is much more

even, so why the disparity? Does it therefore relate to the avoidance of

talking about money?

The Ombudsman for Banking Services, Reana Steyn, said that this may be

an indication that either women are smarter than their male counterparts

when it comes to banking products and services, or that they just

complain less. “Regardless, there is always room for improvement,” she

said.

Analysing the complaints

Of the 1 173 complaints received from women, 21% related to internet

banking, 10% to ATM disputes and 9% to personal loans. The overall

statistics for the office list credit card fraud complaints as the

second highest category, noting that it is not even on the list of the

top three categories for women’s complaints.

The ombudsman also noted that “ATM and internet banking related

complaints are about fraud, mainly phishing and card swapping, and

complaints related to personal loans are about the balances on the

accounts.”

A case study to illustrate

Mrs N obtained a personal loan from a bank and in terms of the

agreement, her last payment was due to be made on 25 December 2018.

Unfortunately, she experienced financial difficulty and in April 2015

she tried to make arrangements with the bank to pay a reduced instalment

for a period of 6 months.

It subsequently transpired that the bank had extended the repayment term

of her agreement for a period of 5 years. Mrs Naidoo disputed having

requested, signed or agreed to a restructuring of her account.

The bank’s view was that she agreed to the rescheduling terms and

conditions, as well as the amended loan repayment term and that it was

not reversible.

The Banking Ombud investigated the matter and noted that section 116 of

the National Credit Act provides that a credit agreement may only be

amended if the amendment is reduced to writing and signed by the

customer in confirmation of her agreement with the amendment. In this

instance, the bank was unable to furnish this office with any proof that

the complainant requested or agreed to the restructure of the loan

account. Accordingly, the Ombud recommended that the bank adjust the

loan account in order to place her in the same position she would have

been in had the restructure not occurred. The bank agreed and an amount

of R64 032.15, in respect of additional interest charged as a result of

the restructure, was written-off from the outstanding balance.

Mrs N remained liable to settle the adjusted outstanding balance, which

she was happy to do. Steyn advised that “it is important for bank

customers to keep record of any discussions with the bank regarding

changes made to their account. Bank customers must always request that

such changes be reduced to writing to avoid misunderstandings - a tip

for both you and your client.

Learnings from case studies and research

The National Credit Act is relatively new, and has undergone several

changes of late. The ignorance of the law displayed in the case study

noted above is simply not acceptable, and one has to wonder whether it

was accidental or intentional. Making big bucks by fleecing the

ignorant, while gladly forfeiting the illegal gains without any penalty

is simply not an ethical business practice. A financial adviser found

guilty of such a misdemeanor would have to cough up and face possibly

losing his licence. Now that banks also fall under the Financial Sector

Conduct Authority, we will be watching closely to see whether the same

sauce is dished up for the gander AND the goose.

Another take away is that there is a difference between men and women’s

financial behaviour. It is therefore important to understand these

disparities in behavioural patterns. This will allow us to better serve

our clients, no matter the gender and age.

Click here to access the Ombudsman for Banking Services website. |

|

|

|

ADVERTORIAL

|

|

2019 Diamond Arrow Award winner

GTC was ranked 1st overall in the 2019 PMR.africa Business

Excellence Awards in the category of pension fund service providers,

administering between 100 000 and 150 000 members.

You should be talking to us about your clients’ retirement fund

administration and counselling requirements:

retirementfunds@gtc.co.za.

Visit our website at

www.gtc.co.za. |

|

|

Your Practice Made Perfect |

|

|

New driving demerit system – What will the impact be on insurance? |

Two weeks ago President Cyril Ramaphosa signed the controversial

Administrative Adjudication of Road Traffic Offences (Aarto) Bill into

law. In general, the Bill will result in the setting up of a demerit

system for drivers, who lose points for traffic offences, which may

ultimately result in the loss of a driving licence.

