|

To Subscribe please click

here |

|

|

Investment Indicators - 8 January 2018 |

|

|

|

|

Paul Kruger

Author/Editor |

| |

|

|

| |

|

|

|

|

|

It is never too late to be what you might have been – George Eliot |

| |

|

|

Distributed to 49,030 subscribers.

To advertise with us

click here |

|

| |

.jpg) |

What if you could focus on doing what you love - looking after your

clients?

Leading Independent Financial Advisory (IFA) practices are using GTC’s

Strategic Partner solution to:

- increase time with clients

- increase earnings

- reduce costs

Shouldn’t you too?

Our staff and systems deliver exceptional service, increasing revenues

and saving costs and time for you, enabling you to build value for

succession.

With offices nationally, we are well-placed to help you.

Call us to discuss a strategic partnership.

t. +27 (0) 10 597 6831

e. info@gtc.co.za

w. www.gtc.co.za

An authorised Financial Services Provider FSP no. 731 |

|

| Rates Review |

|

|

1. Secured Investment Rates |

|

Please note that (G) indicates a Guaranteed and (L) a Linked product. In order to understand the difference between guaranteed and linked rates,

kindly click here for an explanation. |

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Clientéle Life (L) |

6.900% |

7.450% |

|

2 |

1Life (L) |

6.820% |

7.540% |

|

3 |

Absa (L) |

6.686% |

7.443% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Clientéle Life (L) |

7.000% |

7.550% |

|

2 |

Momentum (G) |

6.990% |

7.230% |

|

3 |

1Life (L) |

6.820% |

7.540% |

|

|

|

|

|

|

2. Money Market Funds |

|

|

|

Please bear in mind that our figures, though based on the actual quotations that you also use, are for information purposes only,

and can never replace the official quotation from the product house. In terms of the guarantees, you are requested

to clarify the exact extent of such guarantees with the product house prior to advising clients. |

|

|

|

|

|

|

|

From the Crow's Nest |

|

|

Final Insurance Conduct Regulations and Policyholder

Protection Rules |

We have become used to the publication of important regulatory changes

on and after 15 December each year, but 2017 set a new “record”

which will be hard to beat.

We will be sharing this information in small dosages so as not to

scare you out of the industry with a leg(th)al overdose.

The draft Insurance Conduct Regulations and PPRs were tabled in

Parliament on 2 November 2017. The period for Parliamentary review

ended on 2 December 2017, and the final Regulations and Rules were

published on 15 December 2017.

The Regulations and PPRs aim to deliver better customer outcomes

across the financial sector and improve market conduct in the

insurance industry by ensuring that appropriate products are

provided to consumers.

The proposed reforms also address conduct of business risks and

abuses that were identified through supervision. A more detailed

review of the Regulations will form part of the broader review of

all conduct of business legislative frameworks across the various

sectors regulated by the future Financial Sector Conduct Authority

as part of the Twin Peaks reforms.

Background to the Regulations and PPRs

The conduct of business reforms that will be given effect through

the Regulations and PPRs relate to –

-

Phase 1 of the 2014 Retail Distribution Review ("RDR") which

proposes a number of improvements to how financial products are

distributed and sold, including principles for remuneration of

intermediaries to address conflicts of interest (especially those

relating to advisors representing both insurers and the consumer),

ensuring that insurers who outsource critical functions remain

ultimately responsible for those functions, and curbing poor advice

and intermediary practices.

-

Improvements to the requirements for binder agreements in support

of the RDR which limit who may enter into a binder agreement, what

sort of activity may be outsourced and what remuneration may be paid

in a binder agreement, so as to address conflicts of interest.

-

Addressing identified concerns with respect to consumer abuses in

the consumer credit insurance market. The amended Regulations and

PPRs introduce alignment with planned dti Regulations dealing with

caps on mandatory credit life premiums, as well as introducing a

range of principles and requirements on fair treatment of

policyholders that also apply to consumer credit insurance products.

-

Improving policyholder protection in the Ombud system by

compelling the insurer to display Ombud information to

policyholders, keeping records of complaints and requiring

cooperation with the insurance Ombuds.

