|

To Subscribe please click

here |

|

|

Investment Indicators - 11 December 2017 |

|

|

|

|

|

|

Paul Kruger

Author/Editor |

| |

|

|

| |

|

|

|

|

The excellence of a gift lies in its appropriateness rather than in its

value

– Charles Dudley Warner |

| |

|

|

Distributed to 49,121 subscribers.

To advertise with us

click here |

|

| |

.jpg) |

What if you could focus on doing what you love - looking after your

clients?

Leading Independent Financial Advisory (IFA) practices are using GTC’s

Strategic Partner solution to:

- increase time with clients

- increase earnings

- reduce costs

Shouldn’t you too?

Our staff and systems deliver exceptional service, increasing revenues

and saving costs and time for you, enabling you to build value for

succession.

With offices nationally, we are well-placed to help you.

Call us to discuss a strategic partnership.

t. +27 (0) 10 597 6831

e. info@gtc.co.za

w. www.gtc.co.za

An authorised Financial Services Provider FSP no. 731 |

|

| Rates Review |

|

|

1. Secured Investment Rates |

|

Please note that (G) indicates a Guaranteed and (L) a Linked product. In order to understand the difference between guaranteed and linked rates,

kindly click here for an explanation. |

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

1Life (L) |

7.540% |

7.540% |

|

2 |

Clientéle Life (L) |

7.450% |

7.250% |

|

3 |

Absa (L) |

7.443% |

7.448% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Clientéle Life (L) |

7.550% |

7.350% |

|

2 |

1Life (L) |

7.540% |

7.540% |

|

3 |

Assupol (G) |

7.480% |

7.470% |

|

|

|

|

|

|

2. Money Market Funds |

|

|

|

Please bear in mind that our figures, though based on the actual quotations that you also use, are for information purposes only,

and can never replace the official quotation from the product house. In terms of the guarantees, you are requested

to clarify the exact extent of such guarantees with the product house prior to advising clients. |

|

|

|

|

|

|

|

From the Crow's Nest |

|

|

Compliance is an ongoing requirement |

The importance of having systems in place to ensure compliance was

illustrated this week in a notice from the FSB Enforcement

Committee.

Rule 5.1(a)(i) of the PPR Rules require that a registered entity

should only do business with duly authorised FSPs. This should not

only be ascertained at the contract stage, but on a continuous

basis.

Below is an extract from the FSB notice on a case which illustrates

what can happen if you don’t.

On 28 October 2010, AVBOB entered into an intermediary agreement

with Mr T Nyadombo in respect of which Mr Nyadombo undertook to

render services as intermediary in respect of, inter alia, a savings

product that was underwritten by AVBOB.

On 10 December 2014 Mr Nyadombo’s authorization to render services

as an intermediary in respect of certain financial products, which

included savings products, was withdrawn by the FSB.

From 11 December 2014 until April 2016 Mr Nyadombo continued to

render services as intermediary for and on behalf of AVBOB with

regard to the savings product that was underwritten by AVBOB, whilst

he was not authorised to render financial services in respect of

this product. AVBOB therefore contravened Rule 5.1(a)(i) of the PPR

Rules.

As aggravating factors the Registrar considered, amongst other

factors, that AVBOB failed to demonstrate sound insurance principles

and practice in the interests of the policyholders and that AVBOB

was not aware of the license changes on Mr Nyadombo’s FSP license

until the contravention was brought to its attention by the staff of

the Registrar’s office. In mitigation the Registrar took into

account, amongst other factors, that AVBOB accepted responsibility

for the contravention, co-operated with the Registrar’s

investigation and the subsequent enforcement action, and undertook

to implement measures to prevent similar contraventions from

recurring.

Consequently, the Registrar agreed to a penalty of R100 000, which

penalty was imposed by the Enforcement Committee on AVBOB on 1 December 2017.

The report does not state whether action was also taken against Mr

Nyadombo for submitting business whilst not authorised to do so. |

|

|

|

|

|

|

|

|

Discovery Invest fixed annuity offer

Discovery Invest is commemorating its first decade with a Fixed

Retirement Income Plan that offers an additional 10% income for the

first three years. The offer is only valid until 31 March 2018. The 10%

is an addition to the annuity income amount, after allowing for annual

escalations and before deducting tax.

-

Single-life annuities: the additional income stops after three years,

or on death (if within the first three years).

