|

To Subscribe please click

here |

|

|

Moonstone Monitor - 21 September 2017 |

|

|

.jpg) |

|

Paul Kruger

Author/Editor |

| |

|

|

| |

|

|

|

|

|

The real distinction is between those who adapt their purposes to reality

and those who seek to mould reality in the light of their purposes

– Henry Kissinger |

| |

|

|

Distributed to 48,600 subscribers.

To advertise with us

click here |

|

| |

|

From the Crow's Nest |

|

|

Too many eggs in one basket? |

“Catch-22 is any paradoxical, circular reasoning that catches its victim

in its illogic and serves those who have made the law.”

One of the options in the Merriam-Webster dictionary reads: “A situation

presenting two equally undesirable alternatives.”

At times, these hectic days of constant legislative change reminds me of Joseph

Heller’s zany novel in which the (anti) hero tries to claim that he is insane.

His superiors then determine that only one who is sane will claim that he is

insane, therefore he must be sane.

Two apparently contradictory news reports recently got me thinking again about

where the financial services industry, and our sector, specifically, currently

finds itself, and where it is heading.

Amicus re Incerta

The long-term insurance industry statistics for the 12 months to 30 June 2017

reflects payment of R458 billion in benefit payments from life insurers to

policyholders and beneficiaries.

This included an increase of 21% in claims against individual disability

policies.

“An unusually high increase in disability claims is usually indicative of

consumers under severe strain. Financial stress leads to both mental and

physical illness, which invariably results in higher disability claims.”

The life industry, as custodian of the nation’s wealth, currently holds assets

worth R2.7 trillion on behalf of policyholders.

There can be no better example of the important role the industry plays in the

lives of ordinary citizens, than the support and payments received by

policyholders after the devastating floods and fires in the Western Cape

recently, despite some disgruntled policyholders complaining after being under

insured.

In the middle ages, when I was employed by Old Mutual, its motto was: Amicus

certus in re incerta. A certain friend in uncertain times, or, more plainly put,

a friend in need is a friend indeed. The Dutch have an even more apt

translation: Een echte vriend wordt in onzekere tijden opgemerkt of, in nood

leert men z'n vrienden kennen.

The other side of the coin

Investors in the ill-fated Relative Value Arbitrage Fund are now faced with a

possible 5c for every one rand invested, despite a return of 422% for those who

were fully invested from April 2004 to July 2012. According to the auditors of

the fund, a total of nearly R2.5 billion was invested, while over R1.8 billion

was paid out to investors.

Big losses were also incurred from failed property syndication schemes,

although, as in the RVAF case, many also made significant gains before the

implosion.

Did this warrant the full scale legislative onslaught we have been experiencing

for the past ten or more years? Or did it perhaps take the focus off the good

work done by the industry as consumerism started distorting the focus?

Twin Peaks to the rescue?

The object of the Financial Sector Regulation Act is to establish a financial

system that works in the interests of financial customers and supports balanced

and sustainable economic growth in the Republic.

Critics of the Act were particularly vocal on the huge bureaucracy being

created, with little indication of a thorough cost or impact study.

Just a glance at the various structures to be implemented to ensure synergy

between all the various agencies involved appears to confirm these concerns, and

possibly reminds one about what is said about the road to hell.

But wait, that’s not all…

The 2008 financial meltdown, despite not really impacting on South Africa to the

same extent that it did elsewhere, led to what many view as over reaction from

government. Most of the current bigger maladies are as a direct result of

political interference and the appointment of incompetent people and worse: the

replacement of competent civil servants with lapdogs eager to bark at the

command of his master’s voice.

Other legislation, and notably FICA and POPI, will add a huge administrative

burden to an already overloaded ass. Future legislative interventions, and

notably the Conduct of Financial Institutions Act, may just be the straw that

breaks the proverbial smaller camel’s back.

Independent advice, in particular, will be under severe threat, given the

demands all this will place on time, funds and productivity.

Did FAIS Fail?

If it did, it was not because the legislation was at fault. Any new law will

have shortcomings which need to be addressed over time.

