|

To Subscribe please click

here |

|

|

Investment Indicators - 21 May 2018 |

|

|

|

“While differing widely in the various little bits we know, in our infinite

ignorance we are all equal.” – Karl Popper |

| |

|

|

Distributed to 51,965 subscribers.

To advertise with us

click here |

|

| |

|

| Rates Review |

|

|

1. Secured Investment Rates |

|

Please note that (G) indicates a Guaranteed and (L) a Linked product. In order to understand the difference between guaranteed and linked rates,

kindly click here for an explanation. |

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

1Life (L) |

7.080% |

6.730% |

|

2 |

Clientéle Life (L) |

7.050% |

6.770% |

|

3 |

Absa (L) |

6.753% |

6.408% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Clientéle Life (L) |

7.150% |

6.850% |

|

2 |

Discovery (G) |

7.083% |

6.949% |

|

3 |

1Life (L) |

7.080% |

6.730% |

|

|

|

|

|

|

2. Money Market Funds |

|

|

|

Please bear in mind that our figures, though based on the actual quotations that you also use, are for information purposes only,

and can never replace the official quotation from the product house. In terms of the guarantees, you are requested

to clarify the exact extent of such guarantees with the product house prior to advising clients. |

|

|

|

|

|

|

|

From the Crow's Nest |

|

|

GAP Cover Survey - GTC study reveals huge business

opportunity |

First-ever ranking of Medical Gap Cover GTC launches

inaugural Gap Cover Survey to rank and categorise all providers in

SA

18 May 2018

Sanlam and Absa have emerged as the top-ranked medical Top-up -

often referred to as ‘Gap’ cover - providers in SA, according to the

first ever ranking of these product providers, conducted by leading

wealth and advisory firm GTC.

“Unlike medical aids, where the information is readily available via

the Medical Schemes Council, there is no central database of

providers or products, nor a way of objectively comparing the

policies available in the Gap cover market. We believe medical Gap

cover policies are likely to become increasingly important in the

South African market, especially as medical aids continue to rein in

expenditure, by reducing or limiting their level of cover, and as

the government prepares to impose more restrictions on private

healthcare insurance through the introduction of National Health

Insurance,” says Jill Larkan, Head of Healthcare Consulting at GTC.

“Despite this, our survey has found that there has been relatively

low take-up of these policies amongst medical aid members,” says

Larkan.

“We included 20 providers of Gap cover policies in our survey,

offering 84 plans covering 18 different types of products focused on

four core categories identified by GTC. These plans offer cover to

approximately 550 000 families, representing a small portion of the

potential medical aid market which has in excess of eight million

members,” says Larkan.

Core benefits identified and rated

GTC’s survey attempted to simplify the Gap cover landscape by using

core benefits provided by many of the plans. According to these core

benefits, the survey rated the various plans based on:

-

Gap cover – the in-hospital gap cover and percentage cover the

scheme provides (weighted 60%);

-

Co-payment benefit – the provision of a co-payment benefit

(weighted 13.3%);

-

Oncology cover – the provision of additional cover for cancer

(weighted 13.3%); and

-

Sub-limit benefit extender – provided to enhance sub-limits

imposed by medical aids (weighted 13.3%).

In addition to these four broad benefits, plans were further grouped

into sectors, based on the level of cover offered, namely 200%,

300%, 350% or 500%+.

“The most popular type of plan, according to the survey, is one

which offers in-hospital Gap cover, co-payment, oncology and

sub-limit, to the level of 500% +,” says Larkan.

The plans were rated based on the level of benefits provided within

these stated categories. To determine which plans performed best

amongst the top-ranked ones, the survey identified which provider

offered the best premium for different age groups and family sizes.

“Following this analysis, Sanlam’s Comprehensive Gap Cover emerged

as the top performer for individuals and families under 60, whilst

Absa’s Gold Plan is best suited for individuals and families over

the age of 60,” says Larkan.

While Gap cover may seem a luxury expense, Larkan contends that it

is the most cost-effective way of providing medical insurance,

especially for emergencies or protection against unplanned medical

expenses beyond the limitations imposed by one’s medical aid.

“Some of the entry-level policies can be had for as little as R63

per month, which adds 200% of additional In-Hospital cover to your

medical insurance.”

The survey also found that 25 plans offer a lump sum ranging from R5

500 to R50 000 for members diagnosed with cancer for the first time.

