|

To Subscribe please click

here |

|

|

Moonstone Monitor - 29 March 2018 |

|

|

.jpg) |

|

Paul Kruger

Author/Editor |

| |

|

|

| |

|

|

|

|

|

|

By the time a man realises that his father was right, he has a son who

thinks he’s wrong - Charles Wadsworth |

| |

|

|

Distributed to 51,100 subscribers.

To advertise with us

click here |

|

| |

|

From the Crow's Nest |

|

|

Working under Supervision Going Forward |

The recently published Determination of Fit and Proper requirements (BN 194 of 2017) will impact on the “Supervision” requirements published in BN 104

of 2008. We expect the publication of a discussion document on amendments to the

current “working under supervision” regulations any day now.

Background

Board Notice 104 of 2008 introduced the concept of an exemption from certain fit

and proper requirements while working under supervision. The year 2010 was a

watershed and marked the beginning of regulatory steps to upscale

professionalism in the industry. Prior to this, transitional arrangements for

instance absolved people who had obtained 30 or 60 credits from completing a

recognised qualification.

After 2009 it was a bit of a Catch-22 situation, really. You could not be

appointed without the required experience, for instance, but you could also not

acquire the experience without being appointed. This would have been a death

knell to the industry.

“The objective of this Exemption is to relieve the provider of the obligation

…as regards the competency requirements. This implies that a representative

will, with regards to the experience and qualification and regulatory

examination requirements, not have to comply with the standards set for the

provider at the date of appointment.”

Broadly speaking, new appointees had to write the RE 5 within two years of

appointment and obtain a recognised qualification within six years. Experience

was dependent on the licence categories in which you advised.

What has changed?

BN 194 of 2017 necessitates a number of changes to the above.

The “second level” regulatory exams, for instance, was intended to ensure proper

product knowledge. This has now been replaced by compulsory “Class of Business”

and “Product Specific” training for specified groups, while others are exempt

from it.

The requirements to write the level 1 regulatory examinations have also been

changed, exempting certain categories, and removing the unnecessary requirement

that sole proprietors and KIs, who do not also act as representatives, have to

write both the KI and rep exams.

Continuous professional development (CPD) has suddenly become a reality for the

pre-2010 brigade after being on the backburner for the past ten years.

Transitional arrangements

The so-called grandfathering clause very kindly exempts those who were duly

authorised at the date of publication of BN 194 of 2017 from the qualifications,

experience, product specific, class of business and regulatory exam obligations

provided they stick to what they are doing.

The

interim arrangements for those working under supervision, or appointed after

1 April, are outlined in BN 194.

Going forward

The update on BN 104 of 2008 mentioned above will very likely address some

current anomalies in much the same way as the original document did in 2008 in

respect of qualifications, experience and regulatory examinations. It will have

to address the new fit and proper requirements, and provide for similar

exemptions. Apart from the examples mentioned above, other new elements

introduced include good standing, financial soundness and competence registers.

It does not make business sense to appoint a new representative who is not

allowed to do business before complying with the new fit and proper

requirements, much in the same manner as when the original exemption BN was

published ten years ago.

We expect exemptions, with specific timelines, in much the same manner as

contained in the 2008 document, for those currently working under supervision as

well as new appointments. |

|

|

|

| |

|

|

Your Practice Made Perfect |

|

|

Product Specific Training under Supervision |

Board Notice 194 of 2017 decrees that a representative working under

supervision on 1 April 2018 has three months from 1 May to comply with

the product specific training requirements set out in Part 5 of Chapter 3.

Part 5 of Chapter 3 lists no less than 19 requirements with which such

training have to comply.

Section 29 (1) states further that a FSP and representative must, prior

to the rendering of any financial service in respect of a particular

financial product, complete the class of business training and product

specific training relevant to that financial product and for which they

are authorised or appointed or in respect of which authorisation or

appointment is sought.

Whilst those working under supervision have 12 months in which to do the

Class of Business training, they only have three months to comply with

the Product Specific requirement.

The general consensus appears to be that product providers will be hard

pushed to provide all of the above on such short notice.

The fact of the matter is that there is NO obligation on product houses

in this regard.

