|

To Subscribe please click

here |

|

|

Moonstone Monitor - 24 August 2017 |

|

|

.jpg) |

|

Paul Kruger

Author/Editor |

| |

|

|

| |

|

|

|

|

|

The perfect bureaucrat everywhere is the man who manages to make no

decisions and escape all responsibility – Brooks Atkinson

(Methinks we have one too, only we do not call him a bureaucrat.) |

| |

|

|

Distributed to 48,908 subscribers.

To advertise with us

click here |

|

| |

|

From the Crow's Nest |

|

|

Twin Peaks signed into law |

News 24 reported that President Jacob Zuma signed into law the

Financial Sector Regulation Act 2017 on 21 August.

The legislation – also known as Twin Peaks - was passed by Parliament in

June and sent to Zuma for ratification.

It makes provision for a so-called Twin Peaks model of financial regulation. The

SA Reserve Bank (SARB) will be responsible for regulating all financial

institutions – banks, insurance houses and the asset management sector.

Financial conduct will be governed by a new entity, called the Financial Sector

Conduct Authority, which will replace the current Financial Services Board

(FSB).

The Presidency said in a statement issued on Monday that the Financial Sector

Regulation Act aims to achieve a financial system that works in the interests of

financial customers, and supports balanced and sustainable economic growth in

South Africa.

Industry views differ vastly from that of the Presidency.

Professor Robert Vivian, of Finance & Insurance at the University of the

Witwatersrand and a member of the Free Market Foundation’s Rule of Law Advisory

Board has some rather scathing views on the matter in an article in Fin24 titled

Twin Peaks: Another government-induced calamity. Why fix what isn’t broke?

He referred to National Treasury’s Socio-Economic Impact Assessment (SEIA) as a

“…kind of cost-benefit analysis, on the Financial Sector Regulation Bill (FSR).

Cabinet and MPs should reject this half-baked attempt outright and insist that

it be returned whence it came, before SA has another self-imposed calamity

visited upon it.”

Amongst other criticisms, Vivian condemns the establishment of “legislative

instruments” as a “…violation of the Constitution and the rise of a unitary

state with the state”.

“… the FSR Act and the additional Acts that are promised to follow, will empower

civil servants to tax by decree without so much as a nod from Parliament. They

are to be empowered to raise their own funds through regulatory levies and to

pass their own “laws” euphemistically referred to as “legislative instruments”.

They will have their own courts (“Enforcement Committees”), will impose their

own fines, and keep and spend the proceeds themselves. They are what have been

referred to as a unitary state within the state, violating the Constitutional

requirement of a proper separation of powers between legislature, executive and

judiciary.”

The other side of the coin

In an informative assessment of the Financial Sector Regulation Bill, Alan

Holton, an associate of Moonstone Compliance, wrote in February this year:

“The Bill makes provision for the Prudential Authority and Financial Sector

Conduct Authority to create ‘legislative instruments’. This term is defined and

means subordinate legislation made in terms of a financial sector law, and

includes regulations, prudential standards, conduct standards or joint

standards. These standards have the same effect as the actual legislation and

the most important of these is, arguably, the authority to create Conduct

Standards.”

“Conduct standards must be made in order to ensure the protection and fair

treatment of financial customers and to enhance the efficiency and integrity of

and confidence in the financial system. These standards may also be made to

promote financial literacy and financial capability and to assist in maintaining

financial stability.”

Consultation Requirements

Holton feels quite strongly about criticism that this approach undermines

parliament’s role in law making:

“The financial sector regulator who makes a legislative instrument must, prior

to making a legislative instrument, publish a draft of the instrument that must

be accompanied by a statement explaining the need for the instrument and the

intended operation of the instrument, a statement of the expected impact of the

regulatory instrument and a notice stating that any person may make a submission

about the need for, and the content of, the instrument.

The notice must indicate where and how submissions may be made, and the period

for making submissions, which must be at least 6 weeks.

Before making a regulatory instrument the maker of the regulatory instrument

must submit the regulatory instrument to Parliament together with a report on

the consultation process.

Then, in deciding whether to make a regulatory instrument, the maker must take

into account all submissions received within the 6-week period and must also

take into account any deliberations of Parliament.

Holton’s article also expands in detail on Guidance notices and Interpretation

rulings which form an equally important part of the checks and balances foreseen

in the Act to ensure fair outcomes for all.

