|

To Subscribe please click

here |

|

|

Moonstone Monitor - 14 September 2017 |

|

|

.jpg) |

|

Paul Kruger

Author/Editor |

| |

|

|

| |

|

|

|

|

|

|

Never suffer youth to be an excuse for inadequacy, nor age and fame to be an

excuse for indolence – Benjamin Haydon |

| |

|

|

Distributed to 48,939 subscribers.

To advertise with us

click here |

|

| |

|

From the Crow's Nest |

|

|

Appeal Board upholds Ombud Decision |

In June we reported on three new cases to be heard by the FSB Appeal

Board. One of these concerned a complaint that was dismissed by the Ombud but

the client, an advocate, appealed to the Board against the Ombud’s finding.

Background

The claim was rejected because the vehicle, which was written off in an

accident, was not roadworthy. The tyres were worn and this was “material to the

cause of the loss”.

The complainant was aggrieved as it appears that the underwriting manager, MUA

Insurance Acceptances, changed the insurer from Compass to Auto and General

without informing him. He was adamant that, if he had been informed of the

change of insurer, he would not have agreed to contract with Auto and General

and would have chosen a different insurer to undertake the risk.

The respondents pointed out that, although the insurer was changed, the terms

and conditions of complainant’s contract remained the same.

The Ombud ruled that no other insurer would have paid the claim, given the fact

that the vehicle was not roadworthy.

Grounds for Appeal

The client contended, amongst other arguments, that his contract with MUA did

not make provision for the policy to be ceded or transferred to a third party

without his consent and knowledge. In fact, in terms of Clause 2 of the

contract, both MUA and the broker were obliged to inform him of any changes to

the contract.

He further indicated that the failure to inform him of the change of insurer

prevented him from exercising his right to choose his own insurer. These

failures rendered his policy contract null and void, which meant that the FAIS

Ombud “…erred by considering and adjudicating further on any aspects of the void

insurance contract.”

In terms of these and other breaches of the contract, the Ombud should not have

dismissed the complaint.

Respondents’ case

The applicable terms and conditions under the new policy were identical to those

of the original policy, and MUA, with whom the client was familiar, continued to

administer the policy. They, too, repudiated the claim in terms of their

mandated binder agreement, the terms and conditions of which were identical to

what the client was familiar with.

Appeal Board Finding

The Board was quite scathing in its view on the industry’s disregard for a

client’s rights:

“In our view, the practice in the industry which seems to derive from an

interpretation of Rule 7.3 of the PPR, permitting for unilateral decision-making

with regard to the terms, including changes made regarding the parties to this

policy contract without as much as informing Mr. Phoshera, cannot stand. As

already mentioned, it is out of sync with other applicable legislation. It is

particularly untenable in a legal dispensation such as ours where a supreme

constitution in its Bill of Rights and Responsibilities guarantees and protects

fundamental human rights and freedoms which include the right to freedom of

association, the right of access to information and the right to be treated with

human dignity.”

“That indeed suggests more than just the need for knowledge of the change of

insurer and or underwriter. Bhekukwenza Hlela strengthens the notion that when

a new binder agreement is entered into it is critical that the insured be

appropriately notified so as to grant her/him the opportunity to exercise the

choice to stay, alter and or opt out of the policy contract.”

“Indeed, that right to choose in the context of the conclusion of a policy

contract amounts to consent in line with Section 106 (4) of the National Credit

Insurance Act of 2005 and Section 48A of the STI Act read with the General Code

of the Financial Services Providers.”

As the

terms and conditions of the original policy contract remained identical

to those in the new policy which was based the MUA/Auto & General binder

agreement, and as the same administrator considered the claim as would have been

the case under the original policy, the appeal was not upheld.

Ramifications of the failure by the brokerage concerned to notify the insured of

the change of insurer will be discussed next week.

Please

click here to download the relevant Judgment. |

|

|

|

| |

|

11-15 September is National Wills Week

The latest figures released by the Master of the High Court reveal that

more than 70% of the South African working population do not have

wills.

