|

To Subscribe please click

here |

|

|

Moonstone Monitor - 22 June 2017 |

|

|

|

|

Paul Kruger

Author/Editor |

| |

|

|

| |

|

|

|

|

|

I don't care what is written about me so long as it isn't true

– Dorothy Parker |

| |

|

|

Distributed to 46 787 subscribers.

To advertise with us

click here |

|

| |

|

From the Crow's Nest |

|

|

GTC Medical Aid Survey 2017 |

Results reveal that small medical aids

also offer good value, and highlights that consumers may be unaware of their own

medical aid plans and the benefits contained therein.

Smaller medical schemes perform well by offering consumers value for money, but

they have not been as successful as some of the larger schemes in attracting new

members, and thereby ensuring continued value and ‘health’ for the scheme over

the long term.

This is one of the significant conclusions from leading wealth and financial

advisory firm GTC in its seventh annual Medical Aid Survey for 2017, according

to Jill Larkan, the firm’s Head: Healthcare Consulting.

The Medical Aid Survey analyses and rates medical aid schemes and provides a

standardised comparison and ranking of the choices available to consumers.

“This survey cuts through the notoriously complicated landscape of the medical

aid industry and simplifies it according to the factors that matter most when

consumers choose a medical aid scheme and option,” explains Larkan.

This year’s survey reviewed 23 open medical aid providers (Profmed is the only

closed scheme reviewed this year), with a total of 144 plans, which were

categorised into 11 areas according to benefits offered. The categories range

from entry-level to traditional plans, and include hospital-only, saver and

comprehensive options.

The Medical Aid Survey from GTC assigns every plan with a micro – indicating a

plan’s competitiveness in relation to others in the same category – and macro

rating – broadly a measure of a scheme’s ‘health’, and considers factors such as

membership size and growth, average age and financial stability.

Smaller medical schemes score well yet again in GTC’s micro ratings

“Fedhealth is one of the schemes that has performed consistently well in the

micro ratings, indicating that it is very competitively priced and can offer

consumers good value for money,” she says.

With this year’s inclusion of multiple additional macro demographic areas in the

GTC survey, along with the applied weightings on these, the more stable growing

schemes have now scored considerably better in the macro rating. Discovery

Health has topped these macro rankings in the 2017 survey.

GTC’s overall list of schemes for 2017 – ranked by “likelihood of support”

The full range of plans in this year’s Medical Aid Survey – from entry-level to

comprehensive have been divided between network and non-network plans and been

graded (micro, macro and combined) to simplify the choice and provide an easy

way to compare options and cost.

The macro and micro rankings combine to create GTC’s overall list of schemes in

the Medical Aid Survey for 2017 ranked by “likelihood of support”. This final

analysis reflects a score which indicates the likelihood that a particular plan

/ scheme would receive GTC’s support (or not) through recommendations to

clients.

|

|

NETWORK |

NON-NETWORK |

|

Entry Level

Comprehensive Student |

|

|

|

Entry Level Hospital Only |

Discovery Keycare Core |

|

Comprehensive Low State

(R3000 – R7000) |

Makoti Primary |

|

Comprehensive Low

(R3 000 – R7 000) |

Makoti Primary |

Sizwe Gomomo Care |

Comprehensive Mid

(R7 000- R10 000)

Student Market |

Makoti Primary |

Sizwe Gomomo Care |

|

Hospital Only |

Momentum Custom |

Genesis Private Choice |

|

Saver |

Discovery Essential Delta Saver |

Topmed Active Saver |

|

Saver Plus |

Resolution

Millennium |

Discovery Essential Priority |

|

Comprehensive Risk |

Momentum Extender |

Discovery Essential

Comprehensive |

|

Comprehensive

Complete |

Discovery Classic

Delta Comprehensive |

Discovery Executive |

*table above only highlights the rankings for a family of

four (Principal Member + Adult + 2 Children)

“No medical plan is going to suit all members equally, but

our annual survey helps to ensure that an informed decision

can be made based on these indicators, which will go a long

way to easing member concerns regarding scheme performance

relative to peers and their plan’s ‘health’ status,” Larkan

concludes.

