|

To Subscribe please click

here |

|

|

Investment Indicators - 19 February 2018 |

|

|

|

|

Paul Kruger

Author/Editor |

| |

|

|

| |

|

|

|

|

|

Never cut what you can untie – Joseph Joubert |

| |

|

|

Distributed to 50,055 subscribers.

To advertise with us

click here |

|

| |

|

What if you could focus on doing what you love - looking after your

clients?

Leading Independent Financial Advisory (IFA) practices are using GTC’s

Strategic Partner solution to:

- increase time with clients

- increase earnings

- reduce costs

Shouldn’t you too?

Our staff and systems deliver exceptional service, increasing revenues

and saving costs and time for you, enabling you to build value for

succession.

With offices nationally, we are well-placed to help you.

Call us to discuss a strategic partnership.

t. +27 (0) 10 597 6831

e. info@gtc.co.za

w. www.gtc.co.za

An authorised Financial Services Provider FSP no. 731 |

|

| Rates Review |

|

|

1. Secured Investment Rates |

|

Please note that (G) indicates a Guaranteed and (L) a Linked product. In order to understand the difference between guaranteed and linked rates,

kindly click here for an explanation. |

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Clientéle Life (L) |

6.750% |

7.000% |

|

2 |

1Life (L) |

6.680% |

6.900% |

|

3 |

Absa (L) |

6.514% |

6.775% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Clientéle Life (L) |

6.850% |

7.100% |

|

2 |

1Life (L) |

6.680% |

6.900% |

|

3 |

Assupol (G) |

6.620% |

6.900% |

|

|

|

|

|

|

2. Money Market Funds |

|

|

|

Please bear in mind that our figures, though based on the actual quotations that you also use, are for information purposes only,

and can never replace the official quotation from the product house. In terms of the guarantees, you are requested

to clarify the exact extent of such guarantees with the product house prior to advising clients. |

|

|

|

|

|

|

|

From the Crow's Nest |

|

|

Look beyond the price of group disability insurance |

Group disability insurance in South Africa is highly commoditised,

with decisions driven largely by price in many cases. While premiums

for this highly-valued employee benefit have increased over the last

two years, Regard Budler, Managing Executive: Momentum Corporate

Client Solutions, says that to unlock the real value of group

disability benefits, employers and their financial advisers need to

look beyond price.

Over the last few years many claimants are tending to stay on

disability longer, choosing the relative security of a generous

disability benefit over what they perceive as a less secure return

to work in a stagnating economy. More claims of longer duration

inevitably result in higher premiums.

However, Budler believes that in an environment of rising premiums,

the focus should not only be on price but rather on a holistic

approach to disability insurance. The changing nature of

disabilities and the role that prevention, early detection,

rehabilitation and reskilling plays in reducing the direct and

indirect costs of disability, for both employer and employee, should

be key considerations. Ultimately having a more appropriate solution

for your needs has more value than simply looking for a lower price

on something that you do not need.