This ‘Wills Week’ 11-15 September, GTC’s Fiduciary Services team

invites you to consider setting up a formal partnership with us in order

to offer your clients contemporary and tax-savvy advice in drawing up

their wills and estate plans, to ensure that their testamentary wishes

are carried out and that their fiduciary responsibilities are honoured.

Through a working relationship with GTC Fiduciary Services, you can

assist your clients with the drafting of wills, estate administration,

setting up of trusts, trust administration and taking on professional

trusteeships, along with dedicated estate planning solutions.

For a one-on-one meeting to discuss a partnership with us, please

contact Jeremy Woods: jwoods@gtc.co.za.

t. +27 (0) 10 597 6858

e. info@gtc.co.za

w.

www.gtc.co.za

An authorised Financial Services Provider FSP no. 731. |

|

|

Your Practice Made Perfect |

|

|

POPI Information Officer Obligations |

The Protection of Personal Information Act adds yet another obligation

on businesses in the financial services sector.

Draft regulations, published on 8 September 2017, set out what will be

required. Section 4 outlines the duties and responsibilities of

information officers which companies will be obliged to appoint.

Subject to the provisions of section 55 of the Act, an information

officer must ensure that -

|

a) |

a compliance framework is developed, implemented and

monitored; |

|

b) |

adequate measures and standards exists in order to

comply with the conditions for the lawful processing of

personal information; |

|

c) |

preliminary assessments are conducted; |

|

d) |

a manual for the purpose of the Promotion of Access to

Information Act and the Act is developed detailing—

(i) the purpose of the processing;

(ii) a description of the categories of data subjects and of the

information or categories of information relating thereto;

(iii) the recipients or categories of recipients to whom the personal

information may be supplied;

(iv) the planned trans-border or cross border flows of personal

information; and |

|

e) |

a general description allowing preliminary assessment of

the suitability of information security measures to be

implemented and monitored by the responsible party;

(e) the manual referred to in paragraph (d)

is available -

(i) on the website, of the responsible party; and

(ii) at the office or offices of the responsible party for public

inspection during normal business hours of that responsible party; |

|

f) |

internal measures are developed together with adequate

systems to process requests for information or access

thereto; and |

|

g) |

awareness sessions are conducted regarding the

provisions of the Act, regulations made in terms of the

Act, codes of conduct, or information obtained from the

Regulator. |

Expectations are that Popia will become effective early in 2018, so you

may want to consider getting the ball rolling in respect of the above.

Click here to download the latest draft regulations. |

|

|

|

|

|

|

| |

|

Exemption for Compliance Officers

|

FAIS Notice 119, published on 13 September 2017, contains details of

changes to the minimum prescribed intervals of visits and reports by

compliance officers as contained in Section 4(4) of the Notice on

Compliance Officers. These changes are as a result of feedback from the

industry in response to an invitation by the Regulator.

In essence, the exemption places the onus for determining the number of

branch visits and reports on the compliance officer, who has to have due

regard for a FSP’s specific circumstances which include:

-

the nature, scale and complexity of the provider's business and

nature and range of financial services, activities and ancillary

services offered;

-

compliance risks of the provider having regard to the financial

services, activities and ancillary services offered, as well as the

types of financial products in respect of which the services are

rendered and the market in which it operates;

-

availability and adequacy of off-site monitoring tools; and

-

off-site access to data from the business premises, business units

and/or branches of the provider;

The CO is also obliged to establish and implement a monitoring programme

that takes into consideration all areas of the provider's financial

services, activities and any relevant ancillary services to ensure that

compliance risks and changes to those risks are comprehensively

monitored;

The CO should also review the monitoring programme on a regular basis,

as well as ad-hoc when necessary, to ensure that emerging risks are

taken into consideration and, on a regular basis, report to the provider

on at least the following:

-

adequacy and effectiveness of the overall control environment for

financial services and activities, including systems, policies, controls

and procedures;

-

the risks and deficiencies that have been identified; and

-

the remedies undertaken or to be undertaken.

Finally, the CO must inform the provider to whom the compliance officer

renders compliance services of the applicability of this exemption to

such services.