The single biggest mistake was possibly trying to remedy problems relating to

the investment arena by casting a net to include all other disciplines. Failure

to understand, for instance, that different rules should apply for marketing

funeral policies compared to complex financial investments, led to regulation by

exemption, which increased as time progressed, and is already included in the

new legislation.

Switching the regulatory focus from rules to client outcomes will have a

significant impact on compliance by the industry, and entail a vast investment

in systems development to enable it to monitor and prove fair treatment of

clients. An inherent danger is that those who will rule on whether fair client

outcomes are achieved will necessarily be making a subjective assessment. How

long is a piece of string?

Perhaps Lewis Carroll provided the best summary of the current rat race:

“Now, here, you see, it takes all the running you can do, to keep in the same

place. If you want to get somewhere else, you must run at least twice as fast as

that.“ |

|

|

|

| |

.jpg) |

What if you could focus on doing what you love - looking after your

clients?

Leading Independent Financial Advisory (IFA) practices are using GTC’s

Strategic Partner solution to:

- increase time with clients

- increase earnings

- reduce costs

Shouldn’t you too?

Our staff and systems deliver exceptional service, increasing revenues

and saving costs and time for you, enabling you to build value for

succession.

With offices nationally, we are well-placed to help you.

Call us to discuss a strategic partnership.

t. +27 (0) 10 597 6858

e. info@gtc.co.za

w.

www.gtc.co.za

An authorised Financial Services Provider FSP no. 731. |

|

|

Your Practice Made Perfect |

|

|

The client’s right to know |

Last week, we reported on the Phoshera judgment by the FSB Appeal Board

where it concurred with the view of the FAIS Ombud that the rejection of

a claim was warranted on the basis that the vehicle did not comply with

the required terms and conditions of the prescribed roadworthiness of

the National Road Traffic Act.

The Board was not impressed with the fact that the client was never

informed of the change of insurer, though.

“In our view, the practice in the industry which seems to derive from an

interpretation of Rule 7.3 of the PPR, permitting for unilateral

decision-making with regard to the terms, including changes made

regarding the parties to this policy contract without as much as

informing Mr. Phoshera, cannot stand. As already mentioned, it is

out of sync with other applicable legislation. It is particularly

untenable in a legal dispensation such as ours where a supreme

constitution in its Bill of Rights and Responsibilities guarantees and

protects fundamental human rights and freedoms which include the right

to freedom of association, the right of access to information and the

right to be treated with human dignity.”

“That indeed suggests more than just the need for knowledge of the

change of insurer and/or underwriter. Bhekukwenza Hlela strengthens the

notion that when a new binder agreement is entered into it is critical

that the insured be appropriately notified so as to grant her/him the

opportunity to exercise the choice to stay, alter and or opt out of the

policy contract.”

“Indeed, that right to choose in the context of the conclusion of a

policy contract amounts to consent in line with Section 106 (4) of the

National Credit Insurance Act of 2005 and Section 48A of the STI Act

read with the General Code of the Financial Services Providers.”

In this particular instance, the underwriting manager informed the

client’s broker of the new binder agreement, but the broker failed to

convey this to the client. Failure to advise a client of changes to

material terms of a contract is a serious matter, and can

lead to regulatory action against the broker. |

|

|

|

|

|

|

| |

|

Standardised Short–term Personal Lines Terminology

|

The SAIA published a list of standardised terminology on the SAIA

website. The terms were identified by the SAIA Treating Customers Fairly

workgroup on Standardised Terminology.

The aim of the list is to ensure that policy wording is understood fully

by the consumer and that all potentially confusing terms be defined on

the list, for the ultimate benefit of clients.

SAIA members are encouraged to use the document as a consumer tool, in

order to create understanding and to support disclosure in the industry.

I am sure that most of our readers working in this market will find it a

very handy tool to share with clients to assist understanding, and as an

indicator of your commitment to client care.

The term “consequential loss”, for instance, which we discussed in a recent article,

is fully explained via the link in the document.

Well done, SAIA.

Please

click here to download the document. |

|

|

|

| |

.jpg)

|

| |

|

Updating of Policy Wording

|

A noteworthy comment from the SAIA September newsletter:

The Short-term Ombud indicated that Insurers’ policy wording and claims

philosophies are not updated and aligned to changes in technology and

criminal behaviour. For example, the clause “forcible and violent entry”

is strictly interpreted but today, criminals use car jamming devices

hence the insured will not be able to demonstrate “forcible and violent

entry.”