Click here to download the full

MAS pdf. |

|

|

|

|

Your Practice Made Perfect |

|

|

Insurance Bill Update |

The National Treasury presented its response to public comments received

on the Insurance Bill, 2016, to Parliament’s Standing Committee on

Finance in May. A copy of the Bill, as well as the presentation was

published on Wednesday.

Key Issues Addressed In Proposed Revisions

-

Transformation of insurance sector: The objective of the Act was

amended to include a specific reference to transformation of the

insurance sector.

-

Promoting financial inclusion through microinsurance: Changes here

addresses concerns that the Bill seeks to distinguish between

micro-insurance and macro-insurance business and would exacerbate a lack

of transformation in the industry.

-

Cost of regulation as a barrier to entry: There were concerns that the

Prudential Authority may direct a capital add-on if the risk profile or

governance framework of the insurer deviates from the underlying

Solvency Capital Requirement calculation. This could result in small

black-owned businesses being taken over by big insurers.

-

Alignment with the Financial Sector Regulation Bill: The Insurance

Bill was tabled on 28 January 2016, while the FSRB was being processed

by the SCOF. The Bill needs to be revised to be properly aligned with

the FSRB.

Whilst a number of the changes relate to transformation, two revisions

are interesting from the perspective that it addresses practical issues

relevant to the South African market.

-

Section 63: Prudential standards: This section has been amended to

explicitly provide for specific matters that must be considered (i.e.

the objective of the Bill, international regulatory and supervisory

standards, to the extent practicable and with due consideration to the

South African context and the nature, scale and complexity of different

kinds or types of insurers and controlling companies).

-

Section 66: Exemptions: This is a new section that includes specific

matters that must be considered when granting exemptions (such as

practicalities, proportionality and developmental, financial inclusion

and transformation objectives).

We plan to expand on this in Monday’s newsletter. In the meantime, you

are welcome to download the

SCOF Presentation and the amended

Insurance Bill for your reading pleasure over the weekend between

the All Blacks/Lions and the Springboks/France matches. |

|

|

|

| |

|

|

|

GTC Medical Aid Survey 2017 reveals small medical aids also offer

good value |

Smaller medical schemes perform well by offering consumers value for

money, but they have not been as successful as some of the larger

schemes in attracting new members.

This is one of the significant conclusions from leading wealth and

financial advisory firm GTC in its seventh annual Medical Aid Survey

(MAS) for 2017.

The Medical Aid Survey analyses and rates medical aid schemes and

provides a standardised comparison and ranking of the choices available

to consumers.

This year’s survey reviewed 23 open medical aid providers, with a total

of 144 plans, which were categorised into 11 areas according to benefits

offered.

Click here to

read more

of the article, or download the

2017 MAS

pdf.

For more information contact

Jill Larkan. |

|

| |

|

CMS to address Undesirable Practices

|

The Council for Medical Schemes published Circular 39 of 2017, calling

for industry input on its intention to declare certain practices

irregular or undesirable.

Regulation 8 of the Medical Schemes Act entitles medical schemes to

select certain healthcare providers to provide members with diagnosis,

treatment and care in respect of prescribed minimum benefit (PMB)

conditions. If a member uses a designated service provider (DSP), no

co-payments may be imposed and the member's invoice must be funded in

full.

Regulation 15E(2) further provides that a medical scheme may place

limits on the number or categories of health care providers with whom it

may contract to provide relevant healthcare services, provided that

there is no unfair discrimination and provided that the selection is

based upon a clearly defined and reasonable policy which furthers the

objectives of affordability, cost-effectiveness, quality of care and

member access to health services.

The Registrar has since obtained information suggesting that some

medical schemes are acting beyond the scope of these regulations.

It therefore intends to declare the following practices as

irregular/undesirable:

-

The selection by a medical scheme of healthcare providers as

designated service providers without engaging in a tender process which

is fair, equitable, transparent, competitive, and cost-effective.

