|

To Subscribe please click

here |

|

|

Investment Indicators - 19 June 2017 |

|

|

|

|

Paul Kruger

Author/Editor |

| |

|

|

| |

|

|

|

|

|

Youth is the gift of nature, but age is a work of art - Stanislaw Jerzy

Lec |

| |

|

|

Distributed to 46 837 subscribers.

To advertise with us

click here |

|

| |

|

|

|

What if you could focus on doing what you love - looking after your

clients? |

Leading Independent Financial Advisory (IFA) practices are using GTC’s

Strategic Partner solution to:

- increase time with clients

- increase earnings

- reduce costs

Shouldn’t you too?

Our staff and systems deliver exceptional service, increasing revenues

and saving costs and time for you, enabling you to build value for

succession.

With offices nationally, we are well-placed to help you.

Call us to discuss a strategic partnership.

t. +27 (0) 10 597 6858

e. info@gtc.co.za

w. www.gtc.co.za

An authorised Financial Services Provider FSP no. 731. |

|

| Rates Review |

|

|

1. Secured Investment Rates |

|

Please note that (G) indicates a Guaranteed and (L) a Linked product. In order to understand the difference between guaranteed and linked rates,

kindly click here for an explanation. |

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Absa (L) |

6.449% |

6.481% |

|

2 |

Assupol (G) |

6.140% |

6.290% |

|

3 |

Discovery (G) |

5.730% |

5.756% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Assupol (G) |

6.570% |

6.720% |

|

2 |

Absa (L) |

6.449% |

6.481% |

|

3 |

Old Mutual Wealth (L) |

6.330% |

6.400% |

|

|

|

|

|

|

2. Money Market Funds |

|

|

|

Please bear in mind that our figures, though based on the actual quotations that you also use, are for information purposes only,

and can never replace the official quotation from the product house. In terms of the guarantees, you are requested

to clarify the exact extent of such guarantees with the product house prior to advising clients. |

|

|

|

|

|

|

|

From the Crow's Nest |

|

|

R E and Qualifications Fraud |

In a holding statement published on Thursday, 15 June, the Financial

Planning Institute (FPI) responded as follows to a media release by

the FSB:

Falsification of Regulatory Examination Results and Issuance of

Fraudulent Certificates

On behalf of Godfrey Nti, Chief Executive Officer, Financial

Planning Institute (FPI)

“Following the announcement made yesterday, by the Financial

Services Board (FSB), on the high increase of debarment cases in the

last year due the qualification and examination fraud which was

discovered by the Financial Planning Institute (FPI). The

investigation, initiated by the Institute in 2013 and concluded in

2014, uncovered evidence of collusion and falsification against 120

examinations and/or qualification records.

Based on the findings, FPI terminated the employment of the three

employees involved in the scheme. It also reported the matter to the

Financial Services Board (FSB), Insurance SETA (INSETA) and South

African Police Service (SAPS) Commercial Crimes for further

investigation and criminal prosecution against the perpetrators.

Even though none of the suspected examination candidates are members

of FPI, the Institute has a zero tolerance for any act of fraud,

given the high standards that FPI expects of all financial advisors

in the industry. Since the investigation files were handed over, FPI

has cooperated fully with FSB and SAPS to help further their

respective investigations. FPI will continue doing so until criminal

and administrative action has been taken against all the suspected

candidates and ex-employees.

FPI is committed to the highest ethical standards. Its internal

security measures, systems and processes have since been carefully

re-examined and additional security protocols have been implemented

to ensure that this situation never repeats itself.”

FSB Media Statement

On 14 June 2017, the FSB released a media statement titled,

“Regulatory Examination and Wealth Management Qualification Fraud".

“The industry will have seen an increase in the number of debarments

cases over the last year. The main reason for this increase is that

qualification and examination fraud was discovered by the Financial

Planning Institute of Southern Africa (FPI) which has required the

FSB to take action against a large number of individuals.

The fraud case found that specific FPI employees and a number of

candidates were involved in a dishonest scheme that resulted in the

falsification of their examination and/or qualification results and

the issuance of fraudulent certificates.