Whilst government was determined to win the battle against disobedient

motorists and persistent road fatalities with the implementation of the

Bill, it has received lots of criticism in the media from various bodies

and institutions:

|

● |

The Automobile Association (AA) warned that the

system in its current form – if implemented – will

not in any way reshape the country’s roads to become

safer – one of the original benefits. “Instead, this

system seems to have morphed into a better way for

revenue collection by authorities, with no regard

for safety or proper application of laws. The

implementation of Aarto should be prioritised but

weighed against a review of its original

objectives,” the AA said.

|

|

● |

The civil rights group, the Organisation Undoing Tax

Abuse (Outa), has opposed this bill from the start

and is now planning a constitutional challenge to

it, according to Rudie Heyneke, Outa portfolio

manager on transport. He mentioned to the media that

the pilot projects in Tshwane and Johannesburg using

this system over the past decade failed. “The focus

should be on road safety, not on an administratively

complicated system aimed at collecting revenue,”

said Heyneke. |

There is also a huge question on the impact of Aarto on

insurance. The demerit system could potentially be linked to

underwriting criteria as it does reflect driving behaviour.

Depending on how well and efficiently the bill is rolled

out, this new law could see good drivers benefit from better

premiums with the bad drivers being penalised.

Old Mutual’s Insure insurance expert, Christelle Colman,

mentioned in a

BusinessTech article that the demerit system

will have a direct impact on car insurance. “The demerit

system could potentially be linked to an underwriting

criterion as it does reflect driving behaviour, she said.

“Drivers with poor record on this system could face higher

premiums – but that would be at the discretion of each

company.”

Cape Talk aslo chatted to Wynand van Vuuren, Head of Legal

at King Price Insurance, about the impact on a client’s

insurance premium. Wynand touches on the history of

underwriting and shares that it has changed to a more

refined action in the last 10 years to calculate the risk.

Click here to listen to the podcast.

I suppose there are pros and cons to the implementation of

the Bill – the success or failure lies more in how

government will implement it – will it create chaos or

order?

Click here download the Aarto Bill. |

|

|

|

|

|

|

| |

|

National Health Insurance – Health Minister dismissive of criticism

|

“We are one nation building one health care system. Let's work together.

There is no us and them.” These were the words in a tweet of Dr Zweli

Mkhize, South Africa’s Health Minister. Dr Mkhize attended the annual

Hospital Association of South Africa conference in Cape Town last week.

He addressed leaders of private hospital groups and medical aids and

spoke extensively about National Health Insurance plans.

According to various media reports he accused many people of spreading

"false information" about the Bill. Mkhize denied the Bill meant the

state would nationalise health. He said the perception that the NHI

would result in the nationalisation of private health care facilities

was a "weird idea".

Mkhize added that the NHI could allow the government-run NHI fund to buy

private health care. "What will be possible is entering into agreements

for private facilities to render specific services under NHI in addition

to the public facilities".

"We all have a role to play in fixing our health system, our entire

system. We have a common interest to collaborate in pursuit of health

coverage", he shared.

Mkhize further denied reports about disagreements with the national

Treasury over funding the NHI, and that there is less money available

for NHI, as calculated by the Treasury, than the health department

needs.

Click here to read the media report as published on the TimesLive

website.

Click here to read more about National Treasury’s report. |

|

|

|

| |

|

| |

|

There is a rat in my car – Am I covered?

|

The lyrics of a UB40 song reads “There's a rat in my kitchen what am I

gonna do?” The song also relates to the owner of a Porsche, who

discovered a resident rat in his engine that caused damage of R154 000.

He was one of the lucky ones as his claim was settled by his insurer.

His insurance policy covers damage by animals, excluding domestic pets.

So rat damage is covered, but any scratching, biting, chewing or soiling

by dogs and cats is not.

The detail of this instance is discussed in a recent TimesLive article.

