|

To Subscribe please click

here |

|

|

Investment Indicators - 12 February 2018 |

|

|

|

|

Paul Kruger

Author/Editor |

| |

|

|

| |

|

|

|

|

|

Ability will never catch up with the demand for it – Malcom S Forbes |

| |

|

|

Distributed to 50,025 subscribers.

To advertise with us

click here |

|

| |

|

What if you could focus on doing what you love - looking after your

clients?

Leading Independent Financial Advisory (IFA) practices are using GTC’s

Strategic Partner solution to:

- increase time with clients

- increase earnings

- reduce costs

Shouldn’t you too?

Our staff and systems deliver exceptional service, increasing revenues

and saving costs and time for you, enabling you to build value for

succession.

With offices nationally, we are well-placed to help you.

Call us to discuss a strategic partnership.

t. +27 (0) 10 597 6831

e. info@gtc.co.za

w. www.gtc.co.za

An authorised Financial Services Provider FSP no. 731 |

|

| Rates Review |

|

|

1. Secured Investment Rates |

|

Please note that (G) indicates a Guaranteed and (L) a Linked product. In order to understand the difference between guaranteed and linked rates,

kindly click here for an explanation. |

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Clientéle Life (L) |

7.000% |

7.000% |

|

2 |

1Life (L) |

6.900% |

6.950% |

|

3 |

Absa (L) |

6.775% |

6.828% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Clientéle Life (L) |

7.100% |

7.100% |

|

2 |

1Life (L) |

6.900% |

6.950% |

|

2 |

Assupol (G) |

6.900% |

6.840% |

|

3 |

Absa (L) |

6.775% |

6.828% |

|

|

|

|

|

|

2. Money Market Funds |

|

|

|

Please bear in mind that our figures, though based on the actual quotations that you also use, are for information purposes only,

and can never replace the official quotation from the product house. In terms of the guarantees, you are requested

to clarify the exact extent of such guarantees with the product house prior to advising clients. |

|

|

|

|

|

|

|

From the Crow's Nest |

|

|

Your One-Stop Fit and Proper Solution |

The long awaited

announcement of the new Determination of Fit and Proper requirements

has certainly put the cat amongst the pigeons. A lot of businesses

need to re-schedule their planning in view of the content of this

important document.

Apart from redefining how honesty, integrity and good standing will

be gauged, it also formalised the replacement of what was termed the

Level 2 Regulatory Exams and Continuous Professional Development (CPD)

which was expected to kick in from around 2012/2013.

As the prominent provider of Level 1 REs, we were geared to assist

students down the road after completion of the Level 1 REs. When it

became clear that the originally envisaged format would not

materialise, we redeployed our resources towards what we expected to

happen, and which culminated in what is contained in Board Notice

194 of 2017.

What will the impact be?

The grandfathering clause for experienced advisers and exemption of

certain sections of the industry means that the Class of Business

(COB) Training requirement will focus more on new entrants and those

currently working under supervision.

Whereas CPD was in the past regarded as being on the backburner

after completion of the Level 2 REs, it has suddenly leapfrogged

into prominence, with an effective date of 1 June 2018.

This will very specifically impact on those people who benefitted

from the grandfathering provisions in terms of COB, as they will now

need to earn the required CPD points for the period starting

1 June 2018 and ending 31 May 2019.

What does Moonstone offer?

A lot more than just top class training, that’s for sure.

The F & P requirements determined 9 classes of business. Those who

are licenced for more than one class of business will have to attend

Class of Business training for each one.

At Moonstone we are also in the process of obtaining approval for a

whole range of CPD activities that will add relevant knowledge and

skills to your team, allowing you to plan intelligently to meet the

deadline requirements as per your specific business model.

But wait, that’s not all

Possibly the biggest challenge for most employers will be to keep

track of what is happening, and making sure that you plan ahead to

ensure deadlines, both in terms of COB and CPD. Moonstone is in the

final stages of field testing a “Fit and Proper Tracking Tool” to

empower our clients to stay on track as far as these requirements

are concerned, amidst so many other bureaucratic demands on time and

resources.

Watch this space

Please keep the above in mind when planning your approach to the

obligations contained in Board Notice 194. Moonstone may just

provide you with the best early Christmas present in 2018.

Click here for a more detailed

Powerpoint presentation on Class of Business training. |

|

|

|

|

|

|

|

|

|

Avoid uncertainty in retirement with a guaranteed annuity

A According to the Association for Savings and Investment South Africa (ASISA),

the average living annuity drawdown rate increased from 6.44% in 2015 to

6.62% in 2016. This highlights the impact on the sustainability and

longevity of retirement capital for retirees. The Discovery Invest Fixed

Income Retirement Plan offer increases clients’ retirement income by an

additional 10% for the first three years of their policy. This is in

addition to their quoted annuity income amount, and before tax.