-

Joint-life annuities: the additional income will only be applied to

the current amount in payment and stops after three years, or if both

annuitants die within the first three years.

Nothing contained herein should be construed as financial advice and

is meant for information purposes only.

Discovery Life Investment Services (Pty) Ltd branded as Discovery Invest

is an authorised financial services provider. Registration number

2007/005969/07.

Product Rules and Terms and Conditions Apply.

|

|

| Your Practice Made Perfect |

|

|

Regulatory Examinations Pass Mark |

A candidate recently wrote to protest against what she considers to be

the very high pass mark for the regulatory exams compared to others in

the industry, and suggested it be lowered to 50%. The FSB responded as

follows:

Firstly, it is important to understand the purpose of the examinations.

The examinations were introduced because key individuals and

representatives did not have the required knowledge and understanding of

the legislation required to protect consumers. From the time that the

examinations were introduced in 2010 to date, the FSB has seen a

significant improvement in the compliance of FSPs, key individuals and

representatives with the relevant FAIS Act and the sub-ordinate

legislation – which clearly shows that if people know better, they do

better.

The examinations are therefore achieving the desired outcome – if there

is better compliance with the legislation then there will also be better

outcomes for consumers.

Our research has shown that people failing the regulatory examinations,

in most instances, are not preparing correctly for the examinations.

Most people don’t even know what they will be tested on in the

examination, despite the FSB making a roadmap available that clearly

shows what information the questions in the exam will test. Therefore,

the content of what you will be tested on is clearly mapped out. There

are no other examinations in any other institution (for example a

university) where you will be told exactly what questions to expect in

your exam.

If you prepare in accordance with the roadmap provided, and you make

sure that you study the relevant information (which is also provided in

a separate training manual developed by INSETA) then you should not have

any problem passing the exam. The difficulty level of the exam is at a

Grade 12 / NQF 4 level.

The original pass mark was 70%, which was subsequently reduced to

65/66%. Please remember that this is a professional exam.

The purpose of the FAIS legislation is to protect consumers against

persons giving them poor financial advice. Thus, if a representative

only has 40% of the knowledge required to ensure that he/she performs

her legal duties in accordance with the FAIS Act, then he/she is not

properly equipped to render financial services.

Please also note that the examination bodies operate under very strict

service level agreements with the FSB. They make the rules, and we apply

them strictly in accordance with their instructions. |

|

|

|

|

|

|

| |

|

Proposed closure of Pension Funds

|

The Registrar of Pension Funds published Notice 4 of 2017 which gave

notice of its intention to cancel a substantial number of funds in

response to applications from fund administrators.

Any person aggrieved by the intended cancellation is invited to submit

objections to the proposed cancellation.

The original deadline for submission of objections was extended to 28 February 2018.

The list of proposed funds can be viewed

here.

Readers may remember that the FSB also developed an

Unclaimed Retirement

Benefit Search Engine which is more than handy for anyone wishing to

make sure they are not inadvertently affected negatively by the

cancellation of a pension fund.

If you or your clients want to check whether you are affected, or can

uncover an unexpected Christmas present, be my guest. We do not charge

tracing fees. |

|

|

|

| |

|

|

Regulatory Examinations |

|

|

2018 Schedules updated |

Please note: Registration cut-off is 11 working days before date of exam.

|

|

|

|

| |

|

Self-Help Guidelines to make a

booking, download your certificate or view results |

Candidates who wrote with Moonstone can now view their results,

make a new booking or update their information on our website:

www.faisexam.co.za

Here is what you do:

-

Click on the

Moonstone FAIS Exam website (www.faisexam.co.za)

-

Click on the

second heading: “Update Your Booking/Personal Details/Get

results”.

-

Key in your ID or

Passport Number used to register for the exam: click on Send

password.

-

The system will

send a password to the e-mail address you provided at

registration.

-

Use this password

to log in on the same address as above:

Type in the password – do not copy and paste.

-

Click login.

-

You will then be able to make a booking, download your

certificate or view results.

Frequently Asked RE Questions

– Answers to questions on REs and preparation material

DOFA - Do's and Don'ts

Email enquiries should be addressed to

faisexam@moonstoneinfo.co.za. You can phone us on

021 883 8000 - select option 2 to speak to one of our

consultants. |

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 15 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 49000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

iInvestment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Junior Short Term

Underwriter:

JFA Short Term Brokers, Milnerton - We require a bilingual

underwriter with RE5 and NQF 4 qualification.