According to Ayanda Mazwi, senior assistant ombudsman with the ombudsman

for short-term insurance, their office receives complaints about these

issues. “The matters are dealt with having regard to the terms of the

policy and the facts of each particular case,” she said. She advised

consumers to find out exactly what form of animal-created damage they

are and aren’t covered for. Not all comprehensive insurance policies

cover damage caused by rodents, so car owners would do well to check.

Click here to read the TimesLive article. |

|

|

|

| |

|

|

| |

|

Technologically Speaking

Moonstone Information Refinery

|

|

Drone technology - An empowering game changer |

One type of insurance technology many insurance companies are using

nowadays is drones. According to DeLoitte there are two strategic

objectives: better risk management through improved data collection,

and reduced operational costs through improved efficiency and

effectiveness related to claims.

Drone deployment is rapidly expanding and evolving, with current and

potential applications spanning the insurance value chain. In

an article, DeLoitte highlights the following:

Pre-loss

Risk engineering and pricing: Aerial site assessments can identify

property features that allow the owner either to seek a reduced risk

profile or to take appropriate actions to lower overall risk and

justify premium discounts.

Natural disaster monitoring: Drones can be quickly and safely

deployed to monitor areas threatened by natural disasters.

Governments working with insurance companies can monitor a situation

and alert local residents to potential danger.

Post-loss

Inspection: Drones can provide a safer, faster, and more

cost-effective way to conduct a site inspection, particularly in

challenging working conditions.

Risk assessment: Drones may allow insurers to engage a generalist,

rather than a specialist, to perform field assessments and obtain

high-quality visuals.

Claims adjudication: The precise photos that drones take can

potentially improve the quality of the claims adjudication process.

Fraud prevention: The moment a property claim is reported (First

Notice of Loss), a drone could be deployed to inspect the claims

site, increasing information capture accuracy and timeliness.

In South Africa, Old Mutual iWYZE plans to be the first South

African insurer to use drones. “The application of drone technology

in our business is an empowering game changer – it will

significantly improve our risk assessments, underwriting and

quantification of assets through improved data collection, field

assessments, high-quality photos, videos and analysis,” said

Christelle Colman, an insurance expert at Old Mutual Insure.

She also mentioned that drone operations will further reduce their

operational, safety and fraud risks; fast-track and improve claims

adjudication and processing; cut operational costs through enhanced

efficiency and ultimately elevate the customer experience.

Click here to read the article as published on the BusinessTech

website.

|

|

|

|

|

Regulatory Examinations

|

|

|

Regulatory Exams – The importance

of the FSCA's RE Preparation Guide |

The Preparation Guide outlines exactly what the examination will be

testing and where to find the information.

Studying the Preparation Guide is in fact the very first step a

candidate should take to ensure that he or she knows what they have to

know, and where to find the required information. This is the best

approach to follow when planning and preparing for the Regulatory

Examination as it is highly effective and does result in a better

outcome.

The qualifying criteria provide the basis of knowledge and skills

against which the regulatory examinations are set. Only questions based

on these criteria will be included in the exams.

Students are therefore advised to download and use the FSCA Preparation

Guide.

Please

click here to download the latest Preparation Guide, which also

includes the most recent updates to the qualifying criteria.

Latest legislation:

To access the latest legislation and applicable Board Notices, please

visit the

FSCA website.

The Moonstone website,

www.moonstone.co.za contains a wealth of regulatory

examination information. Please feel free to browse there to your heart’s

content.

Our registration call centre is available weekdays during business hours (08h00

– 16h00). Contact 021 883 8000 / 888 9796 or e-mail

faisexam@moonstoneinfo.co.za. |

|

|

|

| |

|

Schedules for 2019 |

Please note: Registration cut-off is 11 working days before date of exam.

|

|

|

|

|

Careers Platform

|

|

| |

|

Featured Positions |

-

Manager: Life Sales:

Vodacom, Midrand - Vodacom Financial services are currently

looking for an experienced Life insurance sales manager. Candidates must

have a relevant degree or diploma and have at least 10 years’ sales

experience within a life Insurance environment. A strong knowledge of

the Telecommunications industry is essential.