-

Imposing a co-payment in terms of Regulation 8(2)(b) that exceeds the

quantum of the difference between that charged by the designated service

provider of the medical scheme and that charged by a provider that is

not a designated service provider of such scheme.

Interested parties are invited to make written representations which

must reach the Registrar's office within 21 days of the date of

publication of the Government Gazette notice. Representations can be

sent to

legal@medicalschemes.com.

Click here to access a copy of

Circular 39 of 2017. |

|

|

|

| |

|

|

Technologically Speaking |

|

Mitigating cyber risk in the financial services sector |

A summary of this paper first appeared in the June edition of

Moneymarketing.

Whilst I am sceptical of the local application of surveys and

studies done in other countries, I think that this one can be of

value to us for a number of very practical reasons. Security of

client data will become an increasing focus in the months and years

ahead, and the recent spate of cyber attacks just underlined our

vulnerability.

We recently reported about a breach of security at a leading life

office, despite its extensive resources to protect its data.

According to a broker that I spoke to, the criminals actually

targeted his more affluent clients.

If it could happen to an international organisation like this,

imagine how vulnerable most of us “smaller fry” are. And do not fool

yourself that you are too small.

We trust that the information below will assist you in taking the

required preventative action.

Intelliflo, a UK supplier of specialist online software for IFAs and

the NCC Group, a global expert in cyber security and risk

mitigation, recently teamed up to publish a paper entitled

Mitigating Cyber Risk in the Financial Services Sector.

The paper’s purpose is to outline how financial advisers, as part of

a broader group of organisations operating in the financial services

sector, can mitigate cyber risk. The paper draws on the input of

consumer and adviser facing surveys, which indicate that 44% of

advisers in the UK have been impacted by cybercrime.

Disturbingly for advisers, 82% of 500 consumers surveyed would look

to change their financial adviser, or not appoint them in the first

place, if it was public knowledge that the adviser had been

subjected to a cyber-attack.

The paper finds that cyber-attacks are on the rise and that “no

sector is more of a target than the financial industry. Customer

details, sensitive information and money provide a treasure trove of

assets for attackers to target. Staying ahead of the latest threats

is crucial.”

How can financial advisers protect themselves from cyber attacks?

The paper suggests the following:

Develop a cyber security strategy

Despite the increase in cyber-attacks on financial services

institutions, there is often a lack of vision and strategy to

articulate how firms of all sizes will address current gaps, defend

against evolving threats and protect themselves in the long term.

Identify the ‘crown jewels’

The crown jewels are your data sets and they are what hackers want.

These assets have significant value and sensitivity, providing an

attractive target for a motivated attacker. It is vital that

organisations identify their ‘crown jewels’ to provide a foundation

for targeted and prioritised risk assessment.

Improve awareness of cyber-attacks – ransomware

Ransomware is a type of malware that restricts access to systems in

some way, often by encrypting fi les and then demanding a ransom to

obtain access. When subjected to a ransomware attack, many victims

think they have no choice but to pay. But that is not the case. It

is important to remember that you are dealing with criminals. If you

pay them, what next?

Improve awareness of cyber-attacks – social engineering

The methods employed to gain access to systems are more

sophisticated than ever before. Examples include one organisation

hiring phishing specialists who obtained a companywide email address

so they could email all staff . The email was made to look like it

was an internal email and most staff clicked through and entered

their credentials.

Increase employee cyber security awareness

When it comes to cyber security, your employees are often the

weakest link. Cyber security is the responsibility of everyone who

works for you. Attackers increasingly send emails purporting to be

from someone that the user knows, as this means that the user is

more likely to click on an unknown link. This type of attack is

known as phishing.

Implement password protection

Putting a strong password in place in order to access a machine or

in order to access programmes and some web functionality is so

widespread as to be considered a minimum requirement. But it really

is the minimum. Yet many people do not password protect all of their

devices. Mobile phones, so susceptible to loss or theft , are oft en

not password protected.

Implement two-factor authentication

Two-factor authentication is increasingly being deployed by firms to

reduce the risk of unwanted access to their systems.