This offer is only available for new investments taken out before

Saturday, 31 March 2018.

Discovery Life Investment Services Pty (Ltd): Registration number

2007/005969/07, branded as Discovery Invest, is an authorised financial

services provider.

|

|

|

|

|

| Your Practice Made Perfect |

|

Further Panel Beating to Debt Relief Bill likely

by Gerrit Viviers |

Following our article published on 7 December 2017, dealing with the

Draft National Credit Amendment Bill, 2018 (the Bill), the Portfolio

Committee on Trade and Industry held their public hearings on

30, 31 January and 2 February 2018, where various stakeholders within

the credit industry presented their submissions to the committee

members.

According to a media statement by the National Assembly’s Trade and

Industry Committee, “There was general agreement around the need

to address over-indebtedness and assist lower-income consumers to

escape debt traps. However, there were widely divergent positions

on how to achieve this. A number of key points were raised and largely

constructive recommendations made in this regard.”

Some of these “divergent positions” identified by the

stakeholders, included, among others that:

-

By amending section 3(g) relating to one of the purposes of the

National Credit Act, 34 of 2005 (“NCA”), which requires the NCA

“addressing and preventing over-indebtedness of consumers, and providing

mechanisms for resolving over-indebtedness based on the principle of

satisfaction by the consumer of all responsible financial obligations”

and by adding the sentence “where the consumer’s financial

situation so allows, or may so allow in the foreseeable future”

may likely result in consumers deliberately absconding from their

obligations to repay their loans, which is the cornerstone of a healthy

credit industry;

-

The proposed extinguishing of debt raises the concerns about the

constitutionality of the Bill in terms of the deprivation and

expropriation of property in terms of section 25 of the Constitution of

the Republic of South Africa, 108 of 1996 (the “Constitution”). A credit

agreement or the right to collect on credit is seen as ‘property’ for

this purpose and the Constitution specifically protect a property

owner’s rights to be protected against the deprivation thereof, except

in terms of the law of general application and that no law may permit

arbitrary deprivation of property. Deprivation can be loosely defined as

the “effect on a person’s property when the state uses their police

power to limit the use of that property, without compensation”. The

Constitution goes further to state that where the property is

expropriated in terms of the law of general application, it must be for

a public purpose or in the public interest and it is subject to

compensation. According to an article by Business Day, the Treasury

already indicated that it will seek the opinion of a Senior Counsel to

assess the constitutionality of the Bill in respect of the deprivation

of credit provider property.

-

Credit providers may not be in a position to assess whether a previous

credit agreement entered into with another credit provider, was reckless

in that they will have no knowledge of the other credit provider’s

application process and whether the consumer had a general understanding

of his or her rights and obligations under the proposed credit

agreement.

-

Insurers may decline to develop and offer the ‘mandatory credit life

insurance’ products envisaged by the Bill where the credit agreement

exceeds six months and the principal debt is R50 000 or less. This

credit life insurance may not be commercially viable, given the credit

life insurance regulations limitation of R4.50 per R1 000 for unsecured

debt, that may result in the targeted consumer group being excluded.

-

Consumers are already protected against the collection of prescribed

debt, where they can raise it as a defence in civil proceedings and

there was no need to criminalise these practices.

From the public hearings and the nature of the concerns raised by the

stakeholders, it is clear that the Bill requires some panel beating

before it can be promulgated into law. The legislator will need to find

a balance between protecting the rights of consumers and credit

providers alike, while still adhering to the protection afforded by the

Constitution.

Gerrit Viviers is Moonstone’s NCA Specialist who renders NCA

compliance services to its clients and prospective clients. Please

contact him on 021 883 8000 or by email to

gviviers@moonstonecompliance.co.za. |

|

|

|

|

|

|

| |

|

Professional Principal Executive Officer Qualification: Have you

registered?

|

Registration is still open this week for candidates who want to enrol

for the first intake on 26 February 2018.

Moonstone Business School of Excellence (MBSE) is the only duly

accredited training provider to offer this NQF level 7 qualification

which equates to a bachelor’s degree.

The Professional Principal Executive Officer Qualification is the first

occupational qualification which provides recognition of competence in

learners who wish to formalise their education and experience with a

view to enhancing their career prospects. This includes trustees and a

wide variety of other employee benefits functionaries.