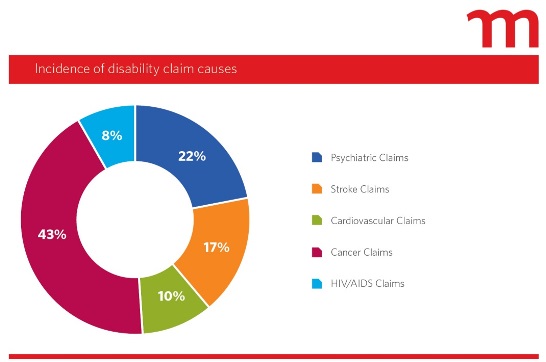

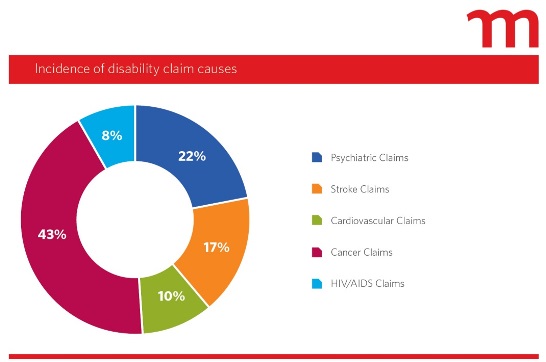

A report on global disability from the World Health Organisation and

World Bank highlights how non-communicable diseases (or chronic

diseases of lifestyle) are playing an increasingly more significant

role in disability claims. As depicted in the following graph, an

analysis of Momentum’s claims experience over the last five years

reflects this trend. Only 8% of claims were related to a

communicable disease (like HIV/AIDS). In contrast, 43% of disability

claims are still related to cancers.

Given the increasing impact of lifestyle choices on disability,

Budler believes engagement programmes that encourage healthy

lifestyles are an essential ‘preventative’ building block. These

programmes help to prevent the onset of chronic illness, which in

turn reduces the risk of a lifestyle related disability.

Early detection of health risks and timeous management also helps to

reduce the severity and impact of the disability. For example,

health assessments at workplace wellness days or occupational health

clinics can help identify individuals with serious health risks.

Rehabilitation is also key in minimising the negative impact on the

employer’s bottom-line. Insurers and employers need to work together

to aid rehabilitation, reskill if necessary, and facilitate

recovery. This paves the way for a successful return to work and

reduces the employer’s recruitment and skills replacement costs.

Budler says that the positive results of a close employer-insurer

partnership and proactive management are evident in Momentum’s

psychiatric-related claims. The South African insurance industry is

currently witnessing a sharp spike in psychiatric claims, largely

due to the increasing financial stress employees experience in the

current economic climate. However, thanks to early notification and

proactive management, Momentum psychiatric claims have remained

relatively stable, with only a small increase. This approach has a

significant impact on the amount and duration of the claim.

Intensive engagement with disability claimants has given Momentum

valuable insights into employees’ needs through the various stages

of disability. Budler says a holistic approach considers these needs

and focuses on keeping the employee’s financial wellness intact. For

example, many claimants need additional funds during the early

stages of disability to cover shortfalls between actual medical

costs and what their medical scheme covers. Rather than push already

indebted employees towards expensive loans, a cash assistance

benefit should be considered to cover these costs.

A more holistic approach also helps to identify areas of

insufficient provision. This could be the result of over-insurance

for certain benefits, such as disability, and underinsurance for

others, such as death and retirement. Reviewing the selection of

benefits will facilitate a more optimal balance, as funds can be

redirected towards areas of under provision.” Budler believes that

this is where the financial adviser’s role is pivotal. “Financial

advisers delve deep into employers and employees’ needs and use this

information, together with their expertise, to recommend a “best of

advice” solution. If the insurer offers flexibility in the right

areas, the financial adviser is able to bring this ‘’best advice

solution” to life.”

Budler concludes, “A focus on only the price of disability insurance

detracts from the real value it offers employers and employees. The

industry needs sustainable solutions that incorporate appropriate

pricing and a holistic benefit structure that adds value and is

dynamic enough to withstand economic challenges. A more holistic

approach focuses on the employee’s overall financial wellness,

encouraging choices that improve physical and financial health and

reduce the risk of disability.”

Click here to download a PDF version of this article to share

with your clients. |

|

|

|

|

|

|

|

|

|

Protect your partner with a fixed income retirement plan

If your client takes out a Discovery Fixed Retirement Income Plan with a

joint-life annuity option, and then they die, their partner will

continue to receive the 10% additional income for the first three years

or until the death of the second partner. This is in addition to the

quoted annuity income amount, before tax. For single-life annuities, the

10% additional income will stop after three years or when your client

dies.

Disclaimer

This article is meant only as information and should not be taken as

financial advice. For tailored financial advice, please contact your

financial adviser. Discovery Life Investment Services Pty (Ltd), branded

as Discovery Invest, is an authorised financial services provider.