Read More

-

Claims Administrator:

Cooke Fuller Group, Kloof - The ideal candidate should be an

assertive individual with strong administration and good interpersonal

skills with minimum 5 years’ experience in Commercial and Personal

claims.

Read More

-

Sales Consultants:

Pioneer Debt Solutions, Durban - To work for this company you

would need Matric, have at least 1-year sales experience and be fluent

in English, Zulu, Sesotho.

Read More

-

Wealth managers:

GTC, Various offices - We are one of South Africa’s leading

advisory practices and have several vacancies for wealth managers.

Positions, for financial planners with varying degrees of experience and

expertise, are available at GTC offices around the country.

Read More

-

Senior Paraplanner:

Excalibur Wealth, West Rand -

Trusted advisor firm of CFP® professionals is looking for a numerate BCom

or equivalent graduate to support their wealth advisory team.

Minimum 5 years experience in a wealth management environment is required.

Read More

-

Short Term Insurance Claims Administrator:

Smythe, Pinetown - Apart from having a Matric and RE5 certificate

candidates must have Domestic and Commercial claims experience on

both Property and Motor Claims (non-negotiable).

Read More

-

Financial Advisor / Broker:

Astute FS, Durban -

Astute FS provides tailor made solutions to both individuals and

businesses for comprehensive financial cover, whether life, health,

wealth or investments. We have an opportunity for a career driven

individual with exceptional communication skill, strong sales and

business management experience.

Read More

-

Personal Lines Supervisor:

Cooke Fuller Group, Kloof -

We are looking for a candidate to manage a team of underwriters. Requirements

include: matric and a minimum 10 years’ experience in the Short-term Insurance Industry.

Read More

-

Financial Planner:

Volker Consulting, Century City, Cape Town

We are a financial planning practice specialising in executive financial planning, employee benefits

and corporate assurance and require a certified financial planner with 5 years experience in these categories.

Read More

|

|

|

|

|

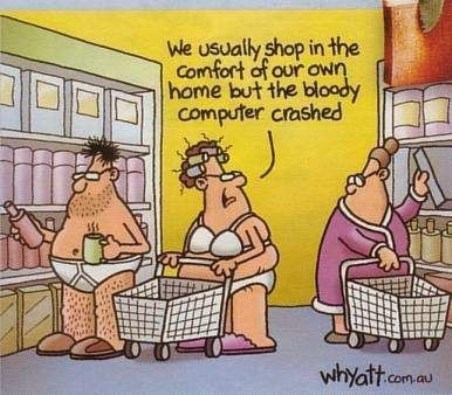

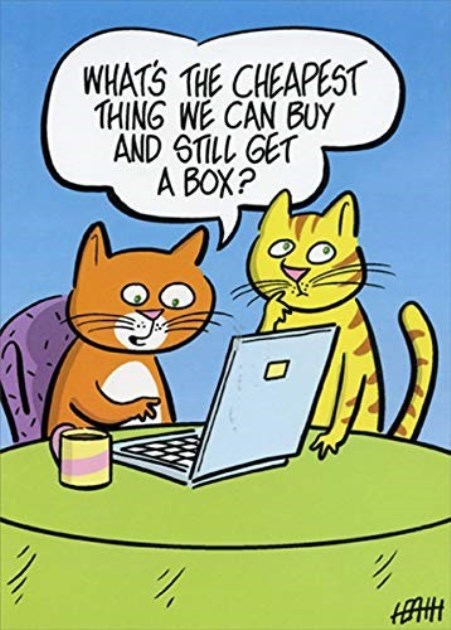

In Lighter Wyn |

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here.

|

|

|

©2015 Moonstone. All rights reserved. |