|

To Subscribe please click

here |

|

|

Investment Indicators - 17 October 2016 |

|

|

|

|

Paul Kruger

Author/Editor |

| |

|

|

| |

|

|

|

|

|

I must govern the clock, not be governed by it – Golda Meir |

| |

|

|

Distributed to 46 774 subscribers.

To advertise with us

click here |

|

| |

|

|

|

Today’s 50-year olds are often at risk of inadequate retirement

provision |

Modern 50-year olds need to review their retirement provision more

regularly if they want to ensure they have an adequate pension for the

post-work lifestyle they desire. This generation is increasingly

vulnerable to changes in expenditure which may have a serious

detrimental impact on their long-term savings.

Martin Wagenaar, wealth management consultant at leading financial

advisory business GTC, believes this is due to societal and economic

changes that tend to affect people in the 50-year old range more acutely

than others. “In our experience, the problem is that most people have

not changed their retirement provision and savings strategy sufficiently

to adjust for material changes to their expenses.”

Click here to read the full article. |

|

| Rates Review |

|

|

1. Secured Investment Rates |

|

Please note that (G) indicates a Guaranteed and (L) a Linked product. In order to understand the difference between guaranteed and linked rates,

kindly click here for an explanation. |

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Assupol (G) |

7.540% |

7.370% |

| 2 |

Clientéle Life (G) |

7.470% |

7.320% |

|

3 |

Discovery (G) |

6.626% |

6.453% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Company |

This Week |

Last Week |

| 1 |

Assupol (G) |

7.730% |

7.810% |

|

2 |

Clientéle Life (G) |

7.650% |

7.500% |

|

3 |

Discovery (G) |

7.175% |

7.002% |

|

|

|

|

|

|

2. Money Market Funds |

|

|

|

Please bear in mind that our figures, though based on the actual quotations that you also use, are for information purposes only,

and can never replace the official quotation from the product house. In terms of the guarantees, you are requested

to clarify the exact extent of such guarantees with the product house prior to advising clients. |

|

|

|

|

|

|

|

From the Crow's Nest |

|

|

POPI becomes a Reality |

The proposed amendments to the Financial Intelligence Centre Act (FICA),

which is still awaiting signature by the President, takes on

significant meaning in view of the court action instituted by the

Minister of Finance on Friday for a declaratory order on government

intervention in the affairs of banks and their clients.

The protection of data and personal information is becoming

increasingly important. On the one hand, you have FICA requiring

reporting on suspicious transactions and, on the other hand, the

Protection of Private Information (POPI) Act which aims to safeguard

privacy. Then, if, unlike most of us, you have a third hand, there

is the Promotion of Access to Information Act (PAIA).

This reminds me of the rather cynical saying by George Bernard Shaw:

A government that robs Peter to pay Paul can always depend on the

support of Paul.

IT Web reported as follows on 16 September:

“The effective date for the Protection of Personal Information (POPI)

Act could be before the end of this year, following the

recommendation of Pansy Tlakula as chairperson of the newly-formed

information regulator.”

“The industry has welcomed the much-delayed recommendation of

Tlakula, as POPI will enable SA to be globally competitive on

privacy matters and international data exchange laws.”

“POPI was signed by the president on 19 November 2013 and published

in the Government Gazette on the 26 November 2013. On 10 May 2016,

the Portfolio Committee on Justice and Correctional Services

shortlisted five candidates for the office of information

regulator.”

“The National Assembly recommended the appointment of the office

bearers on 7 September 2016. As part of the process, Parliament

invited everyone to nominate people and shortlisted candidates to

appoint as members of the information regulator. The office of the

information regulator will be made up of advocate Tlakula as

chairperson, advocate Cordelia Stroom and Johannes Weapond as

full-time members, and professor Tana Pistorius and Sizwe Snail as

part-time members.”

The article, titled

Industry awaits controversial Tlakula to stir POPI, also

provides positive views from industry experts on the new incumbent’s

experience, and how this will stand her in good stead in doing her

job well.