Registration number 2007/005969/07..

|

|

| Your Practice Made Perfect |

|

|

Matthew Lester on VAT and the budget |

Prof Matthew Lester does not share the general consensus that an

increase in VAT is the least painful way of funding the budget

shortfall.

There seems to be a consensus that SA needs to find an extra R50 billion

if there is to be any hope of containing the national debt trajectory at

around 4% of GDP.

Up to R20 billion will fall on personal income tax, mainly by copping

out on fiscal drag adjustment. That will leave the bulk of the tax

increase on the middle working class of 5 million South Africans earning

less than R500 000 p.a. A bit more will come from the 1 million South

Africans who earn more than R500 000 p.a. and already pay 62% of PIT.

By Wednesday night PIT Collections will exceed 40% of total revenue. The

PIT tax base is now exhausted.

That leaves R30 billion to get. Perhaps R10 billion will come from

Fuel Levy (or VAT on fuel), sin taxes, estate duty and transfer

duty.

So that leaves R20 billion. ‘That’s easy,’ say the rafts full of

economists and commentators,‘ increase the VAT rate by 1%.’

But that makes an absolute farce of Hugh Masekela’s lines “I wanna be

there when they triumph over poverty…” Not that there’s too much wrong

with taxing the alcoholics, perhaps it will even help them too. But

despite our best efforts we cannot drink SA better. Even with Eish.

Click here to read the whole article

Breathe, Cyril, breathe. Please don’t increase VAT. There is another

way on Biznews. |

|

|

|

|

|

|

| |

|

Professional Principal Executive Officer Qualification: Last chance to

register

|

Registration is still open this week for candidates who want to enrol

for the first intake on 26 February 2018.

Moonstone Business School of Excellence (MBSE) is the only duly

accredited training provider to offer this NQF level 7 qualification

which equates to a bachelor’s degree.

The Professional Principal Executive Officer Qualification is the first

occupational qualification which provides recognition of competence in

learners who wish to formalise their education and experience with a

view to enhancing their career prospects. This includes trustees and a

wide variety of other employee benefits functionaries.

Registration and more information

You are welcome to speak to Frans Petrus Zeelie at 087 702 6429 who will

gladly assist.

To register,

click here,

select The Professional Principal Executive Officer

button.

To find out more about this NQF level 7 qualification, please

click here. |

|

|

|

| |

|

| |

|

Pre-Budget 2018

commentary by Mazars

|

TREASURY’S OPTIONS FOR RECOVERY ARE RUNNING OUT

Treasury will need to think outside the box this year if it is to make

any meaningful difference to its current revenue shortfall, estimated to

currently stand at around R50.8 billion. This is according to David

French, Tax Consulting Director at Mazars, who says that, ahead of the

2018 Budget Speech, Treasury’s options to raise revenue are becoming

increasingly limited.

“I believe that the Minister is very constrained this year in terms of

where he is going to find extra revenue. With the national election

looming, it is highly unlikely that Treasury will entertain any notion

of raising the Value Added Tax (VAT) rate. Even though it might still be

one of the most effective ways to substantially increase revenue, it

would certainly be very unpopular with the South African public.”

French also indicates that personal and corporate taxes may have already

been stretched as far as they can possibly go. “I believe that income

taxes in South Africa are close to the point where raising them may

actually become detrimental to Treasury’s revenue collection efforts. It

is probable that the Minister will once again take advantage of ‘bracket

creep’ – keeping income tax brackets at the same level and taking

advantage of the fact that most taxpayers fall into higher tax brackets

when they receive their yearly wage increases. I cannot see how Treasury

can reasonably do much more than this as far as personal income is

concerned”.