Read More

-

Personal Assistant and

Administrator of investments, life insurance and Medical Aids:

Vesto Capital, Moorreesburg - We are looking for a qualified,

experienced and well groomed lady to commence employment on 8 January

2018.

Read More

-

Short Term Claims

Administrator:

The Insurance Center, Westville, Durban - The successful applicant

must be experienced, work unsupervised and be competent to negotiate

claims settlements at the highest level.

Read More

-

Financial Sales Consultant:

Quest Staffing Solutions, Cape Town - You will provide qualified financial advice directly to clients and

therefore a minimum of 6 months Outbound Call Centre sales experiences or 12

months face to face financial sales, with a RE qualification will be required.

Read More

-

Group Compliance

Practitioner:

LegalWise, Gauteng - You will play a key role in assisting the Group

Compliance Manager to enhance and maintain the compliance strategies and

processes, as well as a culture of ethics and compliance, across the

Group.

Read More

|

|

|

|

|

In Lighter Wyn |

|

|

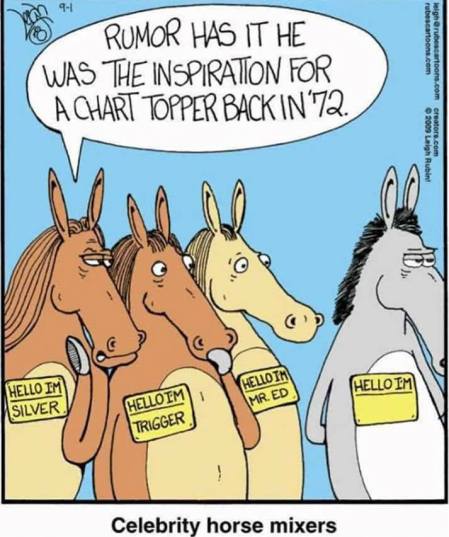

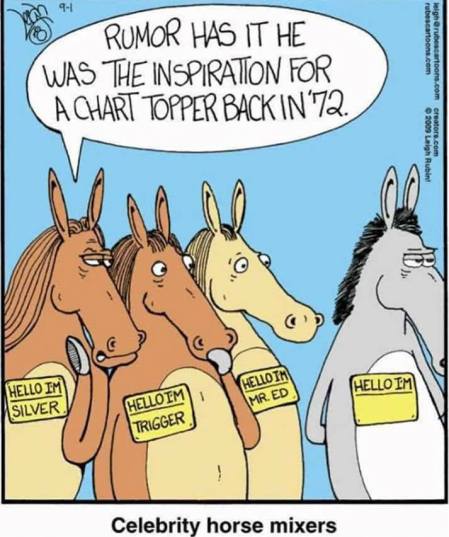

Memory test for old toppies and new word |

|

One for the old toppies

Can you guess the name of the song? Here’s a clue: The band’s name

was America. Call Doctor Google. We’ll publish the answer in

Wednesday’s Moonstone Monitor in the unlikely event that you do not

get it.

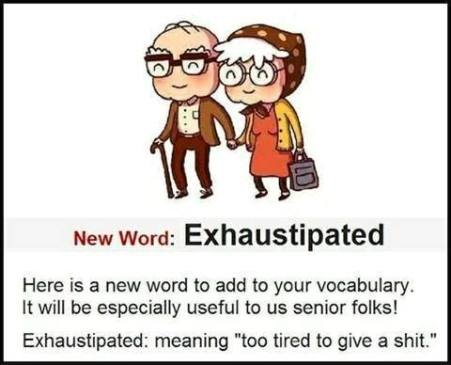

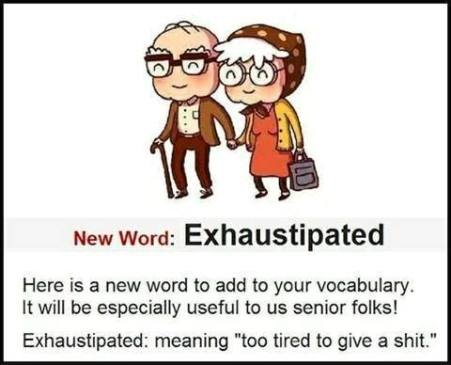

And, finally, this word sums up how most of us feel:

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here. |

|

|

©2015 Moonstone. All rights reserved. |

| |

.jpg)