The report also quotes Adrian Schofield, an ICT veteran, according

to the article, as saying:

"Every entity's information officer will have to register with the

regulator. This is the other side of the PAIA coin – the Promotion

of Access to Information Act required every entity to have an

information officer to whom persons could apply to have access to

information. That officer will now have to register with the

information regulator – and presumably accept responsibility for

compliance with POPI as well as PAIA.”

"Getting all that up to speed will obviously take some time but

entities that process personal information must ensure their

procedures are compliant immediately, if they are to avoid the risk

of prosecution."

In August, we published a two part article titled, POPI and your

FSP, written by Alan Holton, on how the new legislation will

impact on your business.

The introduction reads:

The Protection of Personal Information Act 4 of 2013 (“POPI” or “the

Act”) was signed into law on 19 November 2013, but the commencement

date of the Act has not been announced yet. It is important to note

that once the effective date is finalized, FSPs will have one year

before the Information Regulator will start enforcing the provisions

of the Act.

POPI is not ground breaking stuff – FSPs are already bound by the

provisions of S 3(2) of the General Code of Conduct. In terms of

that requirement, FSPs may not disclose any confidential information

acquired from a client, unless written consent was obtained

beforehand, or disclosure of the information is required in the

public interest, or under any law.

The Act was introduced in response to the perceived threat posed by

the unregulated processing of personal information. It aims to

regulate the processing of personal information, and to give effect

to the constitutional right to privacy by introducing measures to

ensure that organisations use (“process” is the word used in the

Act) personal information in a fair, reasonable, responsible and

secure manner. The introduction of a data protection law in South

Africa is in line with other jurisdictions such as the UK, where

legislation that regulates the processing of personal information

has been in place for several years.

All FSPs are bound by this piece of legislation which applies to

personal information of clients, prospects, employees, product

suppliers or any other party.

Please

click here to read Alan’s article to understand the full impact

on you and your business. |

|

|

|

| |

|

| Your Practice Made Perfect |

|

|

Moonstone extends its Global footprint |

On a recent sojourn, a Moonstone delegation consisting of Hjalmar Bekker,

Director of Moonstone and Bobby Londt, Digital Strategist, visited

prominent industry counterparts in the UK.

This was not the first time since the introduction of international

regulatory intervention in the financial services industry, that Hjalmar

Bekker had undertaken such forays with the intention of gaining

first-hand experience of how the industry there experienced, in

practical terms, such changes. He also conducted extensive discussions

with the UK authorities to understand the rationale behind their

thinking.

Australia and the United Kingdom embarked on the regulatory trail long

before South Africa did. Whilst each country has its own unique

characteristics, there are also many similarities, like the outcomes of

the Treating Customers Fairly approach by the FSB which absolutely

mirrors the UK version. The objective of these visits is to learn from

others, and to foster collaboration so as to not re-invent the wheel.

The SimplyBiz Group played an important role in these developments from

as early as 2004, as did ThreeSixty, more recently.

Typically, says Bobby, we would compare notes on where we are in terms

of regulatory developments. From there the conversation would shift to

synergies and experiences and the sharing of best practice ideas,

including operational and commercial considerations. At the root of all

these discussions was the intent to offer the adviser the best possible

options to choose from in the current state of affairs.

For Bobby the experience at SimplyBiz (Huddersfield) was especially

rewarding as this was the company he worked for as a start-up in 2003

and stayed with until 2011 when he returned to SA. The growth and

solutions developed in the last 5 years literally snowballed, and

contributed immensely to the company’s success. Joint Managing Director,

Matt Timmins, played host to our visit and as always had us hooked on

his thinking and philosophy regarding service excellence to their

advisers.

ThreeSixty’s Managing Director, Phil Young, hosted us in Manchester for

a couple of hours and his views on regulatory change and the environment

was of particular interest.