Click here to read the

full article. |

|

|

|

| |

|

|

Regulatory Examinations |

|

|

2018 Schedules updated |

Please note: Registration cut-off is 11 working days before date of exam.

|

|

|

|

| |

|

Regulatory Exam: Take note of

changes that will impact you |

Change is always inevitable. Not only will there be a change in

questions as a result of the new Determination of Fit and Proper

Requirements (BN 194 of 2017), but also an increase in fees as

recently announced by the FSB. It is therefore important to take

note of the implementation dates and to be prepared for it.

New requirements entail new questions:

The new Determination of Fit and Proper Requirements (BN 194 of

2017) come into effect on 1 April 2018.

The new Fit and Proper requirements will form part of the

regulatory exam question data bank from 1 April 2018.

This means that those who register to write after 29 March 2018

will have to study the new Determination of Fit and Proper

requirements as it appears at this stage that the updated study

material may not be available by 1 April 2018.

New fees:

The new fee of R1226.00 VAT Inclusive per examination apply to

all examinations registered for exam date 10 March 2018

and onwards – if the booking date is before 10 March 2018 and

the exam date is on or after 10 March 2018, the invoice will

reflect the new fee.

IMPORTANT: The standard cancelation clause will apply to

all registrations for the regulatory examinations. Candidates

who wish to re-schedule their examinations should take careful

cognisance of the FSB’s

cancelation clause.

We have limited stock of the current

LexisNexis preparation material available which will be made

available on a first come first served basis.

Contact details

Email enquiries should be addressed to

faisexam@moonstoneinfo.co.za. You can phone us on

021 883 8000 - select option 2 to speak to one of our

consultants. |

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 20 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 49000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

iInvestment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Short Term Insurance

Representative:

JFA Shortterm Insurance Brokers, Milnerton, Cape Town - If you have

at least 3 years of experience and preferably live in the vicinity of

the brokerage then

Read More

-

Client Service

Administrator:

Southwood Financial Planning, Tokai, Western Cape - An FPI approved,

professional practice, based in Tokai, is looking for a client service

administrator.

Read More

-

Experienced Short Term

Underwriter:

The Insurance Center, Westville, KZN - Vacancy for an experienced

short term commercial and domestic underwriter.

Read More

-

Jnr Compliance

Administrator:

Saxo Capital Markets (Pty) Ltd, Sandton - Seeking Jnr Compliance

Administrator to assist internal Head of Legal & Compliance in

conjunction with external Compliance Officer.

Read More

-

Compliance Research &

Developer:

Moonstone Compliance, Stellenbosch - The successful applicant will

work closely with the R&D Manager and will be registered as a compliance

officer under supervision with the FSB.

Read More

-

Senior Regulatory

Compliance Manager:

Clientèle Limited Group, Johannesburg - The successful incumbent

will be responsible for proactively and constructively assisting the

Clientèle Group in managing its responsibility to comply with all

relevant regulatory requirements and minimise compliance risks.

Read More

-

Commercial

Underwriter:

HIC Underwriting Managers, Bedfordview - Join our dynamic team if

you are Fais compliant with 120 credits and 5 years of experience.

Read More

|

|

|

|

|

In Lighter Wyn |

|

|

The wages of sins and taxes |

"It would be nice if we could all pay our taxes with a smile, but

normally cash is required." – Anonymous

"Taxes: One of life's two certainties, the only one for which you

can get an automatic extension." – Anonymous

"People who complain about taxes can be divided into two classes:

men and women."

– Anonymous

"Tax day is the day that ordinary Americans send their money to

Washington, D.C., and wealthy Americans send their money to the

Cayman Islands." – Jimmy Kimmel

"65% of people said that cheating on your income tax is worse than

cheating on your spouse. The other 35% were women." – Jay Leno

"There's nothing wrong with the younger generation that becoming

taxpayers won't cure."

– Dan Bennett

"The income tax has made more liars out of the American people than

golf has. Even when you make a tax form out on the level, you don't

know when it's through if you are a crook or a martyr." – Will

Rogers.

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here. |

|

|

©2015 Moonstone. All rights reserved. |

| |