|

To Subscribe please click

here |

|

|

Investment Indicators - 30 April 2018 |

|

|

Oh yes, the past can hurt. But you can either run from it, or learn from it.

- Rafiki, The Lion King |

| |

|

|

Distributed to 51,951 subscribers.

To advertise with us

click here |

|

| |

|

| Rates Review |

|

|

1. Secured Investment Rates |

|

Please note that (G) indicates a Guaranteed and (L) a Linked product. In order to understand the difference between guaranteed and linked rates,

kindly click here for an explanation. |

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Clientéle Life (L) |

6.720% |

6.620% |

|

2 |

1Life (L) |

6.680% |

6.640% |

|

3 |

Absa (L) |

6.362% |

6.300% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Discovery (G) |

6.899% |

6.624% |

|

2 |

Clientéle Life (L) |

6.820% |

6.720% |

|

3 |

1Life (L) |

6.680% |

6.640% |

|

|

|

|

|

|

2. Money Market Funds |

|

|

|

Please bear in mind that our figures, though based on the actual quotations that you also use, are for information purposes only,

and can never replace the official quotation from the product house. In terms of the guarantees, you are requested

to clarify the exact extent of such guarantees with the product house prior to advising clients. |

|

|

|

|

|

|

|

From the Crow's Nest |

|

|

The benefits of Health Savings Accounts |

Healthcare planning, or the lack thereof, can directly impact

someone’s retirement for better or for worse. Kevin Murphy, National

Retirement Plan Strategist at Franklin Templeton, explains the

benefits of Health Saving Accounts, and how they can even help build

your retirement savings for consideration.

Health Savings Accounts: The Intersection of Retirement and Health

Care

The increasing cost of health insurance borne by employees and

employers alike has spawned a variety of plans and strategies to

help manage the expenses. Among these are health savings accounts (HSAs),

which first came onto the scene in 2003. HSAs allow individuals who

are covered by high-deductible health plans to receive tax-preferred

treatment of money they have saved for medical expenses. Kevin

Murphy, National Retirement Plan Strategist at Franklin Templeton,

explains the benefits of HSAs, and how they can even help build your

retirement savings.

Every year Franklin Templeton conducts its Retirement Income

Strategies and Expectations (RISE) survey,1 asking individuals how

prepared they are for retirement, the strategies they have used to

save for it and what concerns them most about their post-work life.

Concerns about health care expenses often top the list of worries

among survey respondents. In fact, in the 2018 RISE survey, paying

for medical and pharmaceutical expenses was the number one expense

individuals were concerned about in retirement. And that’s no

surprise, as health care planning—or lack thereof—can directly

impact one’s retirement for the better or worse.

The ABCs of HDHPs and HSAs

High-deductible health plans (HDHPs) have been one solution to help

employers and employees cope with rising health care costs. Along

with traditional health care plans, increasing numbers of employers

have been offering these plans, which can provide greater upfront

savings to the employer than traditional plans, and significantly

lower premiums for individuals. As the name implies, an HDHP has a

higher deductible than a traditional health insurance plan. The

individual is responsible for paying medical expenses up to a

specified level. After meeting the deductible threshold coverage

kicks in. Certain aspects of care may be covered in full outside the

deductible, such as yearly exams and preventative care.

A Health Savings Account (HSA), which is used in conjunction with an

HDHP, allows users to save money tax-free to pay for qualified

health care expenses paid out of pocket and, HSAs can be used for

health care expenses not only in one’s working years, but also in

retirement. In this sense, the HSA represents the intersection of

retirement and consumer-driven health care.

The Main Advantages of an HSA

There are three main advantages of an HSA.

-

Contributions are not subject to income tax.

-

Earnings and interest grow tax-free.

-

Withdrawals are tax-free if used to pay for qualified medical

expenses.

As HSA participants direct where to invest the funds (which can

include vehicles such as mutual funds), HSAs are often thought of

like an Individual Retirement Account or 401(k) plan for medical

expenses, and a great complement to these long-term retirement

savings strategies. Both offer tax-deductible contributions, but the

main difference is that while most individuals won’t touch their

401(k) assets until they retire, it’s more likely individuals will

need to access their HSA savings periodically before then.

No One-Size-Fits-All Approach

When it comes to health care coverage, what’s appropriate for one

individual or family might not be appropriate for another. If you

choose an HSA plan, you’ll want to give careful consideration to how

your assets are invested based on your personal situation, including

your risk-tolerance, needs and goals.