Larkan concludes: “Gap cover is likely to become an increasingly

important tool for managing medical expenses, especially as medical

aid schemes are reining in their level of cover. However, the

industry urgently needs to make an effort to simplify its offerings

and make it easier for consumers to navigate the market, before

regulators force change upon the providers.”

Click here to download GTC’s full survey.

Read the full

press release here. |

|

|

|

|

|

|

| Your Practice Made Perfect |

|

|

ASISA finalises standardised cost disclosure for umbrella funds |

According to the Association for Savings and Investment South Africa (ASISA),

employers will find it much easier to select the most cost effective

umbrella retirement fund solutions for their employees from March next

year when the new ASISA Retirement Savings Cost (RSC) Disclosure

Standard comes into effect.

In a news release of 16 May 2018 ASISA mentioned that the new RSC

Disclosure Standard commits members of ASISA to present all costs (based

on certain assumptions) relating to umbrella retirement fund solutions

in a standardised manner, enabling employers to compare like with like

when considering quotations from different ASISA members. This will also

make it easier for the Boards of Trustees of umbrella funds to consider

costs as part of their fiduciary duties.

Click here to read more about the ASISA announcement. |

|

|

|

|

|

|

| |

|

CPD requirements: are you ready?

|

With 1 June 2018 around the corner, CPD is now a reality for certain

FSPs, key individuals and representatives. Yes, authorised Financial

Services Providers (FSPs), Key Individuals (KIs) and Representatives

(Reps) must meet certain competence requirements which are set out in

the new

Fit and Proper Requirements.

Is anyone excluded from CPD?

The fit and proper requirements relating to CPD do not apply to:

|

(a) |

a Category I FSP, its key individuals and

representatives that are authorised, approved or

appointed only to render financial services or manage or

oversee financial services in respect of the financial

products: Long-term Insurance subcategory A and/or

Friendly Society Benefits; and |

|

(b) |

a representative of a Category I FSP that is appointed

to only- |

| |

(i) |

render a financial service in respect of a

Tier 2 financial product; and/or |

| |

(ii) |

render an intermediary service in respect of a

Tier 1 financial product. |

| |

The position

regarding representatives working under supervision is

yet to be clarified. The proposed amendments to the

“supervision” Board Notice (BN 104 of 2008) is likely to

be distributed for comment by the industry at the end of

May. |

CPD cycle of 12 months

The CPD cycle runs for a period of 12 months commencing on

1 June of every year and ending on 31 May of the following

year.

How many CPD hours are required?

The minimum CPD hours is determined by the make-up of your

business.

Where you render:

-

a single subclass of business within a single class of

business, you must complete a minimum of 6 hours of CPD

activities per CPD cycle;

-

more than one subclass of business within a single class

of business, you must complete a minimum of 12 hours of CPD

activities per CPD cycle; and

-

more than one

class of business you must complete a minimum of 18

hours of CPD activities per CPD cycle.

We suggest that you study the relevant section in the

2017 Fit and Proper Determination to assess the impact

on your business and what is required of you. |

|

|

|

| |

|

| |

|

Moonstone Regulatory Update Workshops

|

With the first workshop only two weeks away, the Cape Town,

Johannesburg, Pretoria and Durban venues are likely to be fully booked

today.

Bloemfontein, Port Elizabeth and East London venues still has space, but

please book now to avoid disappointment.

You can earn 3 FSCA Fit and Proper CPD hours by attending.

FPI members can, in addition, also qualify for 3 FPI Ethics and Practice

Standard CPD points towards their professional designation CPD

requirement. Members who know how scarce such opportunities are will

certainly make use of this double whammy.

Please note that identification steps will be implemented to ensure the

validity of your CPD claim.

The workshops will cover he Insurance Regulations, Policyholder

Protection Rules, the new Debarment process, the Financial Sector

Regulation Act, proposed changes to the General Code of Conduct and an

in-depth unpacking of the 12 elements of the New Fit and Proper

Requirements.

Staying abreast of these developments is crucial to your survival in the

industry.