Develop a vulnerability management programme

You can also be attacked via weak points in your software. It is

imperative that you keep your software and machines fully up to date

at all times with the latest patches.

Ensure regular backups

Keeping your data backed up at regular intervals is crucial in

minimising the impact of any cyberattack. The more recently your

data has been backed up prior to an attack, the less work you will

have to do to recover lost ground.

You have to sign in to download the whole paper.

Click here to do so.

|

|

|

|

|

Regulatory Examinations

|

|

|

Legislation Handbook and

Preparation Guide for REs |

The Legislation Handbook for Level 1 Regulatory Exams provides the

legislation specified as relevant to the regulatory exams RE 1 and 5.

The Preparation guide includes the qualifying criteria provided by the

FSB for these exams.

The qualifying criteria are cross-referenced in the Preparation Guide to

the relevant sections to be studied in the Legislation Handbook.

Shaded tabs enable the user to easily identify the four sections of the

work and the information is then grouped by subject matter area in order

to assist you to find the relevant items quickly and easily.

The 4th edition reflects the law as at 15 April 2015.

Click here to order these

LexisNexis

books from our Advisor Store.

|

|

|

|

| |

|

RE Schedule updated |

|

Our venues are filling up fast as we approach 30 June 2017.

Candidates who are obliged to write and pass by the end of June

must please register in time.

|

|

|

|

| |

|

RE Self-Help Guidelines and Frequently Asked Questions |

Self-Help Guidelines

Candidates who wrote with Moonstone can now view their results,

make a new booking or update their information on our website:

www.faisexam.co.za

Here is what you do:

-

Click on the Moonstone FAIS Exam website (www.faisexam.co.za)

-

Click on the second heading: “Update Your Booking/Personal

Details/Get results”.

-

Key in your ID or Passport Number used to register for the

exam: click on Send password.

-

The system will

send a password to the e-mail address you provided at

registration.

-

Use this password to log in on the same address as above:

Type in the password – do not copy and paste.

-

Click login.

-

You will then be able to make a booking, download your

certificate or view results.

Frequently Asked RE QuestionsEmail enquiries should be addressed to

faisexam@moonstoneinfo.co.za. You can phone us on

021 883 8000 - select option 2 to speak to one of our

consultants. |

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 15 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 46000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

Investment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Sales Consultant –

Medical Scheme Brokerage:

Optivest, Durbanville - The ideal candidate is RE 5 qualified, has

medical scheme experience and is comfortable to interact by phone.

Read More

-

Accounts Executive /

Broker:

Garrun, Houghton - We require a FAIS compliant and experienced

Short-Term Insurance Broker with own transport.

Read More

-

Life Insurance

Compliance Officer:

Bidvest Life Insurance, Umhlanga - If you have a minimum of 3 years

experience in the life insurance industry and Compliance Officer

experience, then

Read More

-

Financial Planners:

Risk Free Solutions, Port Elizabeth & Kimberley - We are looking for

established, well balanced Financial Planners striving for financial

freedom. If you have matric, your own transport, driver’s licence and RE

qualificaton, then

Read More

-

Short Term Insurance

Underwriter:

The Insurance Centre, Westville - We require a commercial and

personal lines short term insurance underwriter / administrator.

Read More

|

|

|

|

|

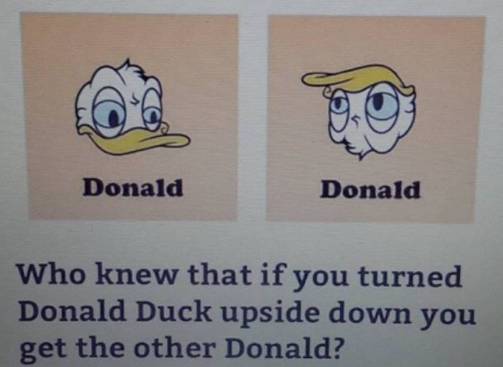

In Lighter Wyn |

|

|

Donald upside down |

|

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here.

|

|

|

©2015 Moonstone. All rights reserved. |