|

To Subscribe please click

here |

|

|

Moonstone Monitor - 13 December 2017 |

|

|

|

If the only tool you have is a hammer, you tend to see every problem as a

nail – Abraham Maslow |

| |

|

|

Distributed to 49,052 subscribers.

To advertise with us

click here |

|

| |

|

From the Crow's Nest |

|

|

FICA Update |

FAIS Newsletter 25 from the FSB is dedicated to the Financial

Intelligence Centre Act and, more specifically, to substantial changes which

came into effect in June and October.

The amendments are designed to bring South Africa’s Anti-Money Laundering and

Countering Financing of Terrorism (AML/CFT) legislative framework in line

with Standards set out by the Financial Action Task Force (FATF) and

international best practices. The amendments are also intended to augment South

Africa’s position in combating money laundering and terrorist financing, and

strengthen its capacity to prevent financial crimes and to discipline such

crimes.

Commencement of the FIC Act

-

The first provisions of the FIC Act commenced on 13 June 2017. These

provisions did not require changes to ML/TF Control Regulations, Exemptions or

internal processes and systems of accountable institutions to enable compliance

with the FIC Act. The provisions dealt mainly with dissolving the CMLAC,

information sharing, consultation arrangements with stakeholders, concerns

relating to inspection powers and warrants, and improvement of the appeal

process.

-

The bulk of the provisions came into effect on 2 October 2017. These

provisions required changes to ML/TF Control Regulations and withdrawal of

Exemptions, as well as training of staff and major changes to processes and

systems used by accountable institutions.

-

The commencement date of the remaining provisions relating to the freezing of

assets in terms of the United Nations Security Council Resolutions on targeted

financial sanctions will still be determined.

Status of Exemptions and ML/TF Control Regulations

The FIC Act is now a principles-based piece of legislation. It sets out broad

obligations for accountable institutions, but leaves the methods of meeting

those obligations to be decided by the accountable institutions. This implies

that accountable institutions should determine the most appropriate means to

implement the provisions of the FIC Act.

Previously, accountable institutions relied on Exemptions and other information

that was prescribed in the ML/TF Control Regulations. The Exemptions were

withdrawn and the ML/TF Control Regulations amended to make way for a risk-based

approach.

A risk-based approach provides accountable institutions with the flexibility to

use a range of mechanisms towards implementation of the FIC Act and encourages

accountable institutions to explore innovative ways of offering financial

services to their broader client-base. It must be noted that accountable

institutions may continue to be guided by the contents of some of the withdrawn

Exemptions in the implementation of their compliance approaches.

Training Obligations (section 43) – The accountable institution is

required to provide its employees with ongoing training to enable them to comply

with the FIC Act and the RMCP and to discharge the specific responsibilities

assigned to them. Please note that accountable institutions with no employees

are also subject to ongoing training.

MBSE Online FICA Training Updated

Moonstone Business School of Excellence worked very hard to align their online

training modules with these amendments and confirmed on Friday that the updated

training is now available. Moonstone Compliance clients get gratis access to the

training.

In order to apply for the FICA Online training, click on the relevant link below:

Click here to download

FAIS Newsletter 25 from the FSB to read all about the new FICA. |

|

|

|

| |

.jpg) |

What if you could focus on doing what you love - looking after your

clients?

Leading Independent Financial Advisory (IFA) practices are using GTC’s

Strategic Partner solution to:

- increase time with clients

- increase earnings

- reduce costs

Shouldn’t you too?

Our staff and systems deliver exceptional service, increasing revenues

and saving costs and time for you, enabling you to build value for

succession.

With offices nationally, we are well-placed to help you.

Call us to discuss a strategic partnership.

t. +27 (0) 10 597 6831

e. info@gtc.co.za

w. www.gtc.co.za

An authorised Financial Services Provider FSP no. 731 |

|

|

Your Practice Made Perfect |

|

|

Festive season greetings |

Our humour section features a slightly more politically correct edition

of the same. This is more from the heart.

