|

To Subscribe please click

here |

|

|

Moonstone Monitor - 13 April 2017 |

|

|

|

|

Paul Kruger

Author/Editor |

| |

|

|

| |

|

|

|

|

|

There is nothing worse than aggressive stupidity

- Johann Wolfgang von Goethe |

| |

|

|

Distributed to 46 526 subscribers.

To advertise with us

click here |

|

| |

|

From the Crow's Nest |

|

Shifts in the Liability Insurance Landscape

By Florence de Vries |

Political challenges in our country and its consequences for our economy

has taken over most of the headlines in the first quarter of 2017 but recent

news events like the Ford Kuga recall and different forms of cybercrime has

turned the spotlight on the proliferating types of liabilities businesses can

face.

Liability insurance is said to have started in the form of mutual agreement

which, much like the concept of general insurance, resulted in the pooling of

funds by various parties. Over time, this specific form of insurance came to be

offered by specialist insurers who keep a close watch on global trends shaping

and setting the agenda for this specific class of insurance.

Today, a number of local commercial underwriters agree that the different types

of risks associated with liability have become more and more prevalent due, in

part, to the increasing amount of ways in which businesses and/or general

entities are/can be exposed to risk.

News headlines citing product recalls and cyber-attacks are a testimony to the

types of risks that various institutions and businesses have to contend with. As

the political, environmental and technological developments take hold and alters

the course of sectors and economies the world over, liability risks in

particular, are likely to increase in both type and complexity. It thus follows

that the associated insurance cover would need to evolve along with it.

This is echoed by the Global Claims Review issued by Allianz Global Corporate

and Speciality (AGCS). The AGCS review, which was released last week, said the

risk landscape for businesses is constantly shifting with (commercial) liability

risks on the rise globally. “Defective product or work, crash and human error

incidents are still the largest causes of liability loss for businesses, based

on an analysis of insurance claims, but everyday liability claims like slips and

falls in the workplace have become less as a result of more stringent safety

regulations and better risk management. The potential for more expensive

liability losses is increasing around the world, particularly in relation to

global product recalls, corporate liability, cyber and environmental incidents.”

Earlier this year, multinational global vehicle manufacturing business Ford was

forced to make a safety recall of its Ford Kuga 1.6-litre model (manufactured

between December 2012 and February 2014) as a result of engine compartment

fires. The risk involved in this prominent recall, would likely have been

mitigated through recall insurance. Interestingly, strategic communications

company FTI Consulting has since shared research which argues that the exact

quantity of damage to the Ford brand will only become apparent in months or

perhaps years to come.

According to the AGCS review, the digitalization and growing use of new

technologies are likely to lead to a further shift in the liability risk

landscape. “New technologies such as the internet of things, autonomous mobility

(e.g. driverless cars) or 3D printing will create fundamentally new liability

scenarios for companies in almost every sector,” says Alexander Mack, chief

claims officer at AGCS.

It is common knowledge that the liability class of insurance relies heavily on

knowledge and experience of intermediaries and insurance specialists. It is for

this reason perhaps, that forms of liability insurance training for

intermediaries has mushroomed over the past few years. Local specialised

liability insurance businesses are delivering training covering various aspects

of liability in the form of workshops, e-books or online learning platforms.

These should certainly serve to help intermediaries position themselves to see

where the opportunities lie in an increasingly regulated financial services

environment.

Florence de Vries is a communications manager in the South African short-term

insurance industry. |

|

|

|

| |

|

| |

|

What if you could focus on doing what you love - looking after your

clients? |

Leading Independent Financial Advisory (IFA) practices are using GTC’s

Strategic Partner solution to:

- increase time with clients

- increase earnings

- reduce costs

Shouldn’t you too?

Our staff and systems deliver exceptional service, increasing revenues

and saving costs and time for you, enabling you to build value for

succession.

With offices nationally, we are well-placed to help you.

Call us to discuss a strategic partnership.

t. +27 (0) 10 597 6858

e. info@gtc.co.za

w. www.gtc.co.za

An authorised Financial Services Provider FSP no. 731. |

|

|

Your Practice Made Perfect |

|

|

Regulatory Exam Seats Filling up Fast |

As the end of June draws near, availability for seats to write the exams

before the DOFA deadline are becoming increasingly scarce.

