|

To Subscribe please click

here |

|

|

Investment Indicators - 18 June 2018 |

|

|

“To live is the rarest thing in the world. Most people exist, that is all.”

- Oscar Wilde |

| |

|

|

Distributed to 52,335 subscribers.

To advertise with us

click here |

|

| |

|

| Rates Review |

|

|

1. Secured Investment Rates |

|

Please note that (G) indicates a Guaranteed and (L) a Linked product. In order to understand the difference between guaranteed and linked rates,

kindly click here for an explanation. |

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

1Life (L) |

7.370% |

7.210% |

|

2 |

Clientéle Life (L) |

7.270% |

7.220% |

|

3 |

Absa (L) |

7.186% |

7.100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Discovery (G) |

7.527% |

7.344% |

|

2 |

1Life (L) |

7.370% |

7.210% |

|

2 |

Clientéle Life (L) |

7.370% |

7.320% |

|

3 |

Assupol (G) |

7.280% |

7.280% |

|

|

|

|

|

|

2. Money Market Funds |

|

|

|

Please bear in mind that our figures, though based on the actual quotations that you also use, are for information purposes only,

and can never replace the official quotation from the product house. In terms of the guarantees, you are requested

to clarify the exact extent of such guarantees with the product house prior to advising clients. |

|

|

|

|

|

|

|

From the Crow's Nest |

|

|

The power of preservation |

A client who withdraws his or her retirement savings when they

resign can come up with valid reasons, whether to sustain them until

they have another job or paying off debt. However, in the long run,

it is worthwhile to resist the withdrawal and rather transfer their

savings to their new employer’s retirement offering instead.

Thandi Ngwane, head of strategic markets at Allan Gray, recently

explained how clients can protect their retirement saving.

Here is a common scenario: you resign from your job. Finance sends

you a form to choose what you would like to do with your retirement

savings, but offers no further advice and don’t put you in touch

with a financial adviser.

Your options are:

To make a full cash withdrawal, transfer the savings to a

preservation fund or your new employer’s retirement fund or a

combination.

A 2015 survey done by Sanlam found that 77% of people

leaving their jobs were taking their retirement savings as a cash

lump sum. About 63% of them use the money to pay off debt and 57%

use it to cover living expenses while looking for a new job.

Phakama Mlangeni* (33) withdrew her retirement savings when she

resigned from her job of eight years to fund a study break. She

thought she had a good plan in place: pay off her credit card and

revolving loan, pay her fees for two years and draw a small income

for living expenses.

Unfortunately, it didn’t work out that way. After paying off debt

and her fees, the money she had left ran out eight months later. In

no time, she found herself back in debt to cover her living expenses

while studying.

How to get back on track

A retirement income equal to 75% of your final salary is a

reasonable figure to aim towards to live comfortably in your ‘golden

years’.

Phakama is determined to get her retirement savings back on track

when she starts working again in two years’ time after completing

her studies. She will be 35. After using an online retirement

calculator, she realises she will have a 44% shortfall in her

retirement income – or put simply, she may not have enough saved for

a comfortable retirement if she lives beyond the age of 80.

The table below shows she will have to put away 29% of her income

towards her retirement as opposed to just 16% (assuming she started

contributing at age 25) if she had not taken the withdrawal. Putting

away almost 30% of her income may be unrealistic, so she may need to

look at what else she can do to still achieve her goals.

Retirement savings rates needed to ensure 75% Replacement Ratio**

|

4% income = 75% replacement ratio if you save at: |

|

|

Return assumption: |

|

Age |

CPI + 5% |

CPI + 4% |

|

25 |

16% |

20% |

|

30 |

21% |

26% |

|

35 |

29% |

34% |

|

40 |

39% |

45% |

|

45 |

56% |

62% |

|

**Assuming retirement age of 65 years, investment returns as

indicated above and inflation-related annual salary

increases. |

Phakama started a small business as a personal stylist and

shopper during her career break. If she is able to continue

running her business part-time while working, she could use

the additional income to top up her retirement savings.

She could also delay her retirement by another five years to

age 70 if possible. In this way, she will get a 10-year

boost in her retirement savings through capital growth and

compound interest If she does this, her income after

retirement could be sustained for 35 years until she is 105,

as opposed to just 81 years old if she retires at 65.