Of course, there are always trade-offs with any type of health plan,

and I certainly would not want to imply an HSA is right for

everyone. It’s important to weigh the pros and cons. But, if you are

healthy and can afford a higher deductible, an HSA can also help

build your retirement savings. |

|

|

|

|

|

|

|

|

|

DISCOVERY INVEST CELEBRATES DECADE OF TOP PERFORMANCE

The

PlexusCrown survey for the fourth quarter of December 2017

saw Discovery Invest ranked as the fourth top CIS management company in

the country. The asset manager’s overall score shot up from 12th spot to

4th spot between March and December last year.

The Discovery Balanced Funds have provided consistent bench-mark beating

returns*. The

Discovery Balanced Fund enjoyed top quartile performance over one,

three, five, seven and ten years, with returns of 10.85%; 6.24%; 10.78%;

and 9.98% respectively to the end of February 2018. Pretty impressive,

and consistent, for a ten-year old.

Source: Profile Data, 28 February 2018

Disclaimer

This article is meant only as information and should not be taken as

financial advice. For tailored financial advice, please contact your

financial adviser.

Discovery Life Investment Services Pty (Ltd), branded as Discovery

Invest, is an authorised financial services provider. Registration

number 2007/005969/07.

Please

click here to read our full disclaimer . |

|

| Your Practice Made Perfect |

|

|

FSCA FAIS Notice 2 of 2018 – Fee exemption for certain FSPs |

A FSP that was authorised on 1 April 2018 to render financial services

in respect of the financial products listed in Column A of Table D in

section 52(17) of the Determination on Fit and Proper requirements and

who applies for authorisation to render financial services in respect of

the corresponding financial products listed in Column B of that Table,

is exempted from having to pay the fees, provided they apply before 1 July 2018.

In plain English this means that this notice deals with the updating of

mandates (To reflect the new products) and FSPs profiles in relation to

Section 52(17):

|

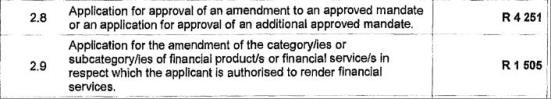

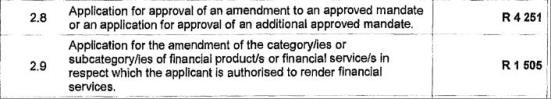

TABLE D |

|

Column A |

Column B |

|

Participatory interest in a

collective investment scheme |

Participatory interest in a CIS

hedge fund |

|

Short-term deposit |

Structured deposit |

|

Long-term deposit |

Structured deposit |

The Notice on Determination of Fees payable to the Registrar of

Financial Services Providers prescribes the following costs, which will

be waived to those applying in time.

|

|

|

|

|

|

|

| |

|

Fit and Proper timeline: 1 May requirements

|

Please take note that the following sections of Board Notice194 of 2017

are effective from 1 May 2018.

Section 13(3)

FSPs must be able to demonstrate and record that it has evaluated /

reviewed at regular intervals its Key Individuals and Representatives

competency. The records must include the actions taken to ensure that

they remain competent and also indicate the appropriateness of training

and CPD undertaken

Section 13(5)

FSPs must maintain a competence register in which the qualifications,

COB, PST, RE and CPD of Key Individuals and Representatives are recorded

Section 29(1)(b)

All Representatives appointed / Sole Proprietors authorised from

1 May 2018 must comply with the Product Specific Training requirements

prior to rendering service

Section 38

FSPs that provide automated advice must have certain policies, processes

and systems in place (in addition to the requirements set out in Section

37). |

|

|

|

| |

|

| |

|

FAIS Ombud dismisses property syndication complaints

|

A recent Business Report states the following:

In the midst of the huge backlog of property syndication complaints the

Financial Advisory and Intermediary Services (FAIS) Ombud recently

dismissed all the property syndication complaints received where the

complainants failed to mention the name of the broker in the complaint.

This while many disgruntled investors in Sharemax Investments have

mobilised themselves into action groups in an attempt to recover the

billions invested by investors in the various property syndication

schemes marketed and promoted by the company.

According to Thobile Masina, the assistant Fais Ombud, the decision

followed the Financial Services Board (FSB) appeal board judgment in

2015 setting aside the determinations issued to complaints lodged

independently by pensioners Gerbrecht Siegrist and Jacqueline Bekker. In

these determinations the Sharemax directors were held liable to repay

the complainants.