The workshops will run from 09h00 until 13h00 and take place on the

following dates and venues:

|

VENUE |

DATE |

|

East London - EL Golf Club |

5 June 2018 |

|

Port Elizabeth - PE Golf Club |

6 June 2018 |

|

Cape Town - The River Club |

18 June 2018 |

|

Johannesburg - Houghton Golf Club |

19 June 2018 |

|

Pretoria - Diep in die Berg |

20 June 2018 |

|

Durban - Coastlands Hotel Umhlanga |

21 June 2018 |

|

Bloemfontein - Emoya Estate |

26 June 2018 |

Book your seat – register today to avoid missing out. |

|

|

|

|

Regulatory Examinations |

|

|

RE Deadline 30 June 2018 - check RE registration

date deadlines |

The table below indicates who has to successfully complete the RE 5 by

30 June 2018.

|

Representatives’ DOFA |

RE 5 Deadline |

|

30/06/2015 – 31/12/2015 |

30/06/2018 |

|

01/01/2016 – 29/06/2016 |

30/06/2018 |

|

30/06/2016 – 31/12/2016 |

30/06/2019 |

DOFA refers to your date of first appointment. For instance,

if you were appointed on 1 September 2015, you actually have

two years and nine months in which to pass the RE 5 for

representatives.

Unfortunately, time is now running out for those who are

compelled to pass in less than two months.

-

Remember

that bookings close about two weeks before the actual exam,

for logistical reasons. On Thursday (24 May 2018) registration closes for

examinations on 8 June 2018.

-

Not everyone passes at the first attempt. If you wish to

give yourself enough time to re-register in such an event,

bear in mind that you should allow for time for your paper

to be marked and the results sent to you. This means that

you should try and write by 8 June, given that our venues

have always been fully booked in the last few weeks of the DOFA deadline.

|

|

|

|

| |

|

2018 Schedules updated |

Please note: Registration cut-off is 11 working days before date of exam.

|

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 20 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 51000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

iInvestment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Para-Planner:

Carrick Wealth, Johannesburg, Durban and Cape Town - The

Para-planner will be responsible for researching and analysing products

to present recommendations to clients based on a thorough financial

planning process.

Read More

-

Financial Advisor:

Universal Life Brokers, Randburg - Candidates must have at least 5

years experience in the long term insurance industry and in possession

of a NQF5 qualification in financial planning.

Read More

-

Experienced Financial

Advisers:

Centered Financial Solutions Pretoria / Centurion - Top franchise

with the most comprehensive product range that included risk,

investment, RA, short term & medical aid looking for dynamic financial

advisers.

Read More

-

Broker Consultant:

CIA - Commercial & Industrial Acceptances, KZN Umhlanga - We are

looking for a candidate with at least 5-10 years working experience in

the insurance industry, short term insurance qualifications and RE1.

Read More

|

|

|

|

|

In Lighter Wyn |

|

|

Monday Wisdom |

The wise old Mother Superior from county Tipperary was dying. The nuns

gathered around her bed trying to make her comfortable. They gave

her some warm milk to drink, but she refused it. Then one nun took

the glass back to the kitchen. Remembering a bottle of Irish whiskey

received as a gift the previous Christmas, she opened and poured a

generous amount into the warm milk.

Back at Mother Superior's bed, she held the glass to her lips.

Mother Superior drank a little, then a little more. Before they knew

it, she had drunk the whole glass down to the last drop.

“Mother", the nuns pleaded, "Please give us some wisdom before you

die."

She raised herself up in bed with a pious look on her face and said,

“Don't sell that cow.".

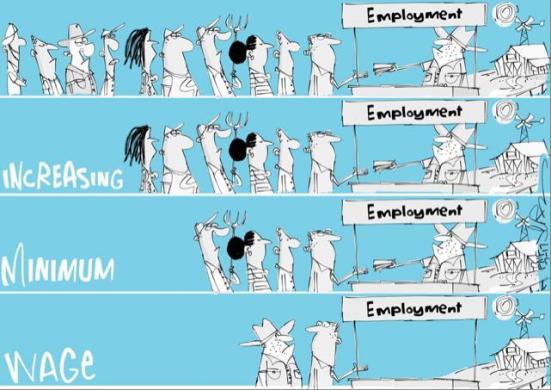

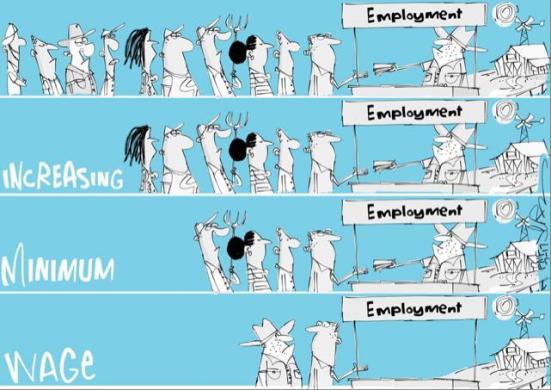

Another take on minimum wages

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here. |

|

|

©2015 Moonstone. All rights reserved. |

| |