It is not only those who have to write before 30 June. A number of

candidates who failed to pass at the first attempt are registering to

write again before the deadline.

As usual, we advise candidates and employers to book in time to provide

for a possible rewrite before the end of June 2017.

Click here to register. |

|

|

|

| |

|

| |

|

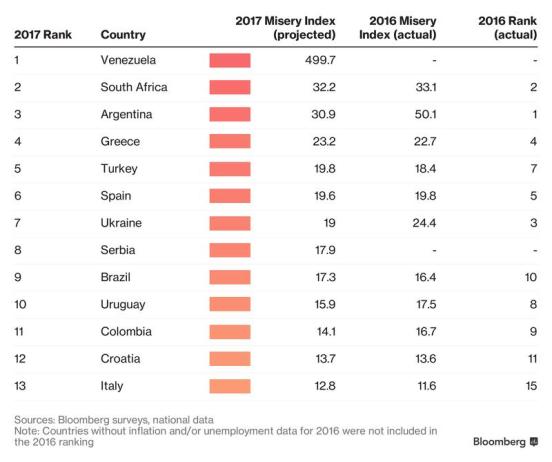

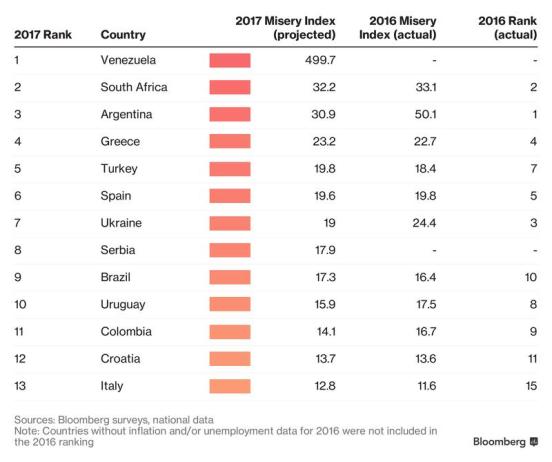

Miserable Countries

|

No, this has nothing to places to avoid when travelling around the

globe. In fact, it may well be places you wish to go to, given the poor

exchange rate because of the state they’re in.

Bloomberg's Misery Index combines countries' 2017 inflation and

unemployment outlooks to calculate the state of misery, and provides

comparisons on various levels.

In view of recent events in South Africa, we thought you might be

interested to see how we fare against other in the Les Miserables

contest.

Well, for once, we are near the top, although it is not really where you

want to be. Having maintained our position from last year is also not an

impressive performance. Perhaps we should ask them to swop places with

the Springboks? That should keep both parties happy.

I belong to a conversation group comprising a few locals and two expats.

After receiving this article, titled

These Economies Are Getting More

Miserable This Year, the bloke in New Zealand remarked:

“I've been asked to meet a few South Africans over the last few years -

all in NZ looking for jobs and opportunities. They've all had a similar

mood about them and I've struggled to put a label on it. Now I know: the

word is miserable.”

To which the converted Aussie retorted:

“My family in SA still have hope, believe it will be good, are "happy"

etc. Admittedly, they do drink a lot.” |

|

|

|

| |

|

| |

|

Legislation Handbook and Preparation Guide for REs

|

The Legislation Handbook for Level 1 Regulatory Exams provides the

legislation specified as relevant to the regulatory exams RE 1 and 5.

The Preparation guide includes the qualifying criteria provided by the

FSB for these exams.

The qualifying criteria are cross-referenced in the Preparation Guide to

the relevant sections to be studied in the Legislation Handbook.

Shaded tabs enable the user to easily identify the four sections of the

work and the information is then grouped by subject matter area in order

to assist you to find the relevant items quickly and easily.

The 4th edition reflects the law as at 15 April 2015.

Click here to order these

LexisNexis

books from our Advisor Store. |

|

|

|

|

Regulatory Examinations

|

|

|

RE Schedule updated |

|

Our venues are filling up fast as we approach 30 June 2017.