Registration and more information

You are welcome to speak to Frans Petrus Zeelie at 087 702 6429 who will

gladly assist.

To register,

click here,

select the

Qualifications

button and click on The Professional Principal Executive Officer

button.

To find out more about this NQF level 7 qualification, please

click here. |

|

|

|

| |

|

|

Regulatory Examinations |

|

|

2018 Schedules updated |

Please note: Registration cut-off is 11 working days before date of exam.

|

|

|

|

| |

|

Regulatory Exam Preparation Material |

The new Determination of Fit and Proper Requirements (BN 194

of 2017) come into effect on 1 April 2018.

-

The new Fit and Proper requirements will form part of the

regulatory exam question data bank from 1 April 2018.

-

This means that those who register to write after

29 March 2018 will have to study the new Determination of Fit

and Proper requirements as it appears at this stage that the

updated study material may not be available by 1 April 2018.

-

IMPORTANT: The standard cancelation clause will apply

to all registrations for the regulatory examinations. Candidates

who wish to re-schedule their examinations should take careful

cognisance of the FSB’s cancelation clause.

We are expecting the last batch of the LexisNexis preparation

material this week. Please watch

this space to check whether we have received it yet, and to

order. We will also publish an update in Thursday’s Moonstone

Monitor.

Frequently Asked RE Questions

– Answers to questions on REs and preparation material

Email enquiries should be addressed to

faisexam@moonstoneinfo.co.za. You can phone us on

021 883 8000 - select option 2 to speak to one of our

consultants. |

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 20 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 49000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

iInvestment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Client Service

Administrator:

Southwood Financial Planning, Tokai, Western Cape - An FPI approved,

professional practice, based in Tokai, is looking for a client service

administrator.

Read More

-

Experienced Short Term

Underwriter:

The Insurance Center, Westville, KZN - Vacancy for an experienced

short term commercial and domestic underwriter.

Read More

-

Jnr Compliance

Administrator:

Saxo Capital Markets (Pty) Ltd, Sandton - Seeking Jnr Compliance

Administrator to assist internal Head of Legal & Compliance in

conjunction with external Compliance Officer.

Read More

-

Compliance Research &

Developer:

Moonstone Compliance, Stellenbosch - The successful applicant will

work closely with the R&D Manager and will be registered as a compliance

officer under supervision with the FSB.

Read More

-

Senior Regulatory

Compliance Manager:

Clientèle Limited Group, Johannesburg - The successful incumbent

will be responsible for proactively and constructively assisting the

Clientèle Group in managing its responsibility to comply with all

relevant regulatory requirements and minimise compliance risks.

Read More

-

Commercial

Underwriter:

HIC Underwriting Managers, Bedfordview - Join our dynamic team if

you are Fais compliant with 120 credits and 5 years of experience.

Read More

-

Insurance Field Sales

Reps:

Quantum Invest, Nationwide - We are looking for field Reps

nationwide. RE5 qualification is recommended. We offer a

competitive commission structure.

Read More

|

|

|

|

|

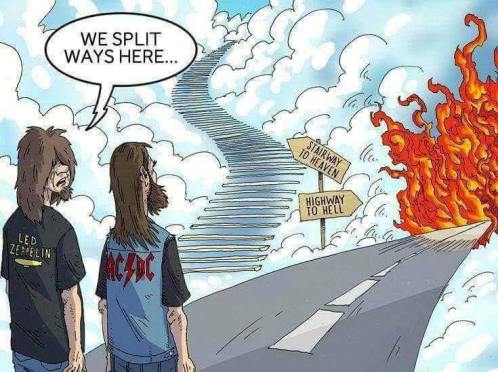

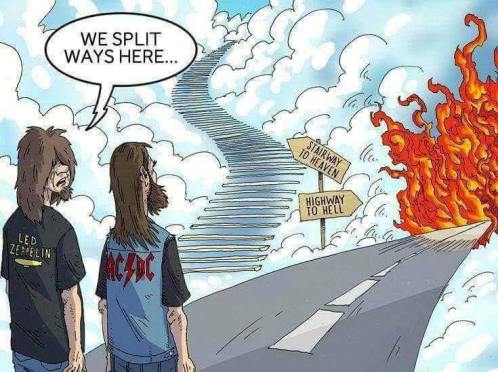

In Lighter Wyn |

|

|

It's dry, very dry... |

|

Hobson's Choice?

Caught in the Act

Droë

Humor

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here. |

|

|

©2015 Moonstone. All rights reserved. |

| |