Chapter 3, under the heading “Responsibilities of an FSP”, notes:

|

(3) |

An FSP must be able to demonstrate and record that it has evaluated

and reviewed at regular and appropriate intervals - |

| |

(a) |

its representatives' and key individuals' competence and has taken

appropriate action to ensure that they remain competent for the

activities they perform; and |

| |

(b) |

the appropriateness of the training and CPD referred to in

subsection 1(d) and (e). |

|

(4) |

The evaluation and review contemplated in subsection (3) must, inter

alia, take into account - |

| |

(a) |

technical knowledge and its application; |

| |

(b) |

skills and expertise; and |

| |

(c) |

changes in the market, to financial products, financial services and

legislation. |

|

(5) |

An FSP must establish, maintain and update on a regular basis a

competence register in which all qualifications, successfully completed

regulatory examinations, product specific training, class of business

training and CPD of the FSP, its key individuals and representatives are

recorded. |

Just before you draft your resignation letter, please note that this

does not mean that all product specific training done up to now will be

disregarded. It simply means that the onus for ensuring compliance with

the guidelines rests with the key individual. No doubt the product

providers, too, will do their best to ensure that you and your personnel

comply with these requirements by reviewing their in-house training.

A question that arises is what will happen in instances where a product

provider does not offer product specific training? The onus will then be

even more squarely on the shoulders of the FSP.

We trust that the soon to be released revised Supervision discussion

document will provide further clarity on this matter. |

|

|

|

|

|

|

| |

High Court sets aside Validation of Gross Income methods

by Gerrit Viviers

|

On 16 March 2018, the High Court in Cape Town provided its favourable

ruling on the matter brought by the retailers, Truworths Limited,

Foschini Group Limited and Mr Price Group Limited (the “Applicants”)

against the Minister of Trade and Industry and the National Credit

Regulator (the “Respondents”) in which the Applicants requested the

court to set aside regulation 23A(4) of the National Credit Act, 34 of

2005 (“NCA”) which deals with the steps required to be taken by credit

providers, to validate the gross income of prospective consumers during

its affordability assessment as part of a credit application.

Regulation 23A(4) provides that “A credit provider must take practicable

steps to validate gross income, in relation to:-

|

(a) |

consumers that receive a salary from an employer: |

| |

(i) |

latest three(3) payslips; or |

| |

(ii) |

latest bank statements showing latest three(3) salary

deposits; |

|

(b) |

consumers that do not receive a salary as contemplated

in (a) above by requiring: |

| |

(i) |

latest three(3) documented proof of income; or |

| |

(ii) |

latest three(3) months bank statements; |

|

(c) |

consumers that are self-employed, informally employed or

employed in a way through which they do not receive a

payslip or proof of income as contemplated in (a) or (b)

above by requiring: |

| |

(i) |

latest three (3) months bank statements; or |

| |

(ii) |

latest financial statements.” |

The crux of the judgement can be summarised as follows:

-

Regulation 23A(4) is set aside. Practically this means that credit

providers do not have to obtain the consumer’s payslips, bank statements

or financial statements to validate the consumer’s gross income;

-

However, this did not discard the credit provider’s responsibility to

take practicable steps to determine (including validate) a prospective

consumer’s income to calculate the consumer’s discretionary income as

part of its affordability assessment. Credit providers may now, however,

determine its own practicable steps in this regard.

Credit providers are urged to consider retaining their current processes

and methods to validate a consumer’s gross income, including obtaining a

prospective consumer’s payslips and/or bank statements. They may,

however, also employ other methods to validate a prospective consumer’s

income. For example, where a consumer does not have a payslip, bank

account (bank statements) or financial statements, he or she can

possibly provide the credit provider with a letter or affidavit from his

or her employer, stating their gross income.

It is expected that the Respondents may appeal against this ruling. If

they are granted leave to appeal, it will mean that the setting aside of

regulation 23A(4) will be suspended until the outcome of the appeal.

Therefore, credit providers should consider this before making drastic

changes to their current processes and methods to validate the gross

income of a prospective consumer.

Please

click here

to download a copy of the ruling.

Moonstone employed an NCA Specialist to render NCA compliance services

to its clients and prospective clients. Should you have any queries,

please contact Gerrit Viviers on 021 883 8000 or by email to

gviviers@moonstonecompliance.co.za.

|

|

|

|

| |

|

| |

|

Gap Cover provides critical support in cases of accidents and

emergencies

|

As another Easter holiday season approaches, our national roads will

fill up and the inevitable road accident statistics will make sickening

reading.

In 2017, fatalities from accidents surged approximately 51%

year-on-year, as thousands of South Africans were involved in collisions

and accidents.

It’s a stark reminder that even if we may be fortunate to be very

healthy, accidents can happen at any time.

Many people make the mistake of thinking that Gap Cover (which assists

with medical expense shortfalls that one’s Medical Aid doesn’t pay) is

only needed for people with illnesses or health risks.

Click here to read the

full article.

. |

|

|

|

| |

|

Technologically Speaking

Moonstone Information Refinery

|

|

Regulator focus now in place for fintech sector |

The South African Reserve Bank (SARB) recently established a Financial

Technology (fintech) Programme which aims to strategically assess

the emergence of technological innovations in the financial sector

and to consider its regulatory implications. Industry leaders agree

that South Africa is all set to be the “fintech centre of

excellence”.

