|

To Subscribe please click

here |

|

|

Investment Indicators - 23 April 2018 |

|

|

"We know what we are, but know not what we may be”

- William Shakespeare |

| |

|

|

Distributed to 52,023 subscribers.

To advertise with us

click here |

|

| |

|

| Rates Review |

|

|

1. Secured Investment Rates |

|

Please note that (G) indicates a Guaranteed and (L) a Linked product. In order to understand the difference between guaranteed and linked rates,

kindly click here for an explanation. |

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

1Life (L) |

6.640% |

6.630% |

|

2 |

Clientéle Life (L) |

6.620% |

6.670% |

|

3 |

Absa (L) |

6.300% |

6.265% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Clientéle Life (L) |

6.720% |

6.770% |

|

2 |

1Life (L) |

6.640% |

6.630% |

|

3 |

Discovery (G) |

6.624% |

6.658% |

|

|

|

|

|

|

2. Money Market Funds |

|

|

|

Please bear in mind that our figures, though based on the actual quotations that you also use, are for information purposes only,

and can never replace the official quotation from the product house. In terms of the guarantees, you are requested

to clarify the exact extent of such guarantees with the product house prior to advising clients. |

|

|

|

|

|

|

|

From the Crow's Nest |

|

Proposed amendments to Premium collection

by Alan Holton |

As I mentioned in my previous article,

Draft Amendments on Premium Collection, a number of

significant amendments have been proposed to the Regulations to both

the LIA and the STIA.

A recent industry article dealt to some extent with the proposed

draft amendments to the STIA Regulations insofar as premium

collection is concerned. The article suggests that an issue with the

current method of premium collection is the perceived risk insurers

have when the IGF guarantee is insufficient to cover the outstanding

premiums. This risk, says the article, will be exacerbated when the

IGF guarantees are no longer available.

The article then suggests that there is a problem with premium

collection and proposes as a solution that premiums be collected and

paid directly into the insurer’s bank account.

This may lead to some confusion in the industry.

Insurers have always been entitled to insist that premiums be paid

directly into their own bank account. The implications inherent in

the article, however, are that this is now a requirement directly as

a result of the proposed repeal of the requirement that collecting

intermediaries hold IGF cover – and that there is no alternative.

Treasury however, are of the view that the repeal of the security

requirements could very well mean that an insurer will,

nevertheless, still require some form of guarantee or fidelity

insurance cover from an intermediary when allowing it to collect

premiums on its behalf. Insurers will do so in the interest of good

governance rather than as a consequence of a regulatory requirement.

Treasury released a “Statement explaining the amendments” (Annexure

E) in which they state that the intention of the amendment to the

LTIA Regulations is to provide more adequate protection to

policyholders and to align the legislative framework governing

premium collection across the LTIA and the STIA. Treasury says

further that, in addition to aligning the requirements relating to

premium collection in the LTIA and STIA, it is essential that the

regulatory framework for premium collection remains relevant to

current practices in the market.

There is no intention to interrupt current premium collection

practices – rather the intention is to improve policyholder

protection. There is no indication from Treasury that premiums must

now be paid directly to insurers. The proposed amended Regulations

are intended to improve the premium collection framework for the

entire insurance market and to compel insurers to have appropriate

oversight by independent intermediaries collecting premiums.

The following excerpt from the Treasury Statement is relevant to

these considerations:

“Due to the fact that the IGF requirements will be repealed from

Regulation 4 and because several significant risks regarding premium

collection have been identified in respect of the manner in which

insurance premiums are dealt with by independent intermediaries

collecting premiums (see Proposal E and F, 2014 RDR), it was deemed

necessary to improve the current legislative framework governing

premium collection. The proposed amendments therefore propose to

improve the premium collection legislative framework by, amongst

other things, including:

-

a prohibition on an independent intermediary delegating the

authority to collect premiums provided to it by a short-term

insurer;

-

requiring that certain matters must be addressed in the written

authorisation provided by the insurer to the independent

intermediary;

-

requiring that the independent intermediary collecting premiums

must maintain a separate bank account for the premiums collected;

-

prohibiting the independent intermediary from using the premiums

collected for any business or commercial purposes; and

-

imposing governance and oversight requirements applicable to a

short-term insurer when allowing an independent intermediary to

collect premiums.

It is acknowledged that some of the existing premium collection

arrangements between short-term insurers and independent

intermediaries will not be consistent with these amendments and such

arrangements will have to be restructured. Further, short-term

insurers that currently do not have appropriate oversight over the

functions performed by independent intermediaries in respect of its

current premium collection arrangements will have to set up

appropriate governance structures. Seeing that there is currently no

requirement in the LTIA Regulations governing premium collection,

National Treasury acknowledges that the new requirements with

regards to premium collection have the potential of having a

significant impact on the long-term and short-term insurance

industry.