Click here to read Alan Holton’s

Legislative Instruments under the FSR Bill.

Alan will also be a presenter at the

Moonstone Regulatory Update Workshops in September.

Click here to download the Financial Sector Regulation Act, 2017. |

|

|

|

| |

.jpg) |

What if you could focus on doing what you love - looking after your

clients?

Leading Independent Financial Advisory (IFA) practices are using GTC’s

Strategic Partner solution to:

- increase time with clients

- increase earnings

- reduce costs

Shouldn’t you too?

Our staff and systems deliver exceptional service, increasing revenues

and saving costs and time for you, enabling you to build value for

succession.

With offices nationally, we are well-placed to help you.

Call us to discuss a strategic partnership.

t. +27 (0) 10 597 6858

e. info@gtc.co.za

w.

www.gtc.co.za

An authorised Financial Services Provider FSP no. 731. |

|

|

Your Practice Made Perfect |

|

|

Property magnate faces huge civil claims |

Legalbrief Today reports:

Property magnate Nic Georgiou may face a slew of civil claims totalling

more than R2bn after the Constitutional Court dismissed his application

for leave to appeal a 2015 High Court judgment, notes a Moneyweb report.

It says the 2015 judgment ordered Georgiou to repay a single investor’s

original capital investment, but was also binding on 45 other investors

with similar claims. Their collective claims exceed R30m.

Advocate Louis Bolt, who represents the 46 investors, said the

Constitutional Court judgment opens the door for thousands of investors

who invested more than R2bn in the Highveld Syndications 21 and 22

schemes. These investment contracts included specific buyback clauses.

Bolt added that in addition to the 46 investors, three other investors

received default judgments against Georgiou in recent weeks. Their

collective claim is nearly R8m.

“This is the end of the road for Georgiou on the defences raised against

the claims. It also opens the door for all the thousands of HS 21 and 22

investors to institute similar claims,” added Bolt.

Georgiou has indicated that he will challenge these judgments.

Jacques Theron, of Theron and Partners, is a member of the Highveld

Syndication Action Group (HSAG) who is pursuing a class action suit

against Georgiou on behalf of other Highveld Syndications investors.

Click here to read the full

Moneyweb article. |

|

|

|

|

|

.jpg) |

| |

|

Moonstone Regulatory Update Workshops 2017

|

Please note: this is NOT

regulatory examination training.

Our popular workshops will be held in seven centres across the country.

Booking for PE and East London closes this coming Tuesday, 29 August.

Please do not delay booking.

The following topics will be covered by Billy Seyffert, COO Moonstone

Compliance, and Alan Holton, industry legal expert:

-

A brief update on the RDR

-

The proposed changes to the Long- and Short-term Insurance Regulations

and the impact on remuneration

-

The proposed changes to the Policy Holder Protection Rules with a

focus on replacement business

-

The Financial Intelligence Centre Amendment Act and how it impacts

Accountable Institutions

-

The future of Fit and Proper and what will be expected of

intermediaries

Click here to register.

Please read the

Registration Guidelines if you need help.

CPD Points

Attendees who wish to apply for CPD points with their

industry bodies can request a certificate of attendance

after the event. This document will contain the required

information for such application.

|

|

|

|

| |

|

| |

Technologically Speaking

Moonstone Information Refinery |

|

Chatbots and Artificial Intelligence

How these might impact the B2C financial services industry |

In a recent blog post in Econsultancy, Alisdair Graham makes the

statement that banking and the financial services industry has been

seen to lag behind in the adoption of emerging and disruptive

technologies, despite a survey which showed that 80% of people in

the industry saw chatbots as an opportunity, rather than a threat.

One of the main reasons for this is that a significant portion of

high value clients, particularly for wealth management firms and

IFAs, are more likely to belong to senior demographics and may have

a higher propensity for non-digital communication such as calls or

face-to-face meetings.

Because of this, a significant proportion of FS businesses may not

have felt the need to invest in digital. This is also potentially

exacerbated by the fact that their competitors and cohorts are also

lagging in terms of digital.

The future is here

As younger, digitally native clients begin moving into the market

for financial services at both a consumer level and professional

level, becoming ‘digital first’ is now imperative for the financial

services industry.

In addition to the changing workforce and consumer landscape, the

Australian Financial Conduct Authority also launched the

Financial Advice Market Review in late 2015 which aimed to

review and explore ways in which financial institutions can take

actions to:

-

Provide affordable advice to consumers.