Similarly, in commercial policies, it is required that there be

“forcible and violent entry” into the main building but often thieves

break into a storeroom, for example, and the claim is rejected as there

was no “forcible and violent entry” into the main building.

The Ombud acknowledges that evidence is important in car jamming claims

but some insurers have rejected these claims despite surveillance

footage. She stated further that insurers are placing a greater emphasis

on criminal conduct rather than the basis of the risk and the protection

that should be afforded to the insured. Insureds are therefore paying

for cover but not receiving the protection at claims stage due to the

strict interpretation of policy wording.

Some insurers also neglect to include the Ombud’s details on rejection

letters which insurers are legally required to do in terms of the

Policyholder Protection Rules. |

|

|

|

| |

|

Technologically Speaking

Moonstone Information Refinery |

|

Technology and Compliance |

A recent article by Patrick Cairns in Moneyweb provides an interesting

perspective on the role of technology in the ever increasing

challenge that compliance is becoming.

The advent of Twin Peaks means that companies will no longer be

tested on processes and procedures, but what they actually end up

delivering. Financial services providers will still be told

what to do, but it is left up to them to decide how they will do it.

“At the moment, for example, we require all financial services

providers above a certain size to have a compliance officer,”

explains the Financial Services Board’s (FSB) head of FAIS, Caroline

da Silva.

“Under the new framework, the company will be required to have

compliance that is structured in a way that is appropriate to the

risks and complexities of the business,” she adds. “It must have

systems and controls in place to provide monitoring, but we don’t

specify exactly how that must be done.”

For Michael Meadon from Thomson Reuters, this has two significant

consequences.

“Firstly, a tick-box, rules-based approach may force institutions to

do things that don’t actually advance the regulator’s desired

outcome,” he says. “Having decided that customers have to be treated

fairly, the regulator may decide that all financial services

companies have to do certain things. But doing those things might

not necessarily lead to the outcome the regulator wants, and so they

have imposed a cost with no corresponding benefit.”

“Allowing companies flexibility, removes that risk,” Meadon says.

“And, secondly, it allows for greater adoption of technology.”

Currently, a lot of compliance functions have to be performed

manually, because that is what is prescribed. But a lot of this work

could be performed more efficiently and effectively by computers.

Click here to read the full

Moneyweb article.

Suitebox Media contact

Neil Summers, Sales Manager, Moonstone Business Services

Mobile: +27729088994

Email:

neil@suitebox.com.

|

|

|

|

|

Regulatory Examinations

|

|

|

|

| |

|

Frequently Asked Regulatory Exam

Questions |

| 1. |

What exam must I write?

Both the RE 5 and RE are Level One exams. RE 5 is for Representatives and

RE1 for Key Individuals. The RE 3 exam is for licence category II

candidates.

|

| 2. |

How much does it cost?

The FSB determines the fee. Currently it costs R1163 per exam, also in

the case of a re-write.

|

| 3. |

What preparation material is available?

Fully updated resources are available for those requiring access to the

legislation applicable to the regulatory examinations:

|

| |

● |

Please make sure that you first read the

FSB’s Preparation Guide to

make sure you follow the right process in preparing. Page seven includes

a recent amendment to guide candidates in studying in the correct

manner. |

| |

● |

Click on the following highlighted sections to download the relevant

updated Inseta learning material for key individuals,

RE 1, and

representatives,

RE 5. |

| |

● |

LexisNexis provides a “Legislation Handbook” together with a

“Preparation Guide” containing the qualifying criteria, with a link to

the relevant legislation. |

| |

● |

The

Juta FAIS Pocket Statutes also contains a CD with a comprehensive

list of updated supplementary legislative material for reference

purposes. Please click here to order this from our online shop. |

| |

● |

The FSB’s telematics broadcast on the RE 1 and RE 5

provides a good introduction and overview, and can also be ordered

online in: |

| |

|

DVD format or on a

USB memory stick

New:

MP4 download |

| 4. |

Where can I write?