The first R500 000 of the cash lump sum you take at

retirement is tax-free. However, any withdrawal you make

from your savings before retirement reduces this benefit. To

avoid a huge tax bill at retirement, Phakama should avoid

taking a lump sum in excess of her tax-free allowance as it

will be heavily taxed. If she has no need for the lump sum

portion at retirement, a better option would be to transfer

the full investment into an income providing investment such

as a living annuity, where it can continue to grow,

tax-free. While she will pay tax on her income from her

living annuity, this will be at her marginal tax rate.

*Not her real name

Click here

to download a copy of the press release for your clients. |

|

|

|

|

|

|

|

|

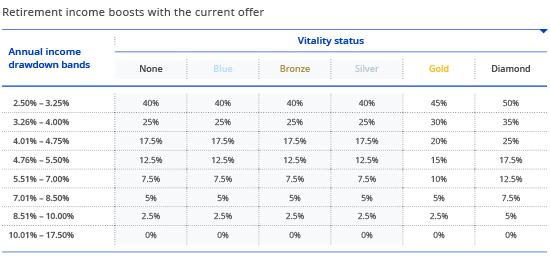

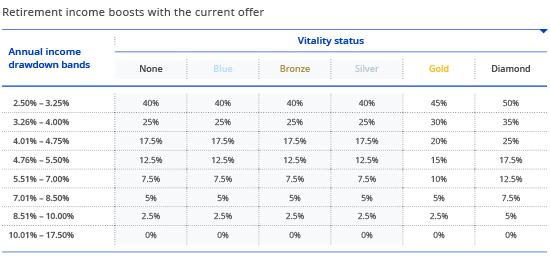

Discovery Invest products encourage lower draw-downs in retirement

The majority of pensioners

using living annuity products in retirement risk eroding their capital

by drawing more than 5% as an income.

However, clients on the Discovery Linked Retirement Income Plan can now

receive up to 50% more income in retirement, depending on their Vitality

status and as a reward for choosing to withdraw a lower level of

retirement income from their savings.

The current offer, available on all new product applications until

Saturday, 30 June 2018, increases the boost percentage that clients

can receive to the equivalent of Silver Vitality status income boosts,

as per the table below:

Disclaimer

This article is meant only as information and should not be taken as

financial advice. For tailored financial advice, please contact your

financial adviser. Discovery Life Investment Services Pty (Ltd):

Registration number 2007/005969/07, branded as Discovery Invest, is an

authorised financial services provider.

Please

click here to read our full disclaimer. |

|

| Your Practice Made Perfect |

|

|

Advisers in employee benefits space |

Delphine Govender, CIO at Perpetua Investment Managers presented to an

audience of diverse investment industry stakeholders at the fifth annual

i3 Summit, jointly hosted by Sanlam Investments and Glacier by Sanlam

last month. She shared with the audience that the ticket to success for

South Africa’s employee benefits consultants and independent financial

advisers (IFAs) is to adapt to change while adding to their value

offering to clients. According to Govender, stakeholders across the

investment value chain will have to adapt to many changes in the savings

landscape, most notably the change in consumer buying patterns on the

back of the continuous acceleration in technology-backed innovation.

She talked about the tendency of financial advisers taking a ‘business

as usual’ approach when it comes to retirement planning. This is the

time to steer away from this approach as the traditional customer

journey has shifted into the digital world and developments such as

blockchain are here to stay. In the past, most customers had one job,

one employer, a pre-determined investment horizon and a predictable

pattern of investing behaviour in a defined benefit (DB) environment.

Both millennial and post-millennial investors now have a totally

different view of the workplace with unique, specific and dynamic advice

needs. The customers have unpredictable expectations and flexible

savings objectives. As she says: “The most important evolution in the

investor journey is that one size no longer fits all,”

Click here to read more. |

|

|

|

|

|

|

| |

|

Professional Principal Executive Officer Qualification

|

Registrations for the second intake starts of the Professional

Principal Executive Officer Qualification commences today, 18 June 2018.

The course will commence on 30 July 2018. Registration will close on 15 July 2018.

The Professional Principal Executive Officer Qualification is a

much-needed stimulus for the professionalisation of the role of the

Principal Officer which has historically been unstructured and

undefined. It will also support the very important transformation

imperative as it enables learners to obtain a qualification which

may have been inaccessible to working individuals, as well as those

unable to satisfy traditional Higher Education access criteria.

Moonstone Business School of Excellence (MBSE) is the first duly

accredited training provider to offer this qualification.