-

Improve and increase access to advice.

-

Address industry concerns relating to future liabilities and

redress without watering down levels of consumer protection.

With these goals in mind,

AI,

chatbots and digital tick a range of boxes, particularly under

the “affordability” and “accessibility” criteria.

Like some systems that consumers may be familiar with, such as

virtual assistants like Siri, Cortana or Amazon’s Echo platform,

chatbots are essentially pieces of software that simulate human,

natural language conversations and can respond to and act upon

queries and commands from users.

The advantage these systems have over a ‘real’ conversation with a

human is that they are able to extract and analyse a user’s needs

and intent and ultimately return the information a user has

requested or perform actions for them faster, at any time of day or

night, more accurately and at significantly lower cost than a human

counterpart.

This new AI technology has been taken note of by financial

institutions on a global scale, with 80% viewing them as an

opportunity.

Click here if you wish to read the full article.

About SuiteBox

SuiteBox transforms customer engagement with intuitive video,

document collaboration, selective recording and real-time digital

signing, helping you accelerate and close business using the full

power of mobile and desktop devices. It is able to be fully white

labelled and seamlessly integrated with a client’s core CRM or

banking platform. SuiteBox is available via monthly subscription, is

delivered via the cloud and requires no technical expertise to use.

Visit www.suitebox.com

for more information.

Suitebox Media contact

Neil Summers, Sales Manager, Moonstone Business Services

Mobile: +27729088994

Email:

neil@suitebox.com

|

|

|

|

|

Regulatory Examinations

|

|

|

|

| |

|

Frequently Asked Regulatory Exam

Questions |

| 1. |

What exam must I write?

Both the RE 5 and RE are Level One exams. RE 5 is for Representatives and

RE1 for Key Individuals. The RE 3 exam is for licence category II

candidates.

|

| 2. |

How much does it cost?

The FSB determines the fee. Currently it costs R1163 per exam, also in

the case of a re-write.

|

| 3. |

What preparation material is available?

Fully updated resources are available for those requiring access to the

legislation applicable to the regulatory examinations:

|

| |

● |

Please make sure that you first read the

FSB’s Preparation Guide to

make sure you follow the right process in preparing. Page seven includes

a recent amendment to guide candidates in studying in the correct

manner. |

| |

● |

Click on the following highlighted sections to download the relevant

updated Inseta learning material for key individuals,

RE 1, and

representatives,

RE 5. |

| |

● |

LexisNexis provides a “Legislation Handbook” together with a

“Preparation Guide” containing the qualifying criteria, with a link to

the relevant legislation. |

| |

● |

The

Juta FAIS Pocket Statutes also contains a CD with a comprehensive

list of updated supplementary legislative material for reference

purposes. Please click here to order this from our online shop. |

| |

● |

The FSB’s telematics broadcast on the RE 1 and RE 5

provides a good introduction and overview, and can also be ordered

online in: |

| |

|

DVD format or on a

USB memory stick |

| 4. |

Where can I write?

Go to:

http://www.faisexam.co.za/show_venues |

| 5. |

What dates are available?

Go to:

http://www.faisexam.co.za/view_schedule |

| 6. |

What training is available?

As an Exam body we are not allowed to recommend companies that offer

face-to-face Regulatory exam classes. You can try Google for someone in

your area.

Bear in mind that this exam tests your knowledge about the laws

applicable to the provision of financial advice and intermediary

services. The questions are based on very specific qualifying criteria

set out in the FSB preparation guide. Any training that does not have

this as a basis will not prepare you properly for the exam. Do your own

research and don’t just accept what others say. |

| 7. |

Where can I buy old question papers?

There are no genuine “old question papers” available. Be very careful

when buying such preparation aids as some of those on offer are not in

line with the high standard prevailing in the actual exams and often

lead to a false sense of knowledge which is sadly exposed when

confronted by the actual exam. Follow the guidelines provided in the FSB

Preparation Guide and you are far more likely to achieve success. |

|

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 15 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 48000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

Investment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Short Term Commercial

and Domestic Sales Consultant:

Wealth Solutions Capital Insurance Brokers, Bedfordview - We are

looking for dynamic and energetic go getters for short term commercial

and personal lines insurance, as well as for Financial Advisers.