This year, which is speeding to an end, has arguably been the busiest in

my 40 years in the industry. The latest batch of legislative changes

envisaged for the next six months is a clear indication of the

applicability of the Bachman–Turner Overdrive song:

You ain’t seen nothing yet.

From all of us at Moonstone, a hearty thank you to all our clients,

subscribers and supporters for your regular input, reflections and

complaints which helped us stay in touch with your reality out there.

I used to say to my daughters, on their way out to a night on the town:

“Enjoy, and behave yourselves”, to which the standard retort was: “Make up

your mind, Pa.”

Please enjoy the festive season responsibly, and rest well. Despite so

many distractions, it is still the prime time of year for family and

friends. Enjoy it to the hilt. |

|

|

|

|

|

|

| |

|

Alcohol abuse and how it affects your insurance

|

This article, first published in News24, is obligatory reading for

all your clients as we head into the festive (aka as excessive drinking)

season for many.

It discusses the impact on your short- and long-term insurance, both

from an immediate and longer term perspective.

If each of you can only convince one person to refrain from drinking and

driving, it means that nearly 60 000 people will not transgress the law.

Just imagine the impact on the carnage on our roads every year at this

time.

It’s the festive season and the year-end parties are mounting up. But be

careful not to over- indulge – because not only is drunk driving against

the law but if you’re involved in an accident your insurance probably

won’t pay out. What’s more, alcohol abuse also impacts on long-term

insurance cover, such as life policies. Let’s look at how over-

indulging affects your insurance.

Car insurance

No payouts

When you drive under the influence, you’re committing an offence and

your insurance company is under no obligation to honour your claim. Even

If you’re just fractionally over the legal alcohol limit and you drive

your car and are in an accident, your insurance company doesn’t have to

pay out your claims. Even if the accident wasn’t your fault.

This also applies to third-party insurance, says Dawie Loots of MUA

Insurance Acceptances. Although you’re insured for damage to the other

person’s car, your insurance isn’t obliged to pay out.

You might have to pay for the repairs to your own vehicle and be held

liable for the damage to the other vehicle. You might also have to pay

legal costs and both parties’ medical expenses.

Higher premiums

The insurer might agree to pay your claim, but can still increase your

monthly premium because you’ve become more risky to insure as a result

of the drunk-driving incident.

Cancellation: If you’re convicted of drunk driving, your insurer could

cancel your vehicle insurance, Loots says. In that case you might

struggle to get vehicle cover elsewhere.

Know this

The insurer isn’t responsible for conducting the blood test to check if

the legal alcohol limit has been exceeded. The police are in charge of

blood tests, and refusing to take the test is a criminal offence.

You can't rely on a Road Accident Fund payout; this fund can also

decline to pay out in the case of a drunk-driving accident.

Life insurance

If the policyholder dies while driving a vehicle under the influence of

alcohol or drugs, he was driving illegally. Again the life assurer has

no obligation to honour claims and then the policyholder’s beneficiaries

won’t get a payout.

But there must be a direct connection between the alcohol or drug

consumption and the accident, and it has to be the fault of the insured.

alcohol or drug dependence or already has a liver disease, the insurer

can request liver function tests, liver biopsies, scans and other tests

to determine the damage to their liver.

The premium applied will depend on whether the tests show any damage and

the extent of it. If you have severe liver damage your application for

cover might be rejected, or you might get cover with death due to

alcohol-related illness excluded.

Higher Premiums

Heavy drinkers also pay higher premiums for life insurance. The reason

for this is that they’re more at risk health-wise than people who drink

less.

When you take out a life policy the insurer will want to know how much

you drink currently and used to drink in the past. Dr Thabani Nkwanyana,

medical officer at Liberty Life, says drinking six or more units of

alcohol a day is regarded as risky alcohol consumption, according to

standards prescribed by the World Health Organisation (WHO). For

example, just 75ml red wine equals one unit.

Risk is assessed on an individual basis and your premium is determined

accordingly. Nkwanyana says if a person has a history of providing

incorrect or incomplete information when you apply for insurance is

referred to as non-disclosure or misrepresentation.