Consideration will be given to appropriate transitional arrangements

necessary for some of the proposed amendments to mitigate the

possible impact thereof. Specific comment is invited from both

industries on what the cost and other potential implications of

complying with these new premium collection requirements will be,

and on transitional amendments necessary to facilitate the

implementation of these requirements.” (Emphasis added)

Alan Holton is an independent compliance officer and regular

consultant to Moonstone. |

|

|

|

|

|

|

|

|

|

DISCOVERY INVEST CELEBRATES DECADE OF TOP PERFORMANCE

The

PlexusCrown survey for the fourth quarter of December 2017

saw Discovery Invest ranked as the fourth top CIS management company in

the country. The asset manager’s overall score shot up from 12th spot to

4th spot between March and December last year.

The Discovery Balanced Funds have provided consistent bench-mark beating

returns*. The

Discovery Balanced Fund enjoyed top quartile performance over one,

three, five, seven and ten years, with returns of 10.85%; 6.24%; 10.78%;

and 9.98% respectively to the end of February 2018. Pretty impressive,

and consistent, for a ten-year old.

Source: Profile Data, 28 February 2018

Disclaimer

This article is meant only as information and should not be taken as

financial advice. For tailored financial advice, please contact your

financial adviser.

Discovery Life Investment Services Pty (Ltd), branded as Discovery

Invest, is an authorised financial services provider. Registration

number 2007/005969/07.

Please

click here to read our full disclaimer .

|

|

| Your Practice Made Perfect |

|

|

Don’t let good news headlines thwart your savings plans |

Positive sentiment in the country is being

fuelled by a change in political leadership, the stronger rand, a

higher-than-expected GDP growth rate and a more optimistic consumer

outlook. The latest decision by ratings agency Moody’s to keep South

Africa's sovereign debt at above investment grade and revise its outlook

from negative to stable, confirms this.

But, says Rob Formby, chief operating officer designate at Allan Gray,

while the current mood is indeed good news for South Africans, investors

should not let this distract them from continuing to tighten their

belts.

“These good news headlines are a relief for many South Africans, but the

reality is that a lot of work is required to fix the economy and the

country. South African investors should not make changes to their

long-term savings plans based on the recent euphoria alone,” says

Formby.

Despite the recent interest rate cut, a Value Added Tax (VAT) hike – the

first increase in the country since 1993 – coupled with the

below-inflation increase in the bottom three personal income tax

brackets and no inflation adjustment to the top four tax brackets, will

see people out of pocket.

“Amidst this climate, we should still look at frugality as the new

normal, adopt a savings mentality where possible, and look for ways to

rein in spending,” he says, adding that going back to investing basics

in 2018 will help investors stick to their plan.

“Investors should focus on spending less money than they earn, saving

wherever their budget allows, and starting as early as possible.”

A recent report released by Lloyds Banking in the UK is calling for 2018

to become known as the year of savvy spending: It claims that, an

astounding, 50% of people have changed their spending habits since the

start of the year.

“South Africans would do well to follow this trend,” Formby notes.

Formby further reminds investors not to make sudden changes to their

portfolios in response to the news headlines.

“Investors often lose out on performance when trying to adjust their

investments based on day-to-day news and events. It makes far more sense

to base investment decisions on what you need to reach your goals, and

then stick with the plan,” he concludes.

Share the article with your clients –

click here to download pdf version. |

|

|

|

|

|

|

| |

|

Setback for home loan defaulters

|

An article on the rights of home loan defaulters was recently

published on the GroundUp website. Below is a summary from Legalbrief

Today on the matter.

In a setback for home loan defaulters, the Gauteng High Court (Pretoria)

recently dismissed a challenge against the constitutionality of certain

rules of court which enable the home of a debtor to be sold without a

reserve price. The primary issue the court had to determine was the

constitutionality of rule 46(12) of the High Court rules which enable a

creditor to attach and sell a debtor’s home without a reserve price

being set. Under this rule, it is possible for the bank to sell a

debtor’s home for any price and recover any amount they can for the

outstanding debt, notes a GroundUp report examining the judgment.

In reaching its decision, the court dealt with four main issues –

-

will a reserve price result in a home being sold for a higher price;

-

does a sale without a reserve price constitute an arbitrary

deprivation of property;

-

does the fact that the rules were subsequently amended mean that the

previous rules were defective and

-

does the rule infringe upon the right to adequate housing?

Among other things it found that because there is judicial oversight

over the process of determining whether a house is specifically

executable before a warrant of execution is issued, the right to

adequate housing is already protected. As such, there was no need for

further protection in the form of a reserve price. It also decided the

question of whether a reserve price should be set or not is in fact a

policy decision which is best left to Parliament to determine.