We also met with a few industry personalities to which we hope to

introduce you later – conversations with them was to gain their views

and thoughts on matters of mutual interest.

Moonstone, in turn, also introduced

Suitebox, and the reception of this new technology was extremely

positive.

The introduction of

SuiteBox to the South African market will commence in the coming

weeks – please have a look at the short video clip linked in the banner

below. We regard this as the future of financial advice, not only in

South Africa, but in the world.

We hope to reciprocate the welcome hospitality experienced during our

recent visit to influential players from the UK, Middle East and

Australia. They all admit to having a weakness for Stellenbosch wines,

and with the current exchange rate, coupled with the approaching summer,

cannot wait to visit us. |

|

|

|

| |

|

|

Regulatory Examinations |

|

|

Schedules updated |

The Moonstone RE schedules containing dates and venues, have just been

updated. Please click on the link below for full details.

|

|

|

|

| |

|

Regulatory Exam Preparation Material |

Assure success by using the correct preparation material:

-

The FSB's

Level 1 RE Preparation Guide for Key Individuals

and Representatives

should be your first port of call to know what you have to do, and

what to expect.

-

The Inseta study material for:

Representatives (RE 5) and/or

Key Individuals/Sole Proprietors

(RE 1)

contain all the information essential for proper preparation. It is

free, and can be downloaded from our website.

It is written in plain

language, and easy to follow, with tests to monitor your progress.

-

LexisNexis provides a Preparation Guide and Legislative Handbook

which is more closely aligned to the “legalise” used in the actual exams.

Many students have found this useful to bridge the gap between the study material

in layman’s language and the actual legislation.

You need to order both the Preparation Guide and the

Legislative Handbook to gain the maximum benefit. Please

click here to order directly from them.

-

DVD to Aid

Preparation for Exams: Many candidates have found the DVD of a FSB

broadcast on the REs a very useful tool in preparing for the exams.

It is not a training aid, but rather a detailed extension of

what is covered in the FSB Preparation Guide. Please

click here to order a copy.

Our

website also contains a vast amount of information to assist learners

in preparing for the exams, including

Tips on writing the Regulatory Exams.

Contact details

Email enquiries should be addressed to

faisexam@moonstoneinfo.co.za. You can phone us on 021 883 8000 -

select option 2 to speak to one of our consultants .

|

|

|

|

|

Careers Platform

|

|

Are you hiring? Advertise your position on Moonstone’s Career Platform

|

| • |

The Moonstone website -

www.moonstone.co.za

- enjoys an average of 15 000 visits and approximately 39 000 page views per month. |

| • |

Moonstone boasts an exclusive newsletter mailing list of over 46000

dedicated financial decision makers who receive 2 newsletters per week. |

| • |

Our audience is relevant and industry specific: individual and corporate advisors and brokers in the following financial sectors:

iInvestment, Risk, Healthcare, Banking, Retirement, and Insurance. |

|

|

|

|

| |

|

Featured Positions |

-

RE Qualified Tele

Assistants:

Primary Miriadian Direct, Johannesburg - Experienced call centre

agents with excellent communication skills, articulate and fluent in

English and RE5 qualification, are required at our Bryanston office.

Read More

-

Financial Business

Development Assistant:

St. James Global, Johannesburg - An excellent career opportunity

awaits within the offshore financial services industry to highly

motivated individuals who are looking to obtain valuable financial

services work experience and want to make a career in this industry.

Read More

-

Compliance Officer:

Associated Compliance, Johannesburg - Due to

substantial growth we need another specialist compliance officer to

operate within our motor division which consists primarily of large

corporate motor dealerships, a number of which are public companies.

Read More

-

Junior Operations

Manager:

St Pauls Financial Services, Johannesburg - A rapidly growing Forex

Intermediary Company is looking for a dynamic, resourceful and efficient

candidate to assist the head of forex with operations.

Read More

-

Financial Adviser:

Carric Wealth, Cape Town & Johannesburg - Relevant 5-year experience

as well as RE exams a minimum requirement. Adviser must be Fit and

Proper as per the FAIS Act.