Go to:

http://www.faisexam.co.za/show_venues |

| 5. |

What dates are available?

Go to:

http://www.faisexam.co.za/view_schedule |

| 6. |

What training is available?

As an Exam body we are not allowed to recommend companies that offer

face-to-face Regulatory exam classes. You can try Google for someone in

your area.

Bear in mind that this exam tests your knowledge about the laws

applicable to the provision of financial advice and intermediary

services. The questions are based on very specific qualifying criteria

set out in the FSB preparation guide. Any training that does not have

this as a basis will not prepare you properly for the exam. Do your own

research and don’t just accept what others say. |

| 7. |

Where can I buy old question papers?

There are no genuine “old question papers” available. Be very careful

when buying such preparation aids as some of those on offer are not in

line with the high standard prevailing in the actual exams and often

lead to a false sense of knowledge which is sadly exposed when

confronted by the actual exam. Follow the guidelines provided in the FSB

Preparation Guide and you are far more likely to achieve success. |

|

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 15 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 48000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

Investment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Marketing & Events

Coordinator:

Sovereign Group, Cape Town - The applicant must be a fluent and

articulate English and Afrikaans speaker holding an undergraduate degree

obtained from a reputable tertiary institution. Applicants with a

marketing background will receive preference.

Read More

-

Legal/Administration

Assistant Position (Half Day):

Sovereign Group, Cape Town - The successful applicant will assist

two to three lawyers in the office, must have a relevant degree and be

fluent and articulate in English and Afrikaans.

Read More

-

Financial Advisor:

Origin Financial, Cape Town - The core function of the successful

candidate is to look for new business and maintain relationships with

clients. Must have own car & driver’s licence as well as RE certificate.

Read More

-

Financial Advisors:

Quantum Invest (Pty) Ltd, Randburg Ridge, Johannesburg - If you have

a Matric and RE5 Certificate with 8 months experience in the Insurance

Industry, then

Read More

-

Short Term Commercial

and Domestic Sales Consultant:

Wealth Solutions Capital Insurance Brokers, Bedfordview - We are

looking for dynamic and energetic go getters for short term commercial

and personal lines insurance, as well as for Financial Advisers.

Read More

|

|

|

|

|

In Lighter Wyn |

|

|

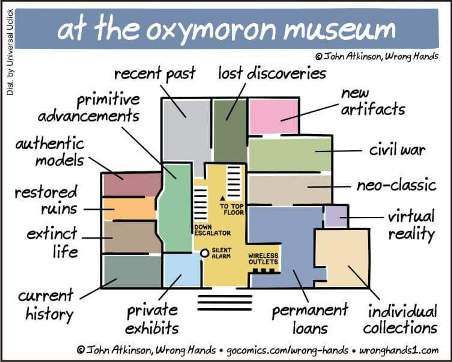

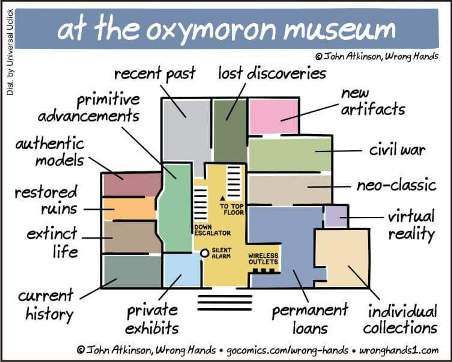

Oxymorons |

The comedian George Carlin is credited with identifying two of the

finest examples of contradictory terms: “Military intelligence” and

“Business ethics”.

My favourite pet hate is the modern monstrosity called “Reality

shows”.

Interestingly, even Shakespeare wikkled a spies in Romeo and Juliet:

O brawling love! O loving hate!

O anything of nothing first create!

O heavy lightness, serious vanity!

Misshapen chaos of well-seeming forms!

Feather of lead, bright smoke, cold fire, sick health!

Still-waking sleep that is not what it is!

This love feel I, that feel no love in this

Thanks John O B for sharing these fine specimens.

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here.

|

|

|

©2015 Moonstone. All rights reserved. |

.jpg)

.jpg)

.jpg)