-

The introduction of requirements for claims management procedures,

monitoring and analysis of complaints and the reporting of

complaints information to the regulator and Ombuds.

-

Regulations on Advertising, Brochures and Similar designed to

ensure fair and not-misleading communication with potential

policyholders.

-

Appropriate minimum requirements for claims management.

-

Additional steps to ensure protection for policyholders, including

principles to inform premiums and premium reviews, minimum data

governance requirements and negative option marketing.

-

Alignment with international standards in terms of the

International Association of Insurance Supervisor’s Insurance Core

Principles.

-

Alignment, in certain respects, with the Financial Advisory and

Intermediary Services Act, 2002.

-

Closing regulatory gaps and effecting technical improvements to

clarify the intent and purpose of certain provisions.

The Regulations also introduce changes to the maximum causal event

charges that apply to legacy contractual savings policies (entered

into before January 2009) in the life insurance sector. The

Regulations provide for the progressive reduction over time of the

maximum penalty that can be charged when a legacy policy is lapsed,

surrendered, transferred or the premium reduced.

Implementation timelines

The Regulations and PPRs will take effect from 1 January 2018 with

transitional provisions provided for certain sections.

All the documents are available on the National Treasury’s website

at

www.treasury.gov.za and the Financial Services Board’s website at

www.fsb.co.za. |

|

|

|

|

|

|

|

|

Fixed annuities protect you against volatility

A guaranteed or fixed income annuity offers clients protection against

the risks of longevity and volatile investment returns. As Discovery

Invest marks its 10th birthday, Discovery clients can

actively maximise their retirement income by taking out a Fixed

Retirement Income Plan with an additional 10% income for the first three

years. This offer is available until 31 March 2018. The 10% is an

addition to the annuity income amount, after allowing for annual

escalations and before deducting tax. After three years, the annuity

income will return to the quoted income annuity amount before deducting

tax.

Nothing contained herein should be construed as financial advice and

is meant for information purposes only.

Discovery Life Investment Services (Pty) Ltd branded as Discovery Invest

is an authorised financial services provider. Registration number

2007/005969/07.

Product Rules and Terms and Conditions Apply.

|

|

| Your Practice Made Perfect |

|

|

Update on legislative changes in 2018 |

The Insurance Conduct Workshops held in Pretoria and Cape Town in

December 2017 were very informative and provided a good update of the

current and future regulatory landscape. Those unable to attend are

advised to study the presentations published on the FSB website.

Below are some proposed implementation timelines, but this is dependent

on what happens in Parliament.

-

Financial Sector Conduct Authority: The move from FSB to the new FSCA

is envisaged to be effective from April 2018.

-

The Insurance Bill was passed by the National Assembly with a planned

effective date of July 2018.

-

The Conduct of Financial Institutions Bill will be published early in

2018 for comment with a view to tabling it in Parliament in the 2nd half

of 2018.

-

Tranche 1 PPR amendments and Tranche 1 Insurance Regulations

amendments were published on 15 December 2017 and became effective on 1 January 2018.

-

The planned effective date for Equivalence of Reward is 1 January 2018.

-

The Third Party Cell Captive Insurance Position Paper was scheduled

for 15 December 2017.

-

Publication of a comment document on Adviser Categorisation and the

“Two Tiers” product distinction is expected early in 2018.

-

A report on a Short-term Insurance Intermediary Activity Analysis is

expected early in 2018.

-

Comments on Additional PPR and Insurance Regulations amendments in

respect of Tranche 2 are expected to be called for in April 2018 with a

possible effective date in July 2018.

Some of these amendments will have transitional periods but we will only

be able to advise on this once the final versions are published.

I am no weather forecaster, but expect a turbulent year ahead. |

|

|

|

|

|

|

| |

|

Municipal Councillors Pension Fund under Curatorship

|

The FSB published the following media release on 20 December:

On 19 December 2017, the Pretoria High Court granted an application

brought by the Registrar of Pension Funds in terms of section 5(1) of

the Financial Institutions (Protection of Funds) Act, 2001 for the

appointment of curators to the Municipal Councillors Pension Fund.