Read More

-

Compliance Officer

under Supervision:

Moonstone Compliance, Johannesburg - The role will provide a

practical internship, during which the applicant will receive on the job

training and mentorship in the provision of outsourced compliance and

risk management services to clients in the financial services industry.

Read More

-

Financial Advisors:

Odinfin, Irene, Pretoria - We are looking for insurance sales agents

to join our successful team.

Read More

|

|

|

|

|

In Lighter Wyn |

|

|

Pictures to ponder |

|

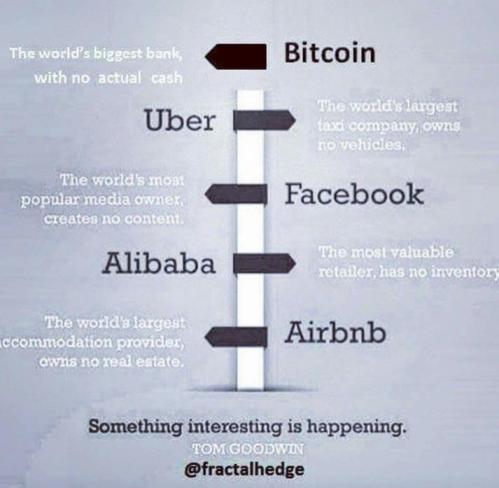

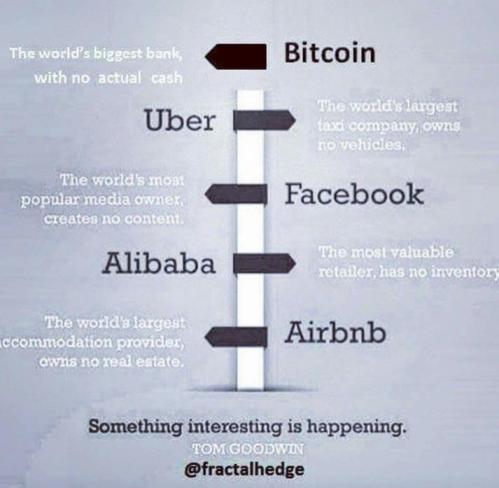

The current future

Guilty as charged, M’lord

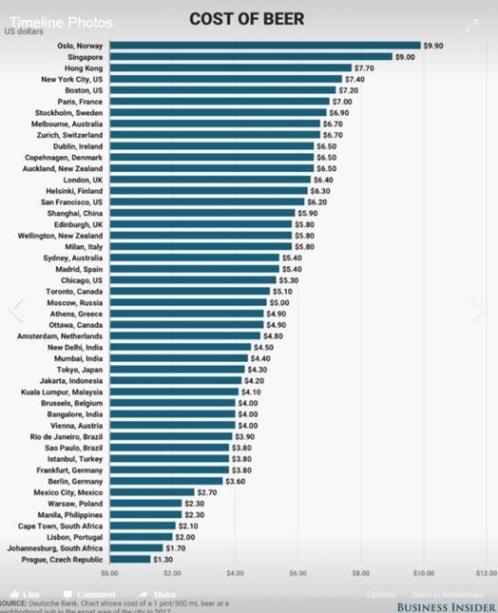

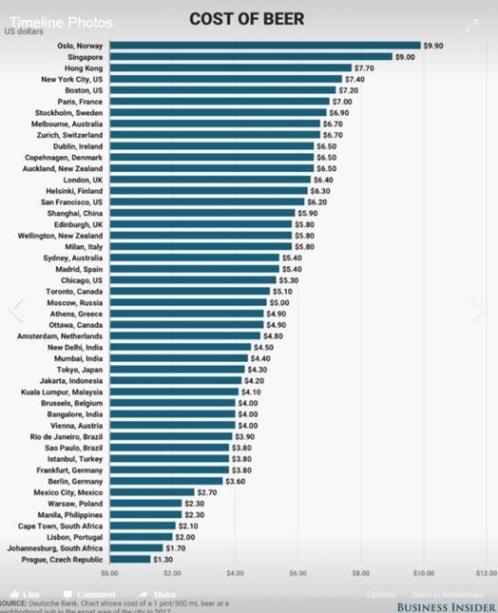

Best reason not to emigrate

The only ones bucking the trend are the Vaalies semigrating to Cape

Town.

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here.

|

|

|

©2015 Moonstone. All rights reserved. |

.jpg)

.jpg)

.jpg)