Click here to read the full Business Report article. |

|

|

|

| |

|

Incompatibility as grounds for dismissal

|

So what does the squabble between André Watson and the SA Rugby

Union have to do with this topic?

It may just help you understand how to address the problem when an

employee just makes life miserable for all or some of the people in

the office.

Rugby followers may remember that several rugby referees laid a

complaint with Watson’s employer about what they considered his

‘dictatorial, strict and abrasive management style’. The SA Rugby

Board found against him in a disciplinary hearing and terminated his

services. The Labour Court, however, overturned this decision and

ordered that the sacking be replaced with a written warning, and

Watson be reinstated.

This is but one example of cases where incompatibility was used as

the grounds for dismissing an employee in an article published on

the

Van Der Spuy & Partners website.

Click here to read the full article.

PS

No mention is made of what staff can do when the manager is the

misery monger.

|

|

|

|

| |

|

Regulatory Update Workshops – save the dates

|

Moonstone Compliance and Risk

Management’s comprehensive, practical workshops, unpacking the Fit

and Proper requirements will run in June 2018 as recently published.

We moved these dates forward to June to coincide with the first CPD

cycle to allow attendees to claim CPD hours.

The workshops will run from 09h00 until 13h00 and take place on the

following dates and venues:The workshops will run from 09h00 until 13h00 and take place on the

following dates and venues:

|

VENUE |

DATE |

|

East London - EL Golf Club |

5 June 2018 |

|

Port Elizabeth - PE Golf Club |

6 June 2018 |

|

Cape Town - The River Club |

18 June 2018 |

|

Johannesburg - Houghton Golf Club |

19 June 2018 |

|

Pretoria - Diep in die Berg |

20 June 2018 |

|

Durban - Coastlands Hotel Umhlanga |

21 June 2018 |

|

Bloemfontein - Emoya Estate |

26 June 2018 |

Please save the date - we will confirm as soon as registration opens. |

|

|

|

|

Regulatory Examinations |

|

|

2018 Schedules updated |

Please note: Registration cut-off is 11 working days before date of exam.

|

|

|

|

| |

|

Frequently asked Questions |

Please

click here to access a list of questions and answers,

including information on what exams to write, the cost

thereof, study material, training and a lot more.

Contact details

Email enquiries should be addressed to

faisexam@moonstoneinfo.co.za. You can phone us on

021 883 8000 - select option 2 to speak to one of our

consultants. |

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 20 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 51000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

iInvestment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Broker Consultant:

CIA - Commercial & Industrial Acceptances, KZN Umhlanga - We are

looking for a candidate with at least 5-10 years working experience in

the insurance industry, short term insurance qualifications and RE1.

Read More

-

Offshore Property

Consultant:

Salesforce Recruitment Johannesburg and Durban - This is your

opportunity to offer a unique, capital growth investment opportunity to

the market without bumping heads with direct competitors.

Read More

-

International Buy to

Let Sales Consultant:

Salesforce Recruitment Johannesburg and Durban - Join this stable,

Offshore Property Investment House and elevate your sales career to the

next level.

Read More

-

Key Individual:

Destinata Capital Ltd, Faerie Glen, Pretoria & Somerset West - We

have a position for a key individual who is licensed for at least

category 1.8.

Read More

|

|

|

|

|

In Lighter Wyn |

|

|

Some uncomfortable truths |

Aphorism: "A short, pointed sentence that expresses a wise or clever

observation or a general truth."

The nicest thing about the future is that it always starts tomorrow.

Money will buy a fine dog but only kindness will make him wag his

tail.

If you don't have a sense of humour you probably don't have any

sense at all.

Seat belts are not as confining as wheelchairs.

A good time to keep your mouth shut is when you're in deep uhm... water.

Business conferences are important because they demonstrate how many

people a company can operate without.

Why is it that at school reunions you feel younger than everyone

else looks?

There are no new sins; the old ones just get more publicity.

There are worse things than getting a call for a wrong number at 4

am; for example, it could be the right number.

No one ever says "It's only a game" when their team is winning.

Be careful about reading the fine print, there's no way you're going

to like it.

The trouble with bucket seats is that not everybody has the same

size bucket.

Do you realize that, in about 40 years, we'll have thousands of old

geezers running around with tattoos?

Always be yourself because the people that matter don't mind and the

ones that mind don't matter.

Life isn't tied with a bow but it's still a gift.

And remember; "Politicians and nappies should be changed often and

for the same reason."

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here. |

|

|

©2015 Moonstone. All rights reserved. |

| |