The

court appointed Mr Juanito Martin Damons and Ms Sophie Thabang Kekana as

the joint curators of the Municipal Councillors Pension Fund.

The application was brought pursuant to an inspection report as well as

reports by the section 26(2) board to the Registrar, which several

serious irregularities pertaining to poor investment decisions and lack

of governance in the fund were reported. The curatorship is intended to

stabilise the management and operation of the fund, and to protect the

interests of its members.

The curators are experienced lawyers, who are well placed to fulfil the

duties required of them as curators and to ensure that all necessary

steps are taken to protect the interests of the fund and its members.

The curators have assumed office and their reports will be uploaded on

the FSB website

https://www.fsb.co.za/Pages/CuratorReports.aspx as they

become available. |

|

|

|

| |

|

|

Regulatory Examinations |

|

|

2018 Schedules updated |

Please note: Registration cut-off is 11 working days before date of exam.

|

|

|

|

| |

|

Self-Help Guidelines to make a

booking, download your certificate or view results |

Candidates who wrote with Moonstone can now view their results,

make a new booking or update their information on our website:

www.faisexam.co.za

Here is what you do:

-

Click on the

Moonstone FAIS Exam website (www.faisexam.co.za)

-

Click on the

second heading: “Update Your Booking/Personal Details/Get

results”.

-

Key in your ID or

Passport Number used to register for the exam: click on Send

password.

-

The system will

send a password to the e-mail address you provided at

registration.

-

Use this password

to log in on the same address as above:

Type in the password – do not copy and paste.

-

Click login.

-

You will then be able to make a booking, download your

certificate or view results.

Frequently Asked RE Questions

– Answers to questions on REs and preparation material

DOFA - Do's and Don'ts

Email enquiries should be addressed to

faisexam@moonstoneinfo.co.za. You can phone us on

021 883 8000 - select option 2 to speak to one of our

consultants. |

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 15 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 49000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

iInvestment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Short Term Insurance

Underwriter:

Milnerton, Cape Town - The minimum experience being 3 years,

preferably living in the vicinity of the brokerage and with the

following minimum requirements:

Read More

|

|

|

|

|

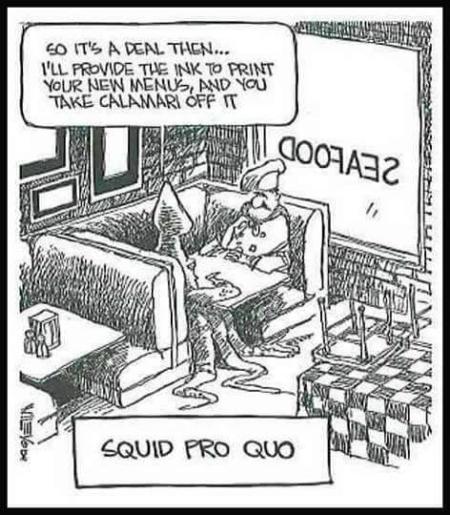

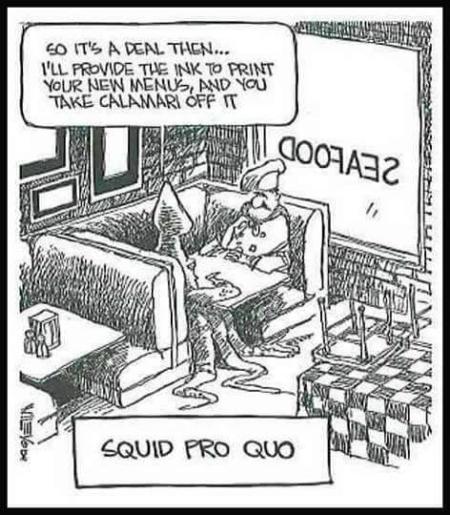

In Lighter Wyn |

|

|

New year's deal and educational licence holder for 2018 |

|

Holiday deal

Licence Holder for 2018

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here. |

|

|

©2015 Moonstone. All rights reserved. |

| |

.jpg)