It’s one of the most common reasons why claims are rejected. Statistics

of the Association for Saving and Investment South Africa show that life

assurers last year turned down claims worth R332 million, with 55,3%

having been rejected due to non-disclosure.

Full disclosure is when you provide all the information asked for on the

application form concerning your lifestyle, state of health and the

medical histories of you and your close family. When a person doesn’t

disclose a health condition, they’re insured on an incorrect risk

profile.

Click here to read the article online on News24 and share with your

clients. |

|

|

|

| |

|

|

Regulatory Examinations

|

|

|

2018 RE Schedules updated |

Please note: Registration cut-off is 11 working days before date of exam. |

|

|

|

| |

|

Frequently Asked Regulatory Exam

Questions |

| 1. |

What exam must I write?

Both the RE 5 and RE are Level One exams. RE 5 is for Representatives and

RE1 for Key Individuals. The RE 3 exam is for licence category II

candidates.

|

| 2. |

How much does it cost?

The FSB determines the fee. Currently it costs R1163 per exam, also in

the case of a re-write.

|

| 3. |

What preparation material is available?

Fully updated resources are available for those requiring access to the

legislation applicable to the regulatory examinations:

|

| |

● |

Please make sure that you first read the

FSB’s Preparation Guide to

make sure you follow the right process in preparing. Page seven includes

a recent amendment to guide candidates in studying in the correct

manner. |

| |

● |

Click on the following highlighted sections to download the relevant

updated Inseta learning material for key individuals,

RE 1, and

representatives,

RE 5. |

| |

● |

LexisNexis provides a “Legislation Handbook” together with a

“Preparation Guide” containing the qualifying criteria, with a link to

the relevant legislation. |

| |

● |

The

Juta FAIS Pocket Statutes also contains a CD with a comprehensive

list of updated supplementary legislative material for reference

purposes. Please click here to order this from our online shop. |

| |

● |

The FSB’s telematics broadcast on the RE 1 and RE 5

provides a good introduction and overview, and can also be ordered

online in: |

| |

|

DVD format or on a

USB memory stick

MP4 direct download - 2 Gb |

| 4. |

Where can I write?

Go to:

http://www.faisexam.co.za/show_venues |

| 5. |

What dates are available?

Go to:

http://www.faisexam.co.za/view_schedule |

| 6. |

What training is available?

As an Exam body we are not allowed to recommend companies that offer

face-to-face Regulatory exam classes. You can try Google for someone in

your area.

Bear in mind that this exam tests your knowledge about the laws

applicable to the provision of financial advice and intermediary

services. The questions are based on very specific qualifying criteria

set out in the FSB preparation guide. Any training that does not have

this as a basis will not prepare you properly for the exam. Do your own

research and don’t just accept what others say. |

| 7. |

Where can I buy old question papers?

There are no genuine “old question papers” available. Be very careful

when buying such preparation aids as some of those on offer are not in

line with the high standard prevailing in the actual exams and often

lead to a false sense of knowledge which is sadly exposed when

confronted by the actual exam. Follow the guidelines provided in the FSB

Preparation Guide and you are far more likely to achieve success. |

|

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 15 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 49000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

Investment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Junior Short Term

Underwriter:

JFA Short Term Brokers, Milnerton - We require a bilingual

underwriter with RE5 and NQF 4 qualification.

Read More

-

Personal Assistant and

Administrator of investments, life insurance and Medical Aids:

Vesto Capital, Moorreesburg - We are looking for a qualified,

experienced and well groomed lady to commence employment on 8 January

2018.

Read More

-

Short Term Claims

Administrator:

The Insurance Center, Westville, Durban - The successful applicant

must be experienced, work unsupervised and be competent to negotiate

claims settlements at the highest level.

Read More

-

Financial Sales Consultant:

Quest Staffing Solutions, Cape Town - You will provide qualified financial advice directly to clients and

therefore a minimum of 6 months Outbound Call Centre sales experiences or 12

months face to face financial sales, with a RE qualification will be required.