You may also want to consider making use of Suitebox, a piece of

technology which can save you aeons of time in both travel and record

keeping. Click here for a 1.5 minute introduction.

Please

click here to download FAIS Notice 119 of 2017. |

|

|

|

| |

.jpg)

|

| |

|

FIC Head Departing

|

Legalbrief Today reports:

The head of the Financial Intelligence Centre (FIC), Murray Michell,

will leave at the end of 2017 and the Treasury is seeking a replacement

for him. A Business Day report says the contract of Michell – who has

been at the helm of the body since it was established about 14 years ago

– is coming to an end. It is understood that he is retiring. The

Treasury advertised the position at the weekend, giving only two weeks

before the deadline for applications, which may suggest that a

replacement has been identified.

The real danger would be if the security cluster of agencies moved in to

take over the institution at a critical time when it will be

implementing higher scrutiny of prominent influential persons under the

recent amendments to the FIC Act. The agencies expressed their

dissatisfaction with the FIC operating outside of their systems during

parliamentary hearings on the amendments earlier in 2017. The report

notes Michell’s imminent departure adds to a number of highly placed

officials who have left the Treasury since Finance Minister Malusi

Gigaba took office.

Full Business Day report. |

|

|

|

| |

|

| |

Technologically Speaking

Moonstone Information Refinery |

|

The future of financial advice in SA |

The SuiteBox client engagement and support tool delivers video

meeting and digital signing capabilities to financial advisers.

Rapid advances in fintech provide a host of solutions that

streamline the delivery of financial advice, while driving customer

engagement, enhancing productivity, minimising costs and ensuring

workflow-embedded risk management and compliance.

Among the most exciting of these fintech solutions is

SuiteBox.

SuiteBox allows advisers and their clients to meet and discuss

financial solutions, whether document or web based, virtually, as if

in the same room. Contracts and agreements can further be signed

online with digital identity certification adding a layer of

validity to the transaction process.

"Not only can technology like

SuiteBox

improve and enhance client/adviser interaction, engagement and

capacity, it does so with adherence to the highest standards of

compliance, record keeping and cost effectiveness. Importantly, it

will free up the adviser to focus on delivering a quality advice

experience to his or her clients,” adds Hjalmar Bekker, Director of

Moonstone Information Refinery, SuiteBox distributor for Africa.

Click here to read more.

Suitebox Media contact

Neil Summers, Sales Manager, Moonstone Business Services

Mobile: +27729088994

Email:

neil@suitebox.com

|

|

|

|

|

Regulatory Examinations

|

|

|

|

| |

|

Frequently Asked Regulatory Exam

Questions |

| 1. |

What exam must I write?

Both the RE 5 and RE are Level One exams. RE 5 is for Representatives and

RE1 for Key Individuals. The RE 3 exam is for licence category II

candidates.

|

| 2. |

How much does it cost?

The FSB determines the fee. Currently it costs R1163 per exam, also in

the case of a re-write.

|

| 3. |

What preparation material is available?

Fully updated resources are available for those requiring access to the

legislation applicable to the regulatory examinations:

|

| |

● |

Please make sure that you first read the

FSB’s Preparation Guide to

make sure you follow the right process in preparing. Page seven includes

a recent amendment to guide candidates in studying in the correct

manner. |

| |

● |

Click on the following highlighted sections to download the relevant

updated Inseta learning material for key individuals,

RE 1, and

representatives,

RE 5. |

| |

● |

LexisNexis provides a “Legislation Handbook” together with a

“Preparation Guide” containing the qualifying criteria, with a link to

the relevant legislation. |

| |

● |

The

Juta FAIS Pocket Statutes also contains a CD with a comprehensive

list of updated supplementary legislative material for reference

purposes. Please click here to order this from our online shop. |

| |

● |

The FSB’s telematics broadcast on the RE 1 and RE 5

provides a good introduction and overview, and can also be ordered

online in: |

| |

|

DVD format or on a

USB memory stick

MP4 download (Only if you have a fast internet connection) |

| 4. |

Where can I write?