An initial investigation was conducted by the FPI and criminal

charges were laid against the implicated FPI employees. The FSB was

informed of the matter in 2014 and launched an inspection to gather

evidence against 120 representatives and Key Individuals who had

allegedly benefitted from the fraud. Debarment action commenced in

2015 and is ongoing with at least 60 cases still underway.

The FSB also conducted an audit of the FPI Examination Body’s

internal security measures, systems and processes. Following the

audit, the FSB recommended additional security protocols to ensure

that a similar situation does not arise in the future -

recommendations that the FPI has adopted and implemented.

The FSB continues to work closely with the recognised examination

bodies, to ensure that all security measures are fully functional at

all times. The FSB sees the regulatory examinations and the

authenticity of qualifications as a critical component of the

competency requirements for financial services providers, and as

such the integrity of the examinations and qualifications must be

protected at all times.”

Appeal Board Decision

We recently reported on a case where an appellant felt that a

debarment period of three years was excessive after he was found

guilty of having paid a former employee of an examination authority

an amount of R1 000 in return for a pass result for the RE1 and RE5

examinations after having failed repeatedly.

The Appeal Board, in its decision, felt that the sentence could have

been harsher.

Click here to read the

Moonstone article. |

|

|

|

|

|

|

|

|

|

FPI Professionals Convention 2017 – Why you need to

attend? |

Whether your career is on the fast track to the top or stuck in a rut,

the international 2017 FPI Professionals Convention, to be held in Cape

Town from 19-20 October, is the place to be this October to get inspired

and forge your own path toward being the professional financial planner

you want to be.

The FPI Professionals Convention, themed “Lead |Inspire| Build

Trust”, has a proud history of hosting the best local and

international speakers on topics that add value to professional

financial planners and advisors, and the customers we serve.

Join us in Cape Town by booking your seat now or to

register visit

www.fpiconvention.co.za. |

|

| Your Practice Made Perfect |

|

|

Minister signs FIC Amendments |

On 15 June 2017, the Minister of Finance announced the coming into

operation of a number of provisions of the Financial Intelligence Centre

Amendment Act, 2017 (the FIC Amendment Act). There are two important

dates for affected parties to note:

13 June 2017

The first set of provisions commenced on this date. These provisions do

not require changes to existing regulations, exemptions or internal

systems of institutions to enable compliance with the FIC Act. The

provisions deal mainly with information sharing, consultation

arrangements, constitutional concerns relating to inspection powers, and

improved functioning of the FIC Act Appeal Board.

2 October 2017

The second set of provisions will commence on this date. It will give

effect to new concepts and approaches, will require changes to existing

regulations and exemptions under the FIC Act, as well as staff training

and major changes to systems by supervisors, the Office of the Chief

Procurement Officer, and accountable institutions.

Draft Guidance Note

A Draft Guidance Note was developed jointly by the FIC, SA Reserve Bank,

Financial Services Board and National Treasury and released on Thursday.

A further document titled “A new approach to combat money laundering and

terrorist financing” was also released last week for public comment on

how best to implement the new measures.

Consultations

The FIC appreciates the need for a transitional to achieve full

compliance with the FIC Amendment Act after law takes effect. The

relevant supervisory bodies will continue regular engagement with the

relevant industries to determine a timetable for full compliance, and

monitor progress on such compliance.

A document titled

FIC Act Commencement 14 June 2017 contains details of what the

changes entail, as well as links to the related documents.

A document titled

Notice for publication of draft guidance contains links to the draft

guidance note, further consultation documents and the online response

form.

Happy reading, if you do not have someone to do it for you. It is a

daunting prospect. |

|

|

|

| |

|

| |

|

Compulsory Compliance Data Update

|

Compliance officers and compliance practices were requested to update

their information with the FS’s Registration Department. The response

was poor, with many letters being returned due to outdated contact

details.

Details must be confirmed by accurately completing the

Confirmation of CO details document and submitting it to

Fais.COapprovals@fsb.co.za.