Read More

-

Group Compliance

Practitioner:

LegalWise, Gauteng - You will play a key role in assisting the Group

Compliance Manager to enhance and maintain the compliance strategies and

processes, as well as a culture of ethics and compliance, across the

Group.

Read More

|

|

|

|

|

In Lighter Wyn |

|

|

Answer to Quiz and Politically correct greetings |

|

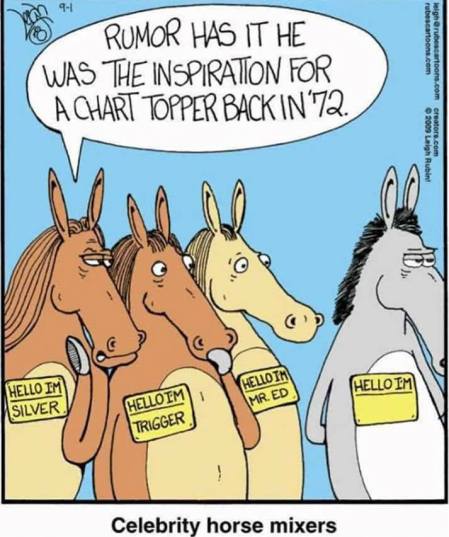

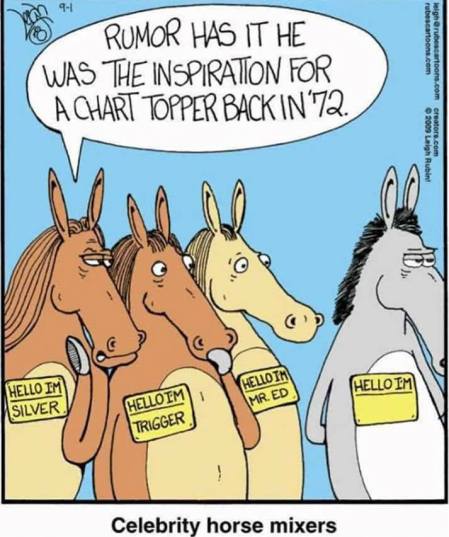

Answer to Monday’s Pic Quiz

The answer, of course, was

A horse with no name. Listen to it while reading the rest below.

Politically correct festive greetings

Please accept, with no obligation, implied or implicit, our best

wishes for an environmentally conscious, socially responsible, low

stress, non-addictive, gender neutral celebration of the winter

solstice holiday, practiced within the most enjoyable traditions of

the religious persuasion of your choice, or secular practices of

your choice, with respect for the religious/secular persuasions

and/or traditions of others, or their choice not to practice

religious or secular traditions at all.

In addition, please also accept our best wishes for a fiscally

successful, personally fulfilling and medically uncomplicated

recognition of the onset of the generally accepted calendar year

2018, but not without due respect for the calendars of choice of

other cultures whose contributions to society have helped make this

country great (not to imply that this country is necessarily greater

than any other country or area of choice), and without regard to the

race, creed, colour, age, physical ability, religious faith or

gender orientation of the wishers.

This wish is limited to the customary and usual good tidings for a

period of one year, or until the issuance of a subsequent holiday

greeting, whichever comes first. ‘Holiday’ is not intended to, nor

shall it be considered, limited to the usual Judeo-Christian

celebrations or observances, or to such activities of any organized

or ad hoc religious community, group, individual or belief (or lack

thereof).

Note: By accepting this greeting, you are accepting these terms.

This greeting is subject to clarification or withdrawal, and is

revocable at the sole discretion of the wisher at any time, for any

reason or for no reason at all.

This greeting is freely transferable with no alteration to the

original greeting. This greeting implies no promise by the wisher

actually to implement any of the wishes for the wisher her/himself

or others, or responsibility for the consequences which may arise

from the implementation or non-implementation of it.

This greeting is void where prohibited by law.

From me and the team, on a more personal note, best wishes for a

joyous and safe holiday season. Thank you for your support,

encouragement, advice and indulgence during one of the most hectic

years in the industry ever. Please take care out there.

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here.

|

|

|

©2015 Moonstone. All rights reserved. |

.jpg)

.jpg)