The report notes that although the amended version of the rules, which

came into effect in December 2017, enables a reserve price to be set in

certain circumstances this is still not the default position. Debtors

whose homes were attached prior to the amended rules will still be in a

potentially precarious position. For this reason, Lawyers for Human

Rights, intend to appeal.

Full GroundUp report

Judgment. |

|

|

|

| |

|

|

Regulatory Examinations |

|

|

Latest on study material |

|

We are still inundated with enquiries about “the new” INSETA study

material.

There is no NEW study material. Only a small section is affected

by the new Fit and Proper regulations, as outlined in the latest

Preparation Guide.

It is therefore important that learners familiarise themselves with this

document which contains the amended qualifying criteria and tasks.

According to the Inseta website, the amended Inseta training manual will

be available from the middle of May onwards.

Click here to download the latest Preparation Guide.

|

|

|

|

| |

|

How can using the Preparation Guide help me prepare? |

Candidates should not find it difficult to prepare for the exam

because the

Prep Guide outlines exactly what the examination will be testing

and where to find the information. Studying the Prep Guide is in fact

the very first step a candidate should take to ensure that he or she

knows what they have to know, and where to find the required

information.

For Example:

Task

no |

Task |

QC |

Qualifying

Criteria |

Knowledge

(K) or Skill

(S) |

Legislation

Reference

Where in the legislation

is this task and criteria covered that must be

studied. |

|

7 |

Dealing with complaints that have been submitted

to the Ombud for FSPs |

1 |

Explain the role and authority of the Ombud for

FSPs |

K |

FAIS Act - Sec 1 Definition of Complaint

FAIS Act - Sec 20(3)

FAIS Act - Sec 20(4)

FAIS Act - Sec 27 & 27(3) & 27(4)

FAIS Act - Sec 28

FAIS Act - Sec 28(4)(a)

FAIS Act - Sec 31

BN 81 of 2003 - Sec 3

BN 81 of 2003 - Sec 4(c) |

In the

Preparation Guide the FSCA shares 6 steps that will work

most effectively for examination preparation:

Step 1: Refer to the mapping document for the exam

you are planning to write. (Appendix A in the Preparation

Guide)

Step 2: Look at the number of criteria for each task

(RE 1 has 16 tasks that will be tested RE 5 has 8 tasks that

will be tested).

Step 3: To prepare for the exam, you must spend time

each day and study the legislation and supporting training

material. One should systematically select one criteria at a

time. (allocate study hours per day to prepare)

Step 4: To start, read the task, and then the first

criteria. Then refer to the legislation for these criteria,

and read the legislation referred to.

Step 5: Now refer to the additional support or

training material (for example the INSETA training material)

and study the section in the training material dealing with

those particular criteria.

Step 6: Then go back to the legislation itself, and

read it again. |

|

|

|

| |

|

2018 Schedules updated |

|

(next UK opportunity is on 1 October 2018)

Registration page

Please note: Registration cut-off is 11 working days before date of exam.

|

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 20 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 51000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

iInvestment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Broker Consultant:

CIA - Commercial & Industrial Acceptances, KZN Umhlanga - We are

looking for a candidate with at least 5-10 years working experience in

the insurance industry, short term insurance qualifications and RE1.

Read More

-

Offshore Property

Consultant:

Salesforce Recruitment Johannesburg and Durban - This is your

opportunity to offer a unique, capital growth investment opportunity to

the market without bumping heads with direct competitors.

Read More

-

International Buy to

Let Sales Consultant:

Salesforce Recruitment Johannesburg and Durban - Join this stable,

Offshore Property Investment House and elevate your sales career to the

next level.

Read More

-

Key Individual:

Destinata Capital Ltd, Faerie Glen, Pretoria & Somerset West - We

have a position for a key individual who is licensed for at least

category 1.8.

Read More

|

|

|

|

|

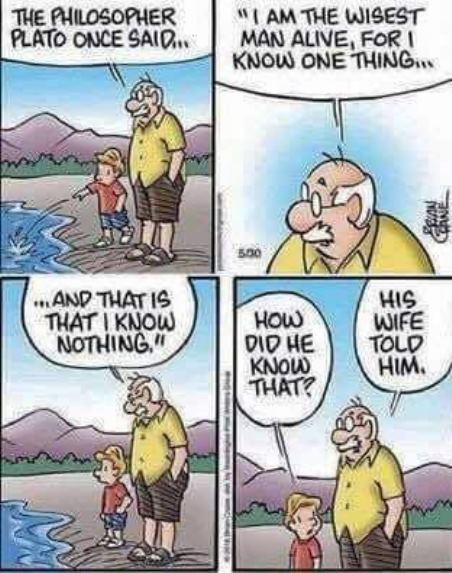

In Lighter Wyn |

|

|

Great thoughts |

|

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here. |

|

|

©2015 Moonstone. All rights reserved. |

| |