|

To Subscribe please click

here |

|

|

Moonstone Monitor - 28 September 2017 |

|

|

.jpg) |

|

Paul Kruger

Author/Editor |

| |

|

|

| |

|

|

|

|

|

|

He who is unable to dance says that the yard is stony - Masai proverb |

| |

|

|

Distributed to 48,900 subscribers.

To advertise with us

click here |

|

| |

|

From the Crow's Nest |

|

Catastrophes and the Bottom Line

By Florence de Vries |

Using attention-grabbing adjectives in news headlines to describe

life-changing events has been the preserve of news offices around the world for

years. Over the course of the past few weeks, news reports have delivered the

devastating consequences of fires in South Africa, monsoon flooding in India,

Nepal and Bangladesh, earthquakes in Mexico and hurricanes in the Caribbean and

US. The words ‘battered’, ‘crushed’, and ‘destroyed’, littered across headlines,

applied equally to the environment and the bottom line of insurance companies.

If one goes back in history, you’ll notice that 2017 is hardly the exception.

As the truth about global climate change and poor risk management and planning

come to the fore, general insurers across the world are contending with the

impact of these events on their profitability. Described as the most devastating

catastrophe event in the local insurance industry, the twin events of a large

storm in the Cape followed by fires in Knysna in June hit South African insurers

hard. Most large listed South African insurers reported that their earnings had

taken a knock in the six months to June and industry analysts estimated overall

losses caused by these events could cost the insurance industry in excess of

R3 billion to R4 billion.

In August and early September, parts of the United States and nearby Caribbean

islands were locked in battle with mother-nature as two hurricanes (Harvey and

Irma) destroyed homes and businesses completely. In what was described as the

“most economically significant natural catastrophe in American history”, the

storms battered nearly every single island and town in its path with the

Financial Times reporting that its occurrence had more than likely hurt the

outlook for earnings in the insurance industry.

News reports confirm that “supercat” Hurricane Irma is set to be a material loss

for both the insurance and reinsurance industry, while the impact of Hurricane

Harvey will have further implications. When it comes to catastrophes, reinsurers

matter, largely because they are “the back-up” that help out when catastrophes

hit. It is said that reinsurance programmes have become instrumental,

particularly in a world that has started to face multiple events almost

simultaneously. For now, insurance analysts venture that Hurricane Harvey may

likely only affect reinsurers with exposure to certain risks.

According to Reuters, Mexican insurers are unlikely to see significant impacts

from the earthquake earlier this month, given the low insurance penetration in

the affected areas and reinsurance programmes. Reports are still streaming in

about the latest earthquake that claimed the lives of more than 200 people.

Similarly, the majority of individuals (and businesses) affected by the monsoon

flooding in South Asia did not have insurance. However, global reinsurer Munich

Re reports that the world will continue to see an increase in water-related

disasters in years to come. In the case of most developing countries like Mexico

and some countries in South Asia, large catastrophe events can trigger

devastating blows to their GDP.

As the next reinsurance renewal season kicks off, insurance industry analysts

believe that cedants, brokers and reinsurance companies will have a lot to

consider, including the assertion that insurers underestimate risks when taking

on new business – which is concerning. It will be up to insurance businesses to

realise that these types of events have long since stopped being confined to

geographical borders. They must realise that when it comes to large natural

disasters, or catastrophes, there is always going to be a global impact. As Guy

Carpenter, vice chairman of Dave Priebe said: “We live in a global world and if

this is a capital event, that’s not just for risk supporting Florida and Texas

(in the context of Hurricanes Harvey and Irma), it’s a capital event for global

risk.”

Florence de Vries is a communications manager in the short-term insurance

industry. |

|

|

|

| |

.jpg) |

What if you could focus on doing what you love - looking after your

clients?

Leading Independent Financial Advisory (IFA) practices are using GTC’s

Strategic Partner solution to:

- increase time with clients

- increase earnings

- reduce costs

Shouldn’t you too?

Our staff and systems deliver exceptional service, increasing revenues

and saving costs and time for you, enabling you to build value for

succession.

With offices nationally, we are well-placed to help you.

Call us to discuss a strategic partnership.

t. +27 (0) 10 597 6831

e. info@gtc.co.za

w. www.gtc.co.za

An authorised Financial Services Provider FSP no. 731 |

|

|

Your Practice Made Perfect |

|

Compliance audit on credit life insurance policies

By Gerrit Viviers |

Since the publication of the final credit life insurance regulations

(the Regulations) that came into effect on 10 August 2017, Moonstone

received numerous queries relating to the compliance requirements

imposed by the Regulations.