Read More

-

Experienced Financial

Advisor:

ULB, Randburg - We are looking for an ethical and compliant

Financial Advisor with at least 5 years experience in the financial

industry, in particular employee benefits and medical aid.

Read More

-

Experienced Investment

Advisors:

Global & Local Investment Advisors, Johannesburg & Cape Town - We

specialise in local and international investments, Forex and money

market products. Fais compliant, experienced applicants are required to

have their own reliable motor vehicle and a valid driver’s licence.

Read More

-

Experienced Brokers /

Financial Advisors:

Calreg, Countrywide - We are looking for the experienced, ethical

and compliant broker seeking a long term income. Minimum Requirments are

a relevant degree, RE qualified and three years experience.

Read More

|

|

|

|

|

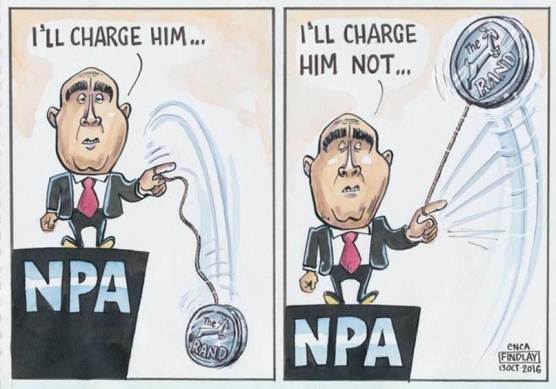

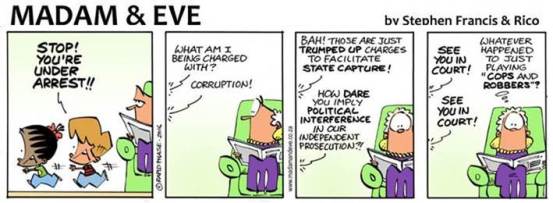

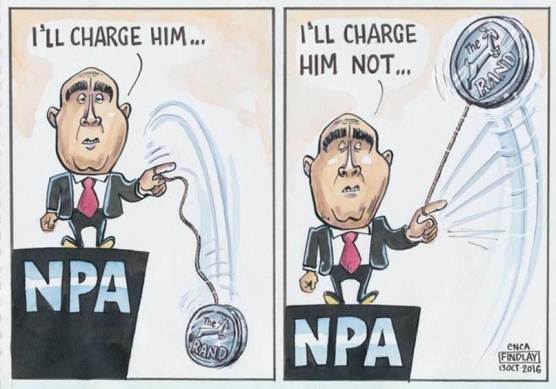

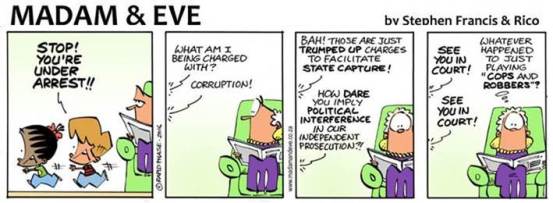

In Lighter Wyn |

|

|

Cartoons on current affairs |

|

|

|

|

|

|

Distributed to 46 774 subscribers

Tel: +27 21 883 8000 | Fax: +27 21 883 8005

info@moonstoneinfo.com

www.moonstone.co.za

P.O. Box 12662, Die Boord, Stellenbosch, 7613, Republic of South Africa

Disclaimer:

Services and products advertised by external product suppliers in

this newsletter are paid for by the respective suppliers. Moonstone

does not endorse any opinions, conclusions, data, products, services

or other information contained in this e-mail which is unrelated to

the official business of Moonstone and furthermore accepts no

liability in respect of the unauthorised use of its e-mail facility

or the sending of e-mail communications for other than strictly

business purposes.

The complete disclaimer can be accessed

here. |

|

|

©2015 Moonstone. All rights reserved. |

| |