In a

recent article by ITOnline, Dominique Collett, senior investment

executive at Rand Merchant Investment Holdings and head of AlphaCode,

a club for fintech entrepreneurs, stated that “the SARB initiative

is very important because of the changing face of financial services

driven by technology, the rise of social media and the change in

consumer demographics and behaviour particularly those of

millennials. The regulator needs to consider how to deal with this

evolving space. Fintech is an enabler and not a threat to making

financial services more relevant to a changing society. The SARB

initiative will help to bridge this gap.”

“We have an advanced banking and financial services system with a

sound regulatory regime. We have extremely competent regulators, top

entrepreneurial talent and innovative businesses that are attracting

considerable local and global investments. The missing puzzle piece

was a regulator focused on the fintech sector which has now been put

in place, so there is no reason why South Africa cannot follow the

UK and Singapore in becoming a fintech centre of excellence” says

Collett.

Are you embracing technology? Do you have any questions on fintech?

Send your comments or questions to

Janine Geldenhuys of Moonstone. We will investigate and report

on it in future editions.

|

|

|

|

|

Regulatory Examinations

|

|

|

Annual Regulatory Exam Deadline

Looming |

This year’s 30 June deadline could be even more stressful than normal,

given the amendments to the study material as a result of the new Fit

and Proper requirements.

Why do so many people put off the inevitable? Is it because they somehow

believe that there will be a last minute reprieve?

We experienced a 300% increase in registrations in March from people who

wanted to write before the changes mentioned above come into effect from

1 April. This happened despite us warning against the folly of leaving

writing to the last minute, and then failing the exam. Our registration

team went through a torrid time from unreasonable candidates who left it

to the last, and wanted to book after registrations closed.

There is every chance that the same will happen towards the end of June.

One can understand that candidates will first want to acquaint

themselves with the changes to the preparation material as outlined

below, but please do not leave it too late. There is just too much at

stake.

The following areas in the new Task and Criteria will be significantly

impacted by Board Notice 194 of 2017. Please note there may also be

individual questions in other specific areas that can be impacted, but

when all questions are reviewed this will be indicated in the prep

guide.

|

Regulatory Examination |

Task |

Criteria |

|

RE1 |

Task 3 |

Criteria 1 - 3 |

|

|

Task 4 |

Criteria 1 – 15 |

|

|

Task 5 |

Criteria 1 - 11 |

|

|

Task 13 |

Criteria 1 - 2 |

|

|

Task 15 |

Criteria 1 - 5 |

|

RE5 |

Task 8 |

Criteria 3 & 8 |

We

received confirmation from Inseta that their adjusted study

material will be available before or on 1 April 2018.

When we checked on Tuesday, it was still not published on

its website.

Frequently asked Questions

Please

click here to access a list of questions and answers,

including information on what exams to write, the cost

thereof, study material, training and a lot more |

|

|

|

| |

|

2018 RE Schedules updated |

Please note: Registration cut-off is 11 working days before date of exam. |

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 20 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 51000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

Investment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Personal Lines

Sales/Underwriter:

Venshaw Insurance Administrators, Bellville, Western Cape - We are

looking for a candidate with 2 years' experience, RE5 and NQF4 (150

credits).

Read More

-

Short Term Insurance

Representative: External Marketer/Service:

Venshaw Insurance Administrators, Bellville, Western Cape - The

candidate should be Xhosa speaking, and have completed RE5 and NQF4 (150

credits).

Read More

-

Short Term Insurance

Representative: Claims Consultant:

Venshaw Insurance Administrators, Bellville, Western Cape - The

candidate should be Xhosa speaking, and have completed RE5 and NQF4 (150

credits).

Read More

-

Broker Consultant:

CIA - Commercial & Industrial Acceptances Pty Ltd, Gauteng, East Rand

and Vaal Triangle - We are looking for an excellent communicator to

represent CIA to our brokers.

Read More

|

|

|

|

|

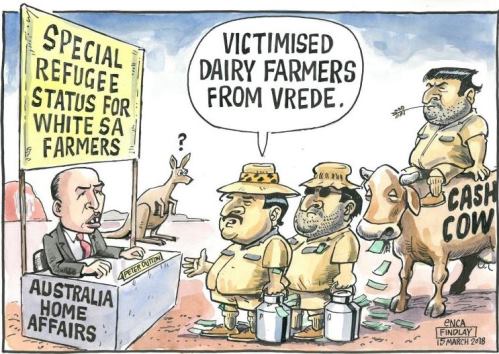

In Lighter Wyn |

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here.

|

|

|

©2015 Moonstone. All rights reserved. |

.jpg)