In the National Credit Regulator’s (NCR) annual report for the period

2016/2017, both the Minister and the NCR’s Credit Provider Compliance

Manager specifically identified the compliance monitoring of the

Regulations as the main focus for the upcoming year. Many credit

providers and insurers will very likely be subject to an NCR monitoring

exercise to assess their compliance with the Regulations.

Moonstone now offers a compliance audit service specifically designed to

assess credit providers’ and insurers’ compliance with the Regulations,

including:

-

The maximum prescribed fee calculations for credit life

insurance premiums;

-

The minimum policy benefits;

-

The permitted policy exclusions and limitations;

-

The avoidance of prohibited conduct;

-

The permitted waiting periods; and

-

The other compliance requirements imposed by the Regulations.

For peace of mind regarding the compliance status of your credit life

insurance products, contact Moonstone today.

Moonstone has a NCA Specialist to render NCA compliance services to

its clients. Should you want to enquire about its product audit service,

please contact Gerrit Viviers on 021 883 8000 or by email to

gviviers@moonstonecompliance.co.za. |

|

|

|

|

|

|

| |

|

Vehicle aftermarket code to aid transformation

|

Legalbrief Today published the following:

The Competition Commission is concerned about anti-competitive conduct

in the automotive after-market and has published far-reaching proposals

that will shake up the industry, says a Business Day report.

The proposals were contained in a draft code of conduct gazetted for

public comment on Friday, 22 September, that aims to transform the

sector and encourage greater participation of historically disadvantaged

individuals. Once finalised, the code will bind the car manufacturers,

government bodies, industry associations and insurers that will be

signatories to it. ‘The code of conduct is intended to address

competition concerns arising from agreements between original equipment

manufacturers and dealers, insurers and repair and maintenance service

providers which have the effect of substantially lessening or

preventing competition and which have created barriers to entry in the

automotive industry,’ the draft code said.

Of concern to the industry will be the proposal to remove restrictions

that stand in the way of small, independent and historically

disadvantaged service providers from undertaking service and maintenance

work while a vehicle is in warranty. The code proposes that original

equipment manufacturers provide access to the safety and technical

specifications of their parts to enable independent service providers to

undertake these repairs. The commission wants to remove the ‘onerous

requirements’ that prevent historically disadvantaged individuals from

owning car dealerships.

Please

click here to download the full media release. |

|

|

|

| |

|

| |

Technologically Speaking

Moonstone Information Refinery |

|

Disruptive Technology in traditional insurance business |

For most of us, the advent of technology in the industry is a bit like

the famous saying back in the bad old army days: Hurry up and wait.

A recent article in the magazine Raconteur made some very

interesting comments about possible applications of technology in

the way we currently do business, and the impact thereof.

Below is a brief synopsis, followed by a link to the full article.

Tech companies succeed when they see the world differently and find

new ways to meet genuine consumer demands at a fraction of the costs

and with none of the complexity associated with the existing

industry players.

This is the allure of technology for the insurance industry.

Characterised as it is, though to some degree unfairly, as old

fashioned in attitudes, approach and customer service, it is seen

both from inside and out as ripe for disruption.

In the past few years, so much technology money poured into the

insurance sector that it created its own buzzword – insurtech. All

manner of innovations, business models and aps are being developed

in the hope that they will revolutionise a traditional business.

But while there is money in abundance we still have not seen the

vision and no one in the technology industry has yet come up with a

fundamentally new way of thinking about the management of risk.

There is as yet no sign of the insurance industry’s Amazon or Uber.

There is a good reason for this. Much of the effort currently is

based on taking what has worked elsewhere in e-commerce and seeking

to apply it to the insurance business.

But there is a problem. Most of the consumer apps, which have

achieved significant success in other areas, provide new and easier

ways for people to find, buy and have delivered something they

really want. These apps are pushing on an open door.

The problem with insurance is that nobody really wants it. People

might understand they would be wise to buy it; they might even as

drivers be compelled to have it, but that does not make it a

purchase they enjoy. New technology can deliver insurance more

cheaply, enable customers to shop around and make the process much

faster, simpler and easier. But it cannot overcome this basic

antagonism.

And it is the same with the issue of trust. The caricature of the

industry is that when a claim is made, the insurer will try to chip

away at the amount and the customer will chuck in a few extra items

which were not lost or stolen in anticipation of this. Then there is

a negotiation. Technology, in theory, should do away with this human

interaction, but in a world where people struggle to come to terms

with business where the “computer says no”, are they really ready

for “computer says trust me”?