Go to:

http://www.faisexam.co.za/show_venues |

| 5. |

What dates are available?

Go to:

http://www.faisexam.co.za/view_schedule |

| 6. |

What training is available?

As an Exam body we are not allowed to recommend companies that offer

face-to-face Regulatory exam classes. You can try Google for someone in

your area.

Bear in mind that this exam tests your knowledge about the laws

applicable to the provision of financial advice and intermediary

services. The questions are based on very specific qualifying criteria

set out in the FSB preparation guide. Any training that does not have

this as a basis will not prepare you properly for the exam. Do your own

research and don’t just accept what others say. |

| 7. |

Where can I buy old question papers?

There are no genuine “old question papers” available. Be very careful

when buying such preparation aids as some of those on offer are not in

line with the high standard prevailing in the actual exams and often

lead to a false sense of knowledge which is sadly exposed when

confronted by the actual exam. Follow the guidelines provided in the FSB

Preparation Guide and you are far more likely to achieve success. |

|

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 15 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 48000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

Investment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Marketing & Events

Coordinator:

Sovereign Group, Cape Town - The applicant must be a fluent and

articulate English and Afrikaans speaker holding an undergraduate degree

obtained from a reputable tertiary institution. Applicants with a

marketing background will receive preference.

Read More

-

Legal/Administration

Assistant Position (Half Day):

Sovereign Group, Cape Town - The successful applicant will assist

two to three lawyers in the office, must have a relevant degree and be

fluent and articulate in English and Afrikaans.

Read More

-

Financial Advisor:

Origin Financial, Cape Town - The core function of the successful

candidate is to look for new business and maintain relationships with

clients. Must have own car & driver’s licence as well as RE certificate.

Read More

-

Financial Advisors:

Quantum Invest (Pty) Ltd, Randburg Ridge, Johannesburg - If you have

a Matric and RE5 Certificate with 8 months experience in the Insurance

Industry, then

Read More

-

Short Term Commercial

and Domestic Sales Consultant:

Wealth Solutions Capital Insurance Brokers, Bedfordview - We are

looking for dynamic and energetic go getters for short term commercial

and personal lines insurance, as well as for Financial Advisers.

Read More

|

|

|

|

|

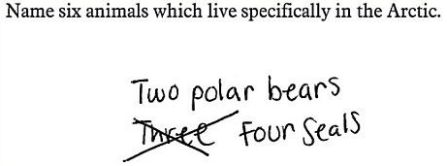

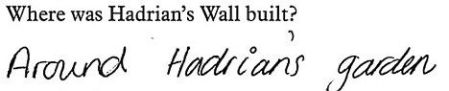

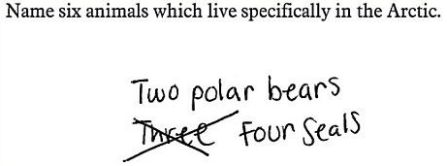

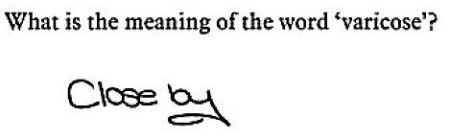

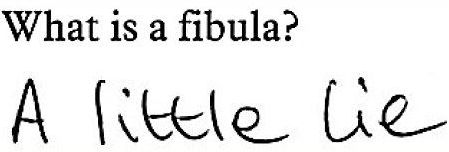

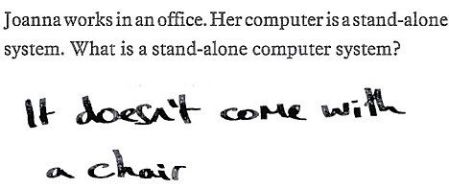

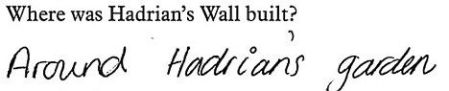

In Lighter Wyn |

|

|

If you don’t know the answer, just wing it |

Thanks, Roche Cowley.

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here.

|

|

|

©2015 Moonstone. All rights reserved. |

.jpg)

.jpg)