Given the very important role played by Principal Executive Officers

within the governance structure of a retirement fund, it is surprising

that, up to now, very little was available in the form of a duly

recognised NQF level 7 qualification for those performing this function,

or those aspiring towards it.

This occupational qualification will form the apex of the retirement

functionary learning path, and will be linked to the Council of

Retirement Funds for South Africa (Batseta)’s professional designations.

Who should register?

-

Current Principal Officers, trustees and retirement fund

functionaries.

-

People working in a claims or employee benefits and compensation

environment who have access to a retirement fund.

Successful learners will be linked to the professional designations

offered by Batseta, the professional body for the profession. The

learning pathway will include the Retirement Fund Trustee qualification.

Registration

You are welcome to contact Frans-Petrus Zeelie at 087 702 6429, or email

frans@mbse.ac.za, who will gladly assist with any questions.

To register, click

here, then on

Enrol today, select Qualifications and

finally click on the Professional Principal Executive Officer button.

For more information, please

click here.

For general queries you may also email us at

learning@mbse.ac.za. |

|

|

|

| |

|

| |

|

Liberty cyberattack

calls for alert

|

Today’s LegalBrief reports that the life insurance industry is on high

alert after the cyberattack and blackmail attempt on insurer Liberty.

Business Day reported that the firm had regained control of its IT

systems by yesterday. The insurance industry holds sensitive data on

millions of clients, including their banking details and medical

reports. Liberty dispatched a large team of IT and security specialists

to investigate the breach of its IT infrastructure on Thursday. Its CEO,

David Munro, said yesterday criminals had hacked into an e-mail server

and removed some recent messages, and possibly some attachments. There

was no evidence that client data files had been taken, Munro said. The

hacking affected the core Liberty insurance business and did not spread

to the group’s asset manager Stanlib or to its businesses outside SA.

Munro said he did not believe any Liberty customers would suffer from

financial loss because of the cyberattack. He would not confirm or deny

if there had been inside help in the cyberattack, as a criminal

investigation was under way. Sanlam CEO Ian Kirk, one of Liberty’s

largest competitors, said his IT security team was also working around

the clock to prevent a similar incident at their data centres. Liberty

clients woke up on yesterday morning to read e-mails and SMSs from the

company, explaining that it had been subject to ‘unauthorised access’ of

its IT infrastructure. The firm’s head of public affairs, Sydney Mbhele,

confirmed that an external party claimed to have seized data, alerted

the group to potential vulnerabilities in its IT systems and demanded

payment. Munro said no concessions had been made to the criminals and

Liberty would not meet their ransom demands.

Click here to read the

Full Business Day report. |

|

|

|

| |

|

FAIS notice 23 of 2018

|

On 15 June 2018, the Financial Sector Conduct Authority published

the Exemption of FSPs from Fees Payable to the Authority in respect

of Certain Amendments to Approved Specimen Mandates, 2018 (“the

Exemption”).

The Determination of Fit and Proper Requirements for Financial

Services Providers, 2017 (“the Determination”), which came into

effect on 1 April 2018, provides that FSPs who were authorised on

1 April 2018 to render financial services in respect of the

financial products listed in Column A of Table C in section 52(14)

will be deemed to be authorised to render financial services in

respect of the corresponding financial products listed in Column B

of that Table.

The purpose of the Exemption is to exempt Category II, IIA and III

FSPs from having to pay the fees in respect of an application for

approval of an amendment to the FSP’s approved specimen mandate to

reflect the products referred to in Column B of Table A.

Click here to

download the FAIS Notice 23 of 2018.

|

|

|

|

| |

|

|

Regulatory Examinations |

|

|

How to prepare for the REs |

|

Inseta has confirmed that they received the updated materials from their

developers and have placed them on their website.

The updated versions can be access via:

http://www.inseta.org.za/inner.aspx?section=4&page=57

The FSCA strongly recommends the use of its

Preparation Guide to prepare for the exams.

The FSCA Preparation Guide suggests the following approach

|

STEP |

ACTIVITY |

DESCRIPTION |

|

1 |

Refer to the

mapping document for the exam you are planning

to write. |

This is the map of

the tasks/criteria that will be assessed in your

exam, and it contains a reference to the

relevant legislation that you are required to

study in order to understand the task /

criteria. Appendix A in the Preparation Guide |

|

2 |

Look at the number

of criteria for each task. |

These are the

knowledge and skill components you require to be

able to perform.