If no confirmation is received by 30 June 2017, the compliance officers

and/or compliance practices will be viewed as dormant and removed from

the register. Access to the on-line portal will also be suspended.

Enquiries in this regard should also be submitted to the inbox published

above. |

|

|

|

| |

|

|

Regulatory Examinations |

|

|

2017 Schedule updated |

|

Our venues are filling up fast as we approach 30 June 2017.

Candidates who are obliged to write and pass by the end of June

must please register in time.

|

|

|

|

| |

|

Self-Help Guidelines to make a

booking, download your certificate or view results |

Candidates who wrote with Moonstone can now view their results,

make a new booking or update their information on our website:

www.faisexam.co.za

Here is what you do:

-

Click on the

Moonstone FAIS Exam website (www.faisexam.co.za)

-

Click on the

second heading: “Update Your Booking/Personal Details/Get

results”.

-

Key in your ID or

Passport Number used to register for the exam: click on Send

password.

-

The system will

send a password to the e-mail address you provided at

registration.

-

Use this password

to log in on the same address as above:

Type in the password – do not copy and paste.

-

Click login.

-

You will then be able to make a booking, download your

certificate or view results.

Frequently Asked RE Questions

Email enquiries should be addressed to

faisexam@moonstoneinfo.co.za. You can phone us on

021 883 8000 - select option 2 to speak to one of our

consultants. |

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 15 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 46000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

iInvestment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

Life Insurance

Compliance Officer:

Bidvest Life Insurance, Umhlanga - If you have a minimum of 3 years

experience in the life insurance industry and Compliance Officer

experience, then

Read More

-

Financial Planners:

Risk Free Solutions, Port Elizabeth & Kimberley - We are looking for

established, well balanced Financial Planners striving for financial

freedom. If you have matric, your own transport, driver’s licence and RE

qualificaton, then

Read More

-

Short Term Insurance

Underwriter:

The Insurance Centre, Westville - We require a commercial and

personal lines short term insurance underwriter / administrator.

Read More

|

|

|

|

|

In Lighter Wyn |

|

|

Daa’s mos net een plekkie… |

Round three of our “Weskus Wysheid” series. This one from from Roche

Cowley:

Polisie: “Klop klop.”

Aubrey: "Wie’s daa?"

Polisie: "Dis die Polisie."

Aubrey: "Wat de @#$ soek djulle?"

Polisie: "Ons wil praat."

Aubrey t: "Hoeveel is djulle?"

Polisie: "Daa’s twie van ons."

Gammat: "Nou @#$ praat dan met mekaar!"

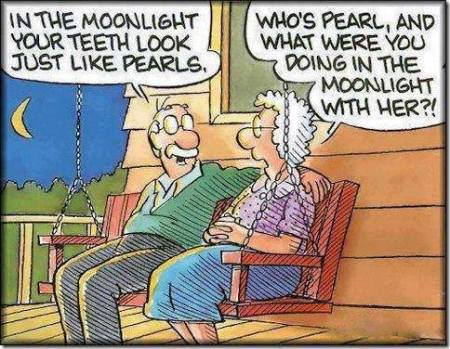

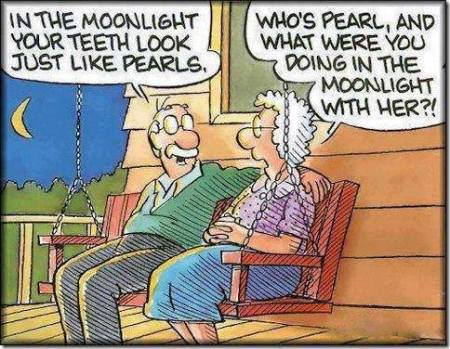

Pearl of wisdom

Aphorisms - a concise statement of truth

Thanks, Brian Jenions

• If at first you don't succeed, skydiving is not for you.

• Red meat is not bad for you - Fuzzy green meat is bad for you.

• Artificial intelligence is no match for natural stupidity.

|

|

|

|

|

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here. |

|

|

©2015 Moonstone. All rights reserved. |

| |