Candidates who are obliged to write and pass by the end of June

must please register in time.

|

|

|

|

| |

|

RE Self-Help Guidelines and Frequently Asked Questions |

Self-Help Guidelines

Candidates who wrote with Moonstone can now view their results,

make a new booking or update their information on our website:

www.faisexam.co.za

Here is what you do:

-

Click on the Moonstone FAIS Exam website (www.faisexam.co.za)

-

Click on the second heading: “Update Your Booking/Personal

Details/Get results”.

-

Key in your ID or Passport Number used to register for the

exam: click on Send password.

-

The system will

send a password to the e-mail address you provided at

registration.

-

Use this password to log in on the same address as above:

Type in the password – do not copy and paste.

-

Click login.

-

You will then be able to make a booking, download your

certificate or view results.

Frequently Asked RE Questions

You can click on

this link to see the answers to the most common

questions we receive.

Email enquiries should be addressed to

faisexam@moonstoneinfo.co.za. You can phone us on

021 883 8000 - select option 2 to speak to one of our

consultants.

|

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 15 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 46000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

Investment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Sales Position:

Uniq Business Solutions, Cape Town - If you are

ambitious & goal driven with 3 years of exceptional sales experience and

RE5 qualified with Fais credits, then

Read More

-

Client Services

Position:

Uniq Business Solutions, Cape Town - Do you have at least 2 years’

experience within a Short term Insurance Services Environment?

Read More

-

Sales Consultant –

Medical Scheme Brokerage:

Optivest Health Solutions, Durbanville, Cape Town - The ideal

candidate will be RE 5 qualified and will interact by phone, collect

information, and conduct follow-ups.

Read More

-

Short-term Commercial

Underwriter:

The Insurance Center, Westville, Durban - We are looking for an experienced

underwriter / administrator to start immediately if possible.

Read More

-

Independent Broker

Consultants and Desk Broker Consultants:

IFAnet, Nationwide - If you have a successful track record in the

“Broker Services” sector of the Life Insurance Industry and own your own

vehicle with a valid driver’s licence, then

Read More

-

Short-term Insurance

Sales Consultant:

Bestsure Financial Services (Pty) Ltd, Florida, Johannesburg - We

are looking for a self motivated sales specialist with FAIS

qualifications to generate new business through inbound requests, leads

and referrals.

Read More

-

Senior Healthcare

Consultant:

Completemed, Bellville, Cape Town - Health and gap cover sales in a

call centre environment. RE5 and full accreditation not negotiable.

Read More

|

|

|

|

|

In Lighter Wyn |

|

|

Of sarchasm |

|

In 2013 I was in the UK for the funeral of a family member. The

tabloids there are just the greatest fun to read.

This is the view of Grace Dent on the new season of Game of thrones

which had just started:

During season 1 of Game of Thrones, the esteemed Caitlin Moran

referred to the show as "that one with the gnomes bumming",

mistaking it for some sort of Hobbit spin-off full of gratuitous

rutting. After she'd left my house and located her coat and handbag

in a nearby hedge, she was prepared to re-evaluate this slur.

Incidentally, if you're planning to write long anti-Americanisation

letters whining about my use of the term "season" as opposed to

"series" please put them on good-quality Basildon Bond notepaper as

I find the lovely "HDDD" sound it makes in the paper-shredder most

invigorating.

A Gentleman’s Game?

What if you were playing in the club championship tournament finals

and the match was halved at the end of 17 holes? On the eighteenth

hole, you have the honour and hit your ball a modest two hundred

fifty yards to the middle of the fairway, leaving a simple six iron

to the pin.

Your opponent then hits his ball, lofting it deep into the woods to

the right of the fairway.

Being the golfing gentleman that you are, you help your opponent

look for his ball. Just before the permitted five minute search

period ends, your opponent says: "Go ahead and hit your second shot

and if I don't find it in time, I'll concede the match."

You hit your ball, landing it on the green, stopping about ten feet

from the pin. About the time your ball comes to rest, you hear your

opponent exclaim from deep in the woods: "I found it!".

The second sound you hear is a click, the sound of a club striking a

ball and the ball comes sailing out of the woods and lands on the

green, stopping no more than six inches from the hole.

Now here is the ethical dilemma:

Do you pull the cheating bastard's ball out of your pocket and

confront him with it, or do you keep your mouth shut?

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here.

|

|

|

©2015 Moonstone. All rights reserved. |