RE 1 has 16 tasks that will be tested

RE 5 has 8 tasks that will be tested

If you have studied all the criteria for every

task, then you would be properly prepared to

write the RE 1 or RE 5 – whichever exam applies to

you. |

|

3 |

To prepare for the

exam, you must spend time each day and study the

legislation and supporting training material.

One should systematically select one criteria at

a time. |

Group the criteria

together in groups of 3 or 4 and allocate study

hours per day to prepare. The total number of

hours will individually differ due to ones

circumstances. At least 2 hours per day is the

suggested number of hours. |

|

4 |

To start, read the

task, and then the first criteria. Then refer to

the legislation for these criteria, and read the

legislation referred to. |

It is important to

first read the legislation so that you can see

what terms are used and how the legislation is

structured. |

|

5 |

Now refer to the

additional support or training material and study

the section in the training material dealing

with those particular criteria. |

The support

material explains the particular concepts in

simple language so that it is easier to

understand what the legislation is actually

saying and what it means. |

|

6 |

Then go back to the

legislation itself, and read it again.

Where there are discrepancies, ALWAYS regard the

legislation as being correct. |

Now that you have

gained a better understanding of what the

legislation is about, you may find reading the

legislation again will make more sense to you if

you didn’t understand it the first time around. |

An alternative that you may want to consider is the

LexisNexis Legislation Handbook for RE 1 (key individual)

and RE 5 (representative) exams.

The 5th edition of the Handbook has just been

released and provides the latest legislation specified as

relevant to the regulatory exams RE 1 and 5.

The Handbook has been divided into 5 sections with shaded

tabs on the side for easy access:

-

TAB A: FAIS Act and Regulations

-

TAB B: Code of Conduct

-

TAB C: Fit and Proper

-

TAB D: General Acts, Board Notices and Guidance Notes

-

TAB E: FIC Act, Regulations and Guidance Notes

The Handbook together with its Preparation Guides provides a

good source to study for the exams. Click here to download

the LexisNexis Preparation Guide for

RE 1 and

RE 5.

The LexisNexis Legislation Handbook has now been updated with all

the new legislation effective from 1 April 2018.

Click here to order your copy from our Advisor Store.

|

|

|

|

| |

|

2018 Schedules updated |

Please note: Registration cut-off is 11 working days before date of exam.

|

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 20 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 51000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

iInvestment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

2 x Marketing

Assistants:

HIC Underwriting Managers Pty Ltd, Bedfordview - We are looking for

two assistants to manage the relationship between the Portfolio Manager

and Broker. Must be able to work under pressure and be deadline driven.

Read More

-

Claims Administrator:

Cooke Fuller Garrun, Kloof, KZN - The ideal candidate should have at

least 5 years experience in Commercial and Personal claims and must be

FAIS qualified.

Read More

|

|

|

|

|

In Lighter Wyn |

|

|

What’s in a Billion? |

I received the following in email format from a friend which sparked the

thoughts below:

The next time you hear a SA politician use the word 'billion' in a

casual manner, think about whether you wanted the politicians

spending YOUR tax money.

A billion is a difficult number to comprehend, but one advertising

agency did a good job of putting that figure into some perspective

in one of its press releases.

A. A billion seconds ago it was 1959.

B. A billion minutes ago Jesus was alive.

C. A billion hours ago our ancestors were living in the Stone Age.

D. A billion days ago no-one walked on the earth on two feet.

E. A billion Rand is spent in only 27 hours and 12 minutes, at the

rate the SA government is spending it.

South Africa is in dire need of big thinkers. While “Ramaphoria” is

still relevantly strong, we need to consider new ways of addressing

our country’s most pressing needs, particularly poverty and

education which form the breeding ground for radicals to gain

traction.

A million Rand seemed a lot of money until fairly recently. A

billion was actually an incomprehensible number for most of us. That

is, until state capture provided us with shocking insight into what

you can achieve if you think big enough.

Just imagine if the amount of money lost in this way could have been

applied towards good causes like infrastructure, notably

municipalities, hospitals, water and sanitation etc. There would be

no need to bail out state owned enterprises, provided of course that

effective management structures were put in place. Ditto the other

troubled agencies.

Imagine if we could arrange a new type of “Dirty Dozen” by pardoning

the main perpetrators of state capture and utilising their ingenuity

in a positive manner?

Thus ends today’s sermon.

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here. |

|

|

©2015 Moonstone. All rights reserved. |

| |