That is not to say there will be no benefits. Facial recognition

technology already provides as much information on age, lifestyle

smoking habits and health as a ten-page medical questionnaire, and

without the ability to embellish the answers.

Life policies could soon be sold on the basis of a selfie, without

the need for the medical.

Insurance could become personal rather than product oriented. If you

have three cars, all have to be insured, though you will only ever

be driving one at any particular time.

But technology will soon make it cheap enough to insure people

rather than products, so the customer will be paying only when the

product is in use, when actually driving or travelling, or taking on

any of life’s other myriad risks.

However, it might not all be cosy for the customer. The other side

of insurtech is the work being done on data, and the developing

ability of underwriters to gather and process vastly greater

quantities of information than ever before, in ways which give them

far greater insight into where the risks really lie.

The upside is that these greater insights should lead to much keener

pricing for the majority. The downside is that those whom the

computer says are risky, might find it impossible to get any cover

at all, just as flood insurance is hard to come by in some areas.

This would also apply in areas of health, where gene sequencing

might be used to predict future illnesses and longevity.

If this leads to only the good risks being insured, it will provoke

an intense debate around the issues of privacy and discrimination.

What all this underlines is that selling financial services is far

more complex than selling conventional items in retail and insurance

is one of the more complex areas within financial services. That

complexity lends itself to bespoke operations and tailor-made

policies whereas technology thrives on standardisation.

But these problems will eventually be solved and there is no

shortage of money looking for the answers.

Click here to read the full article.

Suitebox Media contact

Neil Summers, Sales Manager, Moonstone Business Services

Mobile: +27729088994

Email:

neil@suitebox.com.

|

|

|

|

|

Regulatory Examinations

|

|

|

|

| |

|

Frequently Asked Regulatory Exam

Questions |

| 1. |

What exam must I write?

Both the RE 5 and RE are Level One exams. RE 5 is for Representatives and

RE1 for Key Individuals. The RE 3 exam is for licence category II

candidates.

|

| 2. |

How much does it cost?

The FSB determines the fee. Currently it costs R1163 per exam, also in

the case of a re-write.

|

| 3. |

What preparation material is available?

Fully updated resources are available for those requiring access to the

legislation applicable to the regulatory examinations:

|

| |

● |

Please make sure that you first read the

FSB’s Preparation Guide to

make sure you follow the right process in preparing. Page seven includes

a recent amendment to guide candidates in studying in the correct

manner. |

| |

● |

Click on the following highlighted sections to download the relevant

updated Inseta learning material for key individuals,

RE 1, and

representatives,

RE 5. |

| |

● |

LexisNexis provides a “Legislation Handbook” together with a

“Preparation Guide” containing the qualifying criteria, with a link to

the relevant legislation. |

| |

● |

The

Juta FAIS Pocket Statutes also contains a CD with a comprehensive

list of updated supplementary legislative material for reference

purposes. Please click here to order this from our online shop. |

| |

● |

The FSB’s telematics broadcast on the RE 1 and RE 5

provides a good introduction and overview, and can also be ordered

online in: |

| |

|

DVD format or on a

USB memory stick

MP4 direct download - 2 Gb |

| 4. |

Where can I write?

Go to:

http://www.faisexam.co.za/show_venues |

| 5. |

What dates are available?

Go to:

http://www.faisexam.co.za/view_schedule |

| 6. |

What training is available?

As an Exam body we are not allowed to recommend companies that offer

face-to-face Regulatory exam classes. You can try Google for someone in

your area.

Bear in mind that this exam tests your knowledge about the laws

applicable to the provision of financial advice and intermediary

services. The questions are based on very specific qualifying criteria

set out in the FSB preparation guide. Any training that does not have

this as a basis will not prepare you properly for the exam. Do your own

research and don’t just accept what others say. |

| 7. |

Where can I buy old question papers?

There are no genuine “old question papers” available. Be very careful

when buying such preparation aids as some of those on offer are not in

line with the high standard prevailing in the actual exams and often

lead to a false sense of knowledge which is sadly exposed when

confronted by the actual exam. Follow the guidelines provided in the FSB

Preparation Guide and you are far more likely to achieve success. |

|

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 15 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 48000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

Investment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Business Development

Manager:

Sovereign Group, Johannesburg - If you are a Graduate or admitted

attorney, a confident public speaker with general company, commercial

and trust law and happy to spend 50% of your time out of the office in

meetings, selling Sovereign Trust’s services, then

Read More

-

Marketing & Events

Coordinator:

Sovereign Group, Cape Town - The applicant must be a fluent and

articulate English and Afrikaans speaker holding an undergraduate degree

obtained from a reputable tertiary institution. Applicants with a

marketing background will receive preference.

Read More

-

Legal/Administration

Assistant Position (Half Day):

Sovereign Group, Cape Town - The successful applicant will assist

two to three lawyers in the office, must have a relevant degree and be

fluent and articulate in English and Afrikaans.

Read More

-

Financial Advisor:

Origin Financial, Cape Town - The core function of the successful

candidate is to look for new business and maintain relationships with

clients. Must have own car & driver’s licence as well as RE certificate.

Read More

-

Financial Advisors:

Quantum Invest (Pty) Ltd, Randburg Ridge, Johannesburg - If you have

a Matric and RE5 Certificate with 8 months experience in the Insurance

Industry, then

Read More

|

|

|

|

|

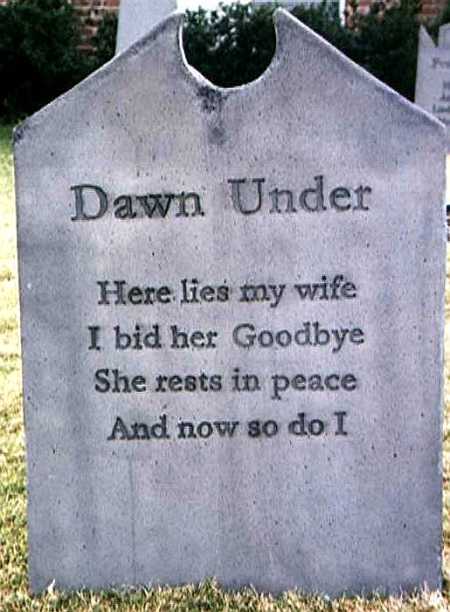

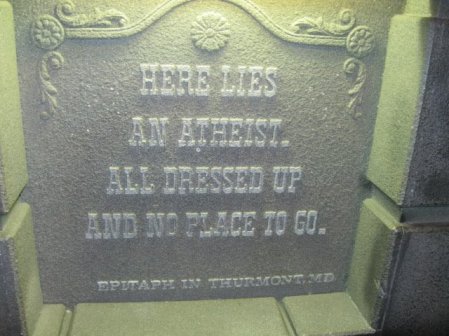

In Lighter Wyn |

|

|

New Logo? |

|

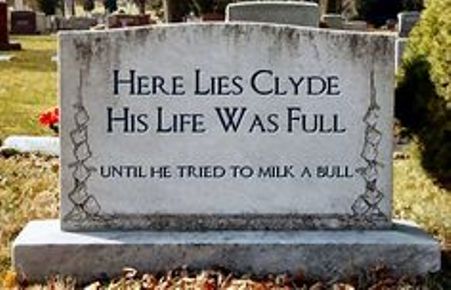

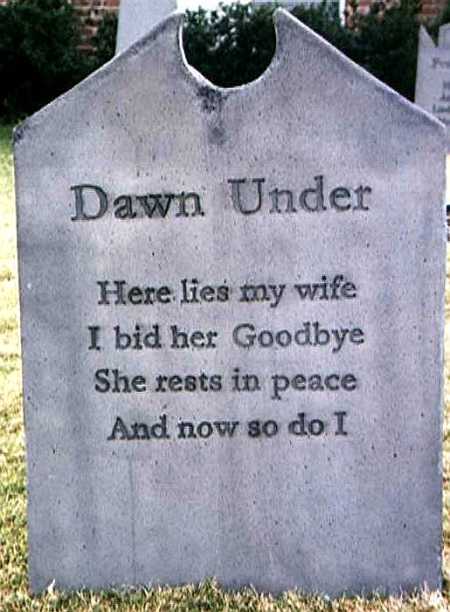

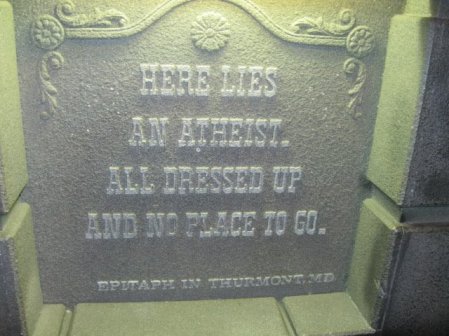

Humorous Epitaphs

In memory of the late Hugh Hefner, who some suggest should have the

following on his gravestone:

Stiff at last without the aid of medication.

And on that deadly note we wish you a great weekend and, hey, be

careful out there!

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here.

|

|

|

©2015 Moonstone. All rights reserved